1. Impact

1.1. Marine Midland Bank v. James Miller

1.1.1. Background: In 1977, an Atlas-Dirty Devil Mining investing group (ADDM), borrowed $9 million from the Marine Midland Bank, to finance a coal mining project. A feasibility report prepared by two coal consulting firms, Miller & Associates and Keplinger & Associates grossly overstated projected yield. In 1979, ADDM filed a petition under Chapter XI of the Bankruptcy Act. In 1980, Marine Midland Bank filed the suit against Miller directly, alleging that Miller & Associates was merely a shell corporation.

1.1.1.1. Walkovsky v. Carlton case was referenced in support of the court's denial to "pierce the corporate veil" due to the lack of the compelling argument.

1.1.1.1.1. Court concluded: "Since [defendant] Atlas himself carefully respected the separate identities of the corporations, and each corporation was pursuing its separate corporate business, rather than the purely personal business of Atlas, we conclude that the corporate veils of the defendant corporations should not be `pierced.'" The case was remanded.

1.2. Gartner v. Snyder, Westerlind, and Snyder-Westerlind Enterprises, Inc.

1.2.1. Background: In 1972, Gartner and Enterprises entered into real estate contract. Due to multiple obstacles, Enterprises was unable to fulfill this obligation and Gartner was offered: 1) to rescind the contract and receive back downpayment; 2) to buy the initial unit for the higher price, or 3) to buy the smaller unit for the original price. Gartner refused, demanding instead that his contract was fulfilled. In 1975, Gartner sued Snyder, Westerlind, and Enterprises for breach of contract. The District Court ruled that Snyder was personally liable for the breach of contract by the Enterprises as the company was inadequately capitalized and he had disregarded its separate identity and "used it to a fraudulent end." Snyder appealed.

1.2.1.1. Walkovszky v. Carlton was referenced in this case in support of the Appellate Court's decision against Gartner.

1.2.1.1.1. According to the New York State law, courts disregard the corporate form only when a fraud was committed, the company was undercapitalized, or when the corporation was used as a stakeholder's alter ego. Decision was reversed.

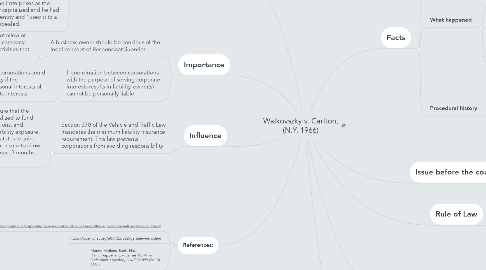

2. Importance

2.1. A business owner should be concious of the legal concept of Respondeat Superior

2.1.1. A business owner should not allow or endorse employees' use of company resources or premises for activities that could result in liability

2.2. If coordination between corporations with the purpose of serving corporate interests results in liability, owner(s) cannot be personally liable

2.2.1. Coordination between corporations could result in personal liability if the coordination serves personal interests of the owner(s) vs. corporate interests

3. Influence

3.1. Section 370 of the Vehicle and Traffic Law mandates the minimum liability insurance requirement. This law prevents corporations from avoiding responsibility

3.1.1. A business owner should assure that the company is sufficiently capitalized to fund damages, meet debt obligations, and prevents owner's personal liability exposure. At this time, multiple state statutes require the applicants for business licensure to show capital necessary to fund at least 3 months of business operations.

4. References:

4.1. https://www.casebriefs.com/blog/law/corporations/corporations-keyed-to-klein/the-nature-of-the-corporation/walkovszky-v-carlton/2/

4.2. https://openjurist.org/607/f2d/582/gartner-v-r-snyder-r

4.3. Marine Midland Bank, N.a., Plaintiff-appellant, v. James W. Miller, Defendant-appellee, 664 F.2d 899 (2d Cir. 1981)

5. Facts

5.1. Parties

5.1.1. John Walkovszky, Plaintiff

5.1.2. William Carlton, Defendant

5.1.2.1. Owner of the fleet of 20 taxicabs set up as 10 corporations. Seon Cab Corporation owned the taxicab involved in the accident resulting in injury to the plaintiff.

5.2. What happened

5.2.1. Walkovszky was severely injured in NYC in 1962 when he was hit by a taxicab owned by Seon Cab Corporation.

5.2.2. To limit exposure and liability, taxi fleet owners engage in the common practice of dividing the fleet into multiple corporations, each owning one or two cabs. The taxi fleet owner was a major stockholder in all corporations and the said corporations shared operational and financial resources.

5.2.2.1. By New York state law, each corporation held the absolute minimum liability insurance of $10,000.

5.3. Procedural history

5.3.1. Walkovszky sued and the Trial Court found in his favor.

5.3.1.1. The plaintiff considered $10,000 insurance held by the Seon Cab Corporation to be insufficient to cover his losses. He wanted to hold the defendant personally liable and asked the Court to "pierce the corporate veil." This way, the plaintiff could sue the defendant and the rest of the corporations directly.

5.3.2. Carlton appealed

5.3.2.1. Appellate Court reversed the decision because of failure to state a cause of action.

6. Issue before the court

6.1. Can the defendant be held personally liable for the injuries to the plaintiff?

6.2. Sub-issue: Should the mandatory minimum amount of insurance be raised so that the liability cannot be artificially protected?

7. Rule of Law

7.1. Respondeat Superior

7.1.1. Latin: "Let the Master Answer"

8. Analysis/Application

8.1. Courts generally apply one of two tests to Verify Respondeat Superior

8.1.1. 1. Benefits Test

8.1.1.1. Are the employees' actions deemed permissible by the employer, result in the gain for the employer, and limit employer's liability?

8.1.2. 2. Characteristics Test

8.1.2.1. Are the employees' actions reasonably characteristic of the job they are performing for the owner?

8.2. All 10 taxicab companies were shown to be operating as one cohesive entity

8.2.1. But, to be liable, Carlton would need to be controlling the entity for the personal gain vs. corporate benefit

8.3. Carlton

8.3.1. Carlton argued that Walkovszky failed to state a cause of action

8.3.1.1. Walkovszky failed to prove fraud

8.3.1.2. Seon Cab Corporation was not undercapitalized

8.3.1.3. Carlton did not use the business for personal gain rather than corporate gain

8.4. Walkovsky

8.4.1. Walkovszky asked the Court to "pierce the corporate veil" so he could sue Carlton and the other 9 corporations directly

8.4.1.1. Under-capitalization - insufficient assets or funds to cover liability at the corporation level

9. Conclusion

9.1. The complaint was dismissed. According to the New York State law, a stockholder is not personally liable for torts of his corporation unless he was conducting business in his own capacity and for personal gain vs. corporate benefit. The Court found that the defendant was not personally liable as there was no evidence of fraud and the business was operated in accordance with the applicable regulations.

9.1.1. The allegation of undercapitalization was also disregarded as the Seon Cab Corporation was adequately capitalized.