1. 2 Systems

1.1. Principles-based system

1.1.1. Used as a conceptual footing for comptrollers and accountants

1.1.2. Professional Judgement

1.2. Rules-based system

1.2.1. List of detailed regulations that accountants follow in order to create fiscal statements

1.2.2. Exercise of judgement is minimized

2. IFRS

2.1. Advantages

2.1.1. Easier to compare FS

2.1.2. Cross-border listing will be facilitated

2.1.3. Company-wide accounting language

2.1.4. Easier for takeovers or mergers

2.2. Disadvantages

2.2.1. High cost for implementing IFRS

2.2.2. The lower level of detail in IFRS

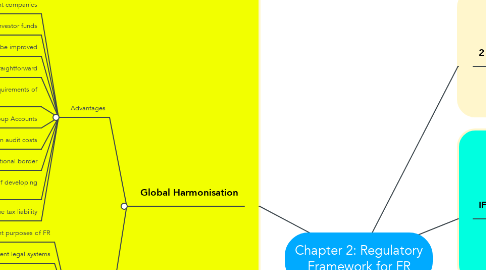

3. Global Harmonisation

3.1. Advantages

3.1.1. Able to compare financial result of different companies

3.1.2. Better access would be gained to foreign investor funds

3.1.3. Management control would be improved

3.1.4. Takeovers and mergers would be more straightforward

3.1.5. Easier to comply with reporting requirements of overseas stock exchanges

3.1.6. Easier to prepare the Group Accounts

3.1.7. Reduction in audit costs

3.1.8. Easier to transfer of accounting staff across national border

3.1.9. Save time and money for Governments of developing countries

3.1.10. Easier to calculate the tax liability

3.2. Barriers

3.2.1. Different purposes of FR

3.2.2. Different legal systems

3.2.3. Different user groups

3.2.4. Needs of developing countries

3.2.5. Unwillingness to accept another country's standard

3.2.6. Cultural differences

3.2.7. Unique circumstances

3.2.8. Lack of strong accountancy bodies

4. Standard Setting Process (IFRS)

4.1. Establish an ADVISORY COMMITTEE and Consultation with ADVISORY COMMITTEE and IFRS ADVSIORY COUNCIL

4.2. Publish DISCUSSION PAPERS for public comments

4.3. Publish an Exposure Draft for Public Comments

4.4. Issue of a final IFRS

5. Support & Criticism of IASB

5.1. Support

5.1.1. Reduce or eliminate confusing variations

5.1.2. Provide a focal points for debate and discussions

5.1.3. Obligate companies to disclose the accounting policies

5.1.4. Less rigid alternative to enforcing conformity

5.1.5. Obligate companies to disclose more accounting information

5.2. Criticism

5.2.1. A set of rules which give backing to one method of preparing accounts might be inappropriate in some circumstances

5.2.2. Standards may be subject to lobbying of government pressure

5.2.3. Many national standards are not based on Conceptual Framework of Accounting

5.2.4. May be trend towards rigidity and away from flexibility