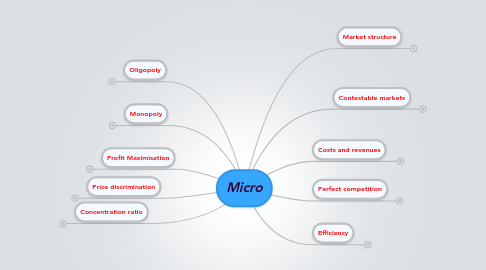

1. Profit Maximisation

1.1. Normal profit

1.1.1. the level of profit just sufficient enough to keep all factors of production in their present use

1.2. Supernormal profit

1.2.1. anything that exceeds normal profit

1.3. maximisation of profit

1.3.1. at the point MC-MR

1.4. Role of profit

1.4.1. Signal for market entry

1.4.2. Investment (R+D)

1.4.3. promotes innovation

1.4.4. Indicates economic performance

1.4.5. indication for allocation of resources

1.5. Firms goals

1.5.1. market share

1.5.2. profit

1.5.3. managerial status

1.5.4. revnue

2. Concentration ratio

2.1. concentration ratio

2.1.1. value of output from the 5 largest firms/ value of output for the industry

2.2. growth

2.2.1. internal

2.2.1.1. use of saved profits to finance expansion by increasing fixed and variable factors

2.2.2. external

2.2.2.1. vertical integration

2.2.2.1.1. same industry at different stage of production come together eg oil company that owns drilling and extraction business together with refining, distribution and retail subsidaries

2.2.2.2. horizontal integration

2.2.2.2.1. two business in the same industry at the same stage of production become one

2.2.2.3. lateral

2.2.2.3.1. merger between related but not identical firms eg newspaper and magazine

2.2.2.4. conglomerate

2.2.2.4.1. merger between unrelated businesses

2.2.3. outsourcing

3. Price discrimination

3.1. conditions necessary

3.1.1. differences in PED

3.1.2. barriers to prevent market seepage (resale)

3.2. first degree

3.2.1. unique price for each individual unit

3.3. second degree

3.3.1. batches - includes something else in deal

3.4. third degree

3.4.1. different prices for the same product in different segments of the market

3.4.1.1. time

3.4.1.2. geography

3.4.1.3. status

3.5. price discrimination is when a producer sells an identical product to different buyers at different prices for reasons unrelated to costs

4. Monopoly

4.1. definitions

4.1.1. one firms exists in industry

4.1.2. a firm has greater than 25% of market share

4.1.3. firm is price maker due to inelastic demand

4.2. barriers to entry

4.2.1. high fixed costs (pharmaceuticals)

4.2.2. economies of scale

4.2.3. brand loyalty

4.2.4. patents

4.2.5. control over factors of production

4.2.6. control over retail outlets

4.2.7. predatory pricing

4.2.8. capacity expansion

4.2.9. hostile takeover

4.2.10. product differentiation

4.3. natural monopolies

4.3.1. gas, electricity, water

4.4. cost to society

4.4.1. set higher prices due to control over market

4.4.2. earn supernormal profits at the expense of static efficiency

4.5. benefits

4.5.1. achieve economies of scale

4.5.1.1. improve dynamic efficiency

5. Oligopoly

5.1. definitions

5.1.1. Market dominated by a few producers, each with a certain degree of control over price

5.1.2. top 5 firms account for 60% of the market shar

5.2. features

5.2.1. interdependence and uncertainty

5.2.2. entry barriers

5.2.3. product branding

5.2.4. non-price competition

5.2.4.1. such as advertising, loyalty cards etc

5.3. kinked demand curve

5.3.1. demonstrates reaction of other firms to a change in price

5.4. collusion

5.4.1. tacit

5.4.2. explicit

5.5. game theory

6. Costs and revenues

6.1. Fixed costs

6.1.1. one that does not change with output

6.2. Variable costs

6.2.1. one that does change with output

6.3. Average cost

6.3.1. Total cost/ quantity

6.4. Marginal cost

6.4.1. The cost of producing one extra

6.5. The law of diminishing returns

6.5.1. as more of a variable factor is affed to a fixed factor, marginal prodct will rise owning to specialisation, but marginal product will fall as diminishing returns sets in

6.6. Short run

6.6.1. the period of time where are least one factor of production is fixed

6.7. Long run

6.7.1. the period of time where all factors are variable

6.8. Economies of scale

6.8.1. an increase in all factors of production lead to a more than proportionate increase in output

6.9. Minimum efficient scale

6.9.1. the lowest point on the average cost curve where the firm achieves constant returns to scale

7. Perfect competition

7.1. conditions for perfect competition

7.1.1. many buyers and sellers

7.1.2. no barriers to entry or exit

7.1.3. identical products

7.1.4. perfect information

7.1.5. no externalities

7.1.6. no economies of scale

7.2. the shutdown condition

7.2.1. short run - price is less than average variable cost

7.2.2. long run - price is less than average cost

7.3. benefits

7.3.1. lower prices

7.3.2. low barriers to entry

7.3.3. lower total profits

7.3.4. greater entrepreneurial activity

7.3.5. economic efficiency

7.4. competing factors

7.4.1. brand

7.4.2. product differentiation

7.4.3. price discrimination

8. Efficiency

8.1. static efficiency

8.1.1. allocative efficiency

8.1.1.1. goods are produced in relation to consumer preference/demands=

8.1.2. productive effiency

8.1.2.1. lowest point on the average cost curve

8.1.3. x inefficiency

8.1.3.1. not producing inside of the average cost curve due to factors such as organisational slack or complacency

8.2. dynamic efficiency

8.2.1. process

8.2.1.1. change the way in which production of the product takes place

8.2.2. product innovation

8.2.2.1. innovation- new technology

9. Contestable markets

9.1. no barriers to entry or exit

9.1.1. access to the same technology (same cost curves)

9.2. how to increase contestability of market

9.2.1. deregulation

9.2.2. competition policy

9.2.3. eg of european single market

9.2.4. technological advancements such as e-commerce

9.3. evaluation

9.3.1. no market is perfectly contestable

9.3.1.1. no such thing as zero sunk costs

9.3.2. threat of hit and run not enough

9.3.3. protection through patents etc are common

9.4. performace

9.4.1. downward pressure on price due to competition

9.4.1.1. increases consumer surplus

9.4.2. lower profit margins

9.4.3. resembles something close to perfect competition in relation to prices

10. Market structure

10.1. characteristics/definition

10.1.1. number of firms

10.1.2. market share of the largest firms

10.1.3. nature of costs

10.1.4. degree to which the industry is vertically integrated

10.1.5. extent of product differentiation

10.1.6. structure of buyers in the industry

10.1.7. turnover of customers

10.2. government policy

10.2.1. use policy to improve innovation across all sectors of the British economy for the economic gains available