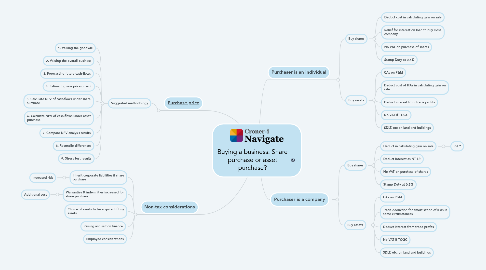

1. [Non-tax considerations](https://library.croneri.co.uk/po-heading-id_K2yUw6zpiEG-ivk26ZpOiA)

1.1. Inherit corporate liabilities if share purchase

1.1.1. Increased risk

1.2. Warranties & indemnities increased for share purchase

1.2.1. Additional cost

1.3. Choice of assets to be acquired if buy assets

1.4. Raising acquisition finance

1.5. Employee considerations

2. [Purchaser is an individual](https://library.croneri.co.uk/po-heading-id_7zTOap_gME-m7m0qVi_r5A)

2.1. Buy shares

2.1.1. Deduct cost in calculating gain on sale

2.1.2. Relief for interest on loan to buy close company

2.1.3. No VAT on purchase of shares

2.1.4. Stamp Duty at 0.5%

2.2. Buy assets

2.2.1. CAs on P&M

2.2.2. Deduct cost of IFAs in calculating gain on sale

2.2.3. Deduct interest from trade profits

2.2.4. No VAT if TOGC

2.2.5. SDLT, etc on land and buildings

3. [Purchaser is a company](https://library.croneri.co.uk/po-heading-id_9LDKCif2YEevs6G0wJd3bw)

3.1. Buy shares

3.1.1. Deduct in calculating gain on sale

3.1.1.1. SSE?

3.1.2. Deduct interest as NT LR

3.1.3. No VAT on purchase of shares

3.1.4. Stamp Duty at 0.5%

3.2. Buy assets

3.2.1. CAs on P&M

3.2.2. Trade deduction for amortisation of IFAs in some circumstances

3.2.3. Deduct interest from trade profits

3.2.4. No VAT if TOGC

3.2.5. SDLT, etc. on land and buildings

4. [Purchase price](https://library.croneri.co.uk/po-heading-id_Etq_aOe2jkKsranf8RLvPA)

4.1. Suggested methodology

4.1.1. 1. Valuing the goodwill

4.1.2. 2. Valuing the overall business

4.1.3. 3. Forecasting future cash-flows

4.1.4. 4. Estimating sale price on exit

4.1.5. 5. Calculate NPV of cash-flows under share purchase

4.1.6. 6. Calculate NPV of cash-flows under asset purchase

4.1.7. 7. Compare NPV analysis results

4.1.8. 8. Reconcile differences

4.1.9. 9. Stress test results