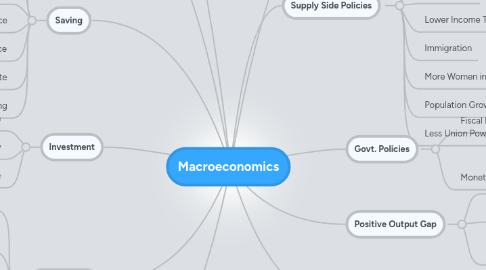

Macroeconomics

by Henry Binning

1. Consumption

1.1. Employment

1.1.1. Job Insecurity = Less Spending

1.1.2. No Wages = Less Spending

1.2. Personal Income

1.3. Food, Petrol Prices

1.4. Housing Market

1.5. Natural Disasters (Drought)

1.6. Confidence

1.7. Exchange Rate

2. Government Spending

2.1. Interest Rates

2.2. Government spending on stimulus

2.3. Tax Rate - Lower Taxes = Lower Government Income

3. Investment

3.1. Confidence

3.2. Job Security

3.3. Financial Market Performance

4. Saving

4.1. Interest Rates

4.2. Risk Tolerance of Individual

4.3. Trust in Pension Funds

4.4. Stick Market Performance

4.5. Bank Performance

4.6. Economic Climate

4.6.1. In a recession people save more

4.7. Knowledge About Saving

5. Inflation

5.1. Cost Push

5.1.1. Rise in raw material costs

5.1.2. Rise in wages

5.1.3. Rise in taxes

5.2. Demand Pull

5.2.1. AD higher than AS

6. Unemployment

6.1. Classical

6.1.1. When wage level too high for employers to afford

6.2. Cyclical

6.2.1. Due to recession

6.3. Seasonal

6.3.1. Eg. ski instructor, hotel worker

6.4. Frictional

6.4.1. Time between changing jobs

6.5. Structural

6.5.1. When industry changes eg. textiles in north of England

7. Negative Output Gap

7.1. Unemployment

7.2. Deflationary Pressure

7.3. Govt. imposes Expansionary Policies

7.3.1. Lower Tax

7.3.2. Lower Interest Rates

8. Supply Side Policies

8.1. Investment in capital goods

8.2. R&D

8.3. Innovation

8.4. Skills, Education and Training

8.5. Competition

8.6. Lower Income Tax

8.7. Immigration

8.8. More Women in Labour Market

8.9. Population Growth

8.10. Less Union Power

9. Positive Output Gap

9.1. Lower Unemployment

9.2. Inflationary Pressure

9.3. Govt. imposes Contractionary Policies

9.3.1. Higher Tax

9.3.2. Higher Interest Rates

10. Govt. Policies

10.1. Fiscal Policy

10.1.1. Government Spending

10.1.2. Taxation

10.2. Monetary Policy

10.2.1. Interest Rates

10.2.2. Supply of Money

11. Current Account

11.1. Exports - Imports

11.2. Transfers

11.2.1. People sending money home from abroad

11.3. Investment Income

11.3.1. BP Angola