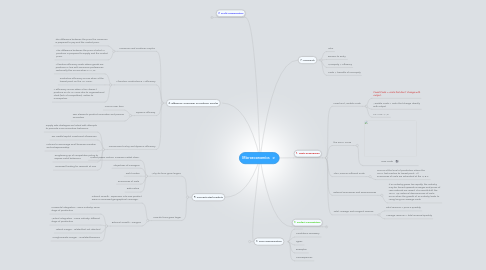

1. 2. Profit Maximisation

1.1. Maximising Profit

1.1.1. Normal profit is that level of profit which is just sufficient to keep all factors of production in their present use.

1.1.2. Average Cost = Average Revenue

1.1.3. Supernormal profit is anything above normal profit.

1.1.4. New node

1.2. The role of Profit in an economy

1.2.1. Allocationof factors of production

1.2.2. Signal for market entry

1.2.3. Promotes innovation

1.2.4. investment

1.2.5. Rewards entrepreneurs for bearing risk

1.2.6. Economic performance indicator

1.3. Alternative goals

1.3.1. Managerial Status

1.3.2. Market share or sales growth

1.3.3. Revenue Maximisation

2. 4. Efficiency, Consumer & Producer Surplus

2.1. Consumer and Producer Surplus

2.1.1. The difference between the price the consumer is prepared to pay and the market price.

2.1.2. The difference between the price at which a producer is prepared to supply and the market price.

2.2. Allocative, Productive & X efficiency

2.2.1. Allocative efficiency exists where goods are producer in line with consumer preferences. Technically this occurs when P = MC

2.2.2. Productive efficiency occurs when at the lowest point on the AC curve.

2.2.3. X Efficiency occurs when a firm doesn't produce on its AC curve due to organisational slack (lack of competition). Refers to monopolies.

2.3. Dynamic efficieny

2.3.1. Occurs over time

2.3.2. Two elements, product innovation and process innovation

2.4. Government Policy and dynamic efficiency

2.4.1. Supply side strategies are linked with attempts to promote more innovative behaviour.

2.4.2. Tax credits/capital investment allowances

2.4.3. Policies to encourage small business creation and entrepeneurship

2.4.4. Toughening up of competition policy to expose cartel behaviour.

2.4.5. Increased funding for research at unis

3. 5. Concentrated Markets

3.1. Why do firms grow larger?

3.1.1. Market power motive, increase market share.

3.1.2. Objectives of managers

3.1.3. Profit motive

3.1.4. Economies of scale

3.1.5. Risk motive

3.2. How do firms grow larger

3.2.1. internal Growth - expansion into new product areas or increased geographical coverage.

3.2.2. External Growth - mergers

3.2.2.1. Horizontal integration - same industry, same stage of production

3.2.2.2. Vertical Integration - same industry, different stage of production

3.2.2.3. Lateral merger - related but not identical

3.2.2.4. Conglomerate merger - unrelated business

4. 6. Price Discrimination

4.1. Intro

4.2. Conditions necessary

4.3. Types

4.4. Examples

4.5. Consequences

5. 1. Costs & Revenues

5.1. Fixed and Variable Costs

5.1.1. Fixed Costs = costs that don't change with output.

5.1.2. Variable Costs = costs that change directly with output

5.1.3. TC = FC + VC

5.2. the SRAC Curve

5.2.1. New node

5.3. The Minimum Efficient Scale

5.3.1. Occurs at the level of production where the LRAC first reaches its lowest point. All economies of scale are exhausted at the M.E.S

5.4. External Economies and Diseconomies

5.4.1. if an industry grows too rapidly, the industry may be forced upwards as wages and prices of raw materials are raised. This would shift the LRAC up. External diseconomies of scale occur when the growth of an industry leads to rising long-run average costs.

5.5. Total, average and marginal revenue

5.5.1. Total revenue = price x quantity

5.5.2. Average revenue = total revenue/quantity

6. 3. Perfect Competition

6.1. Perfect Competition

6.1.1. Defines a market structure whose assumptions are extremely strong and unlikely to exists.

6.1.2. Many buyers and sellers, no one buyer or seller should be able to influence the market price.

6.1.3. No barriers to entry or exit

6.1.4. Identical products

6.1.5. Perfect information

6.1.6. no externalities

6.1.7. No economies of scale

6.2. The Short Run

6.2.1. Firm can operate with supernormal profits in the short term

6.2.2. Shut down conditions is where the price is less than the firms AVC.

6.3. The Long Run

6.3.1. Shut down condition when price is less than AC, firms should leave the industry. No more firms enter the market.

6.4. The benefits of competition

6.4.1. Lower prices due to high competition

6.4.2. Low barriers to entry

6.4.3. Lower total profits

6.4.4. Greater entrepreneurial activity

6.4.5. Economic efficiency