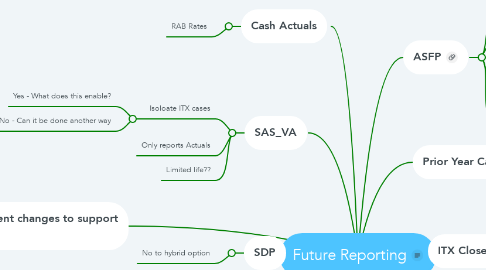

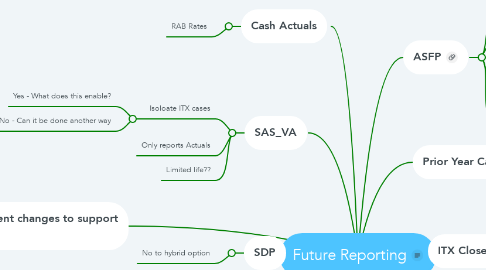

Future Reporting

by Barry Humper

1. SD won't implement changes to support RAB rates

2. Cash Actuals

2.1. RAB Rates

3. SAS_VA

3.1. Isoloate ITX cases

3.1.1. Yes - What does this enable?

3.1.2. No - Can it be done another way

3.2. Only reports Actuals

3.3. Limited life??

4. SDP

4.1. No to hybrid option

5. States & Territories Report

5.1. Mid Jan Deadline

5.2. Gst Centre started producing rpt with SD

6. Unknowns

6.1. Sticky, Timing or Wash

6.1.1. Sticky

6.1.2. Timing

6.1.3. Wash

7. ASFP

7.1. Reporting from source enabler

7.2. Goes live on 30 Dec

7.3. Will it enable cash reporting of GST

7.4. GST reporting not immediate, several weeks delay after ASFP goes live

7.5. Ivan's cash report - will it include GST cash collections

8. Prior Year Cases

8.1. PY Cash

9. ITX Closed Cases

9.1. Number required to be changed to open case

9.2. Bulk case updates potential to enable process

9.3. Some cash actual recording (collection template) $34m by PW BA teams (Nov 19)

9.3.1. recording cash but still closing as per closed reporting