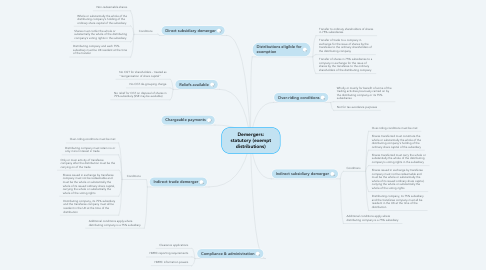

1. Reliefs available

1.1. No CGT for shareholders - treated as "reorganisation of share capital"

1.2. No CGT de-grouping charge

1.3. No relief for CGT on disposal of shares in 75% subsidiary (SSE may be available)

2. Distributions eligible for exemption

2.1. Transfer to ordinary shareholders of shares in 75% subsidiaries

2.2. Transfer of trade to a company in exchange for the issue of shares by the transferee to the ordinary shareholders of the distributing company

2.3. Transfer of shares in 75% subsidiaries to a company in exchange for the issue of shares by the transferee to the ordinary shareholders of the distributing company

3. Over-riding conditions

3.1. Wholly or mainly for benefit of some of the trading activities previously carried on by the distributing company or its 75% subsidiaries

3.2. Not for tax avoidance purposes

4. Direct subsidiary demerger

4.1. Conditions

4.1.1. Non-redeemable shares

4.1.2. Whole or substantially the whole of the distributing company’s holding of the ordinary share capital of the subsidiary

4.1.3. Shares must confer the whole or substantially the whole of the distributing company’s voting rights in the subsidiary

4.1.4. Distributing company and each 75% subsidiary must be UK resident at the time of the transfer

5. Indirect trade demerger

5.1. Conditions

5.1.1. Over-riding conditions must be met

5.1.2. Distributing company must retain no or only minor interest in trade

5.1.3. Only or main activity of transferee company after the distribution must be the carrying on of the trade

5.1.4. Shares issued in exchange by transferee company must not be redeemable and must be the whole or substantially the whole of its issued ordinary share capital, carrying the whole or substantially the whole of the voting rights

5.1.5. Distributing company, its 75% subsidiary and the transferee company must all be resident in the UK at the time of the distribution

5.2. Additional conditions apply where distributing company is a 75% subsidiary

6. Indirect subsidiary demerger

6.1. Conditions

6.1.1. Over-riding conditions must be met

6.1.2. Shares transferred must constitute the whole or substantially the whole of the distributing company’s holding of the ordinary share capital of the subsidiary

6.1.3. Shares transferred must carry the whole or substantially the whole of the distributing company’s voting rights in the subsidiary

6.1.4. Shares issued in exchange by transferee company must not be redeemable and must be the whole or substantially the whole of its issued ordinary share capital, carrying the whole or substantially the whole of the voting rights

6.1.5. Distributing company, its 75% subsidiary and the transferee company must all be resident in the UK at the time of the distribution