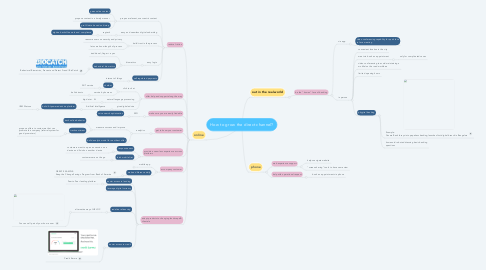

1. online

1.1. reduce friction

1.1.1. propose relevant, user-centric content

1.1.1.1. personalize content

1.1.1.2. propose content in a timely manner

1.1.1.3. pre-fill data based on history

1.1.2. easy and seamless digital onbarding

1.1.2.1. regtech

1.1.2.1.1. digitize backoffice work and compliance

1.1.3. build trust in the process

1.1.3.1. reassure users on security and privacy

1.1.3.2. let users know length of process

1.1.4. easy login

1.1.4.1. biometrics

1.1.4.1.1. traditional; finger + eyes

1.1.4.1.2. behavioral biometrics

1.1.5. self regulated payments

1.1.5.1. internet of things

1.2. offer help and support along the way

1.2.1. click to chat

1.2.1.1. chatbot

1.2.1.1.1. 24/7 service

1.2.1.2. service by humans

1.2.1.2.1. builds trusts

1.2.2. natural language processing

1.2.2.1. big data + AI

1.2.3. give digital advice

1.2.3.1. Artificial Intelligence

1.2.3.1.1. build AI-powered advice platform

1.3. make sure you are easily findable

1.3.1. SEO

1.3.1.1. voice search optimization

1.4. get to know your customer

1.4.1. analytics

1.4.1.1. measure success and improve

1.4.1.1.1. track online behavior

1.4.1.1.2. track sentiment

1.4.1.2. build analytic model for next best offer

1.5. provide a seamless experience accross platforms

1.5.1. responsiveness

1.5.1.1. customers want to open an session on a device and finish on another device

1.5.2. think mobile first

1.5.2.1. customers are on the go

1.6. accompany customer

1.6.1. mobile app

1.6.1.1. give advice based on geo-location

1.6.1.1.1. Ex. Entering the US for business? Here is the best rate for dollars exchange,

1.6.2. make a difference daily

1.6.2.1. GREAT EXAMPLE: Keep the Change Savings Program from Bank of America

1.7. adapt products to changing landscape & clientele

1.7.1. easier access to lending

1.7.1.1. Peer to Peer lending platform

1.7.2. leverage digital currency

1.7.3. redefine refinancing

1.7.3.1. alternative way of HELOC

1.7.3.1.1. You can sell part of your home now.

1.7.4. easier access to credit

1.7.4.1. Credit Karma

2. out in the real world

2.1. be the "human" face of banking

2.1.1. via app

2.1.1.1. video conferencing capability for quick face to face meeting

2.1.2. in person

2.1.2.1. convenient location in the city

2.1.2.2. meet via book an appointment

2.1.2.2.1. only for complicated cases

2.1.2.3. video conferencing to avoid maintaining a mobile/on the road workforce

2.1.2.4. limited opening hours

2.1.2.5. phygital banking

2.1.2.5.1. Example: Canara Bank forays into paperless banking;launches first digital branch in Bengaluru

2.1.2.5.2. humanoid robot addressing basic banking questions

3. phone

3.1. web experience support

3.1.1. helps navigate website

3.1.2. "screen-sharing" tools to have same view

3.2. help with operational request

3.2.1. book an appointment via phone