1. Compounding

1.1. number of time periods increases the future value increases.

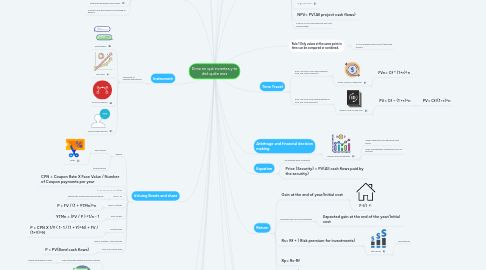

1.1.1. Co + Cf1 * (1+r)^1 + Cf2 * (1+r)^2 + --- + Cfn + (1+r)^n

1.2. Interest on interest

1.3. Increasing rate since there is more interest on interest

1.3.1. Co + Cf1/(1+r)^1 + Cf2/(1+r)^n --- + Cfn/(1+r)^n

1.4. Combing the project with borrowing or saving

2. Net Present Value NPV

2.1. You must respect the sign ( + / - )

2.2. the NPV allow us to evaluate an investment decision

2.3. cash flow at regular intervals forever it is call PERPETUITY

2.3.1. Cf/r

2.4. + = GOOD

2.4.1. Accepting or rejecting a project

2.5. - = BAD

2.5.1. Choosing among project

2.6. NPV= Pv(Benefits)-Pv(cost)

3. Financial appeceament

3.1. lever

3.2. little effort generates more money

3.3. a credit is very good when you are going to balance

4. Instrument

4.1. Instrument vs Potential theoretician

4.1.1. Profit bubble

4.1.2. Bad news

4.1.3. POSITIVE Rumors

4.1.4. About market reaction

5. Valuing Bonds and share

5.1. Bounds

5.1.1. Zero coupon

5.1.1.1. Cetes

5.1.2. Coupon Bonds

5.2. CPN = Coupon Rate X Face Value / Number of Coupon payments per year

5.3. |---c---c---c---c--c---|c+FV

5.4. Price = PV

5.4.1. Interest rate at which we discount bonds

5.5. Yield to Maturity

5.5.1. P = FV / (1 + YTMn)^n

5.6. Zero coupon

5.6.1. YTMn = (FV / P ) ^1/n - 1

5.7. Coupon Bond

5.7.1. P = CPN X 1/Y ( 1- 1 / (1 + Y)^N) + FV / (1+Y)^N

5.8. Yield to Maturity->Discount rate

5.9. Price of a coupon Bond

5.9.1. P = PV(Bond cash flows)

6. Capital Markets and CAPM (capital asset pricing model)

6.1. Small stocks the highest long-terms returns

6.1.1. largest fluctuations in price

6.2. Higher risk requires a higher return

6.3. T-Bills the lowest long-terms returns

6.3.1. lowest fluctuations in price

6.4. Expected return

6.4.1. E (R) = {r Pr X R

6.5. Varance

6.5.1. Var (R) = E [(R-E[R])^2]

6.6. Volality

6.6.1. Measure the total risk

6.6.1.1. SD ( R) = √ VAR(R)

6.7. Volatility measures total rick (systematic plus unsystematic)

6.8. Beta

6.8.1. measure the systematic risk

6.8.1.1. For every 1% change in the market, how much your security moves.

6.8.1.2. If the B is negative, you move to the inverse of the market

6.9. CAPM

6.9.1. Calculate the expected return for a risky security

6.9.2. Calculate the cost of particular project

7. Common Risk

7.1. Perfectly correlated

7.2. Affects all securities

8. Indepent Risk

8.1. Is uncorrelated

8.2. Affects a partiucular security

9. Diversification

9.1. The averaging out of indepent risks in a large portafolio

10. Rule 1 Only values at the same point in time can be compared or combined.

10.1. If it is in present value you don´t apply the formula

11. The timeline

11.1. A timeline is a linear representation of the timing of potencial cash flows.

11.2. 0---------1---------2

11.3. timeline help you visualize the financial problem.

11.4. Today is Date 0

11.5. X------>

11.6. ÷<------

11.7. NPV= PV(All project cash flows)

11.8. If the Cf is not in the same time you can't compare them.

12. Time Travel

12.1. Rule 2 To move a cash flow forward in time, you must compund it.

12.1.1. Future Value of a cash flow.

12.1.1.1. FVn= Cf * (1+r)^n

12.2. Rule 3 To move a cash flow backward in time, you must discount it.

12.2.1. Present Value of cash flow.

12.2.1.1. PV= Cf ÷ (1 +r)^n

12.2.1.1.1. PV= Cf/(1÷r)^n

13. Rate

13.1. Depends the place you invest

14. Arbitrage and financial decision making

14.1. Valuing costs and benefits

14.1.1. Using market prices to determine cash values

14.1.2. When competetitive market prices are not available

15. Equation

15.1. No arbitrage price of security

15.2. Price (Security) = PV(All cash flows paid by the security)

16. Return

16.1. Gain at the end of year/Initial cost

16.1.1. F-I/I

16.2. Expected return of a risk investment

16.2.1. Expected gain at the end of the year/Initial cost

16.3. Rs= Rf + ( Risk premium for investments)

16.3.1. Extra profit

16.3.1.1. Risk premium

16.4. Rp= Rs-Rf

16.5. Rb = Rf+(Risk Premium for the bond

17. T-Bills

17.1. Tresure

17.2. Cetes

18. Using the payback rule

18.1. Payback period the lengt of time required to recover the cost of an investment.

18.1.1. Payback Period = Cost of project / Annual Cash flows

18.2. IRR

18.2.1. Internal rate of return

18.2.1.1. try and failure

18.2.1.2. Evalute and compare projects

18.2.1.3. Iterations

19. Investment grade

19.1. AAA & AA

19.1.1. High credit quality

19.2. A & BBB

19.2.1. Medium credit quaility

19.3. BB, B & CCC

19.3.1. Low credit quality (junk bonds)

19.4. Shares price

19.4.1. Div / Po

19.5. Po = Div1 + P1 / 1 +Re

19.6. Re = Div 1 + P1 / Po - 1

19.7. With different dividends

19.7.1. Po = Div1 / 1 + re + Div2 + p2 / (1 + Re)^2 + Divn / (1 + Re)^n

19.8. Dividend - Discount Model

19.8.1. Po = Div1 / Re - g

19.8.1.1. G

19.8.1.1.1. Growth rate

20. Market portofolio

20.1. An efficent consists of a weighted sum of each asset in the market

20.2. Market Risk premium

20.2.1. E [Rmkt] - Rf

20.3. CAPM

20.3.1. E(R)= rf + B x (E[Rmkt] - rf

20.3.1.1. Risk premium

21. EVA

21.1. Measure the value company generates from funds invested

21.1.1. Evan= Cn - r1n-1 - (Depreciation in Period n)

21.1.2. VA = Actual Value

21.1.3. Profitabily Index

21.1.3.1. Value created / Resource Consumed

21.1.3.1.1. NPV / Resource consumed

21.1.4. EVA for a year