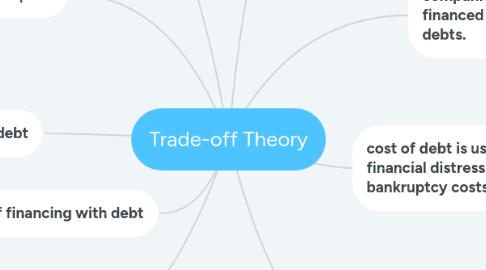

Trade-off Theory

by afifa azan

1. deals with the two concepts

1.1. cost of financial distress

1.2. tax savings

2. important purpose

2.1. to explain the fact that corporations usually are financed

2.1.1. partly with debt

2.1.2. partly with equity

3. advantage to financing with debt

3.1. the tax benefits of debt

4. cost of financing with debt

4.1. the costs of financial distress including bankruptcy costs of debt and non-bankruptcy costs

4.1.1. e.g. staff leaving, suppliers demanding disadvantageous payment terms, etc

5. a firm experiences financial distress when the firm is unable to cope with the debt holders’ obligations

6. refer to the idea that chosen by a company to balancing the costs and benefits

6.1. how much debt finance

6.2. how much equity finance to use

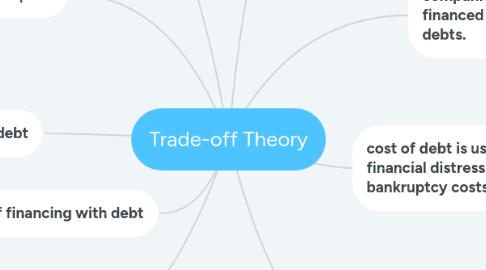

7. companies or firms are generally financed by both equities and debts.

8. cost of debt is usually the financial distress costs or bankruptcy costs of debt

8.1. includes the direct and indirect bankruptcy costs

8.2. include the agency costs from agency theory as a cost of debt

8.2.1. to explain why companies don’t have 100% debt