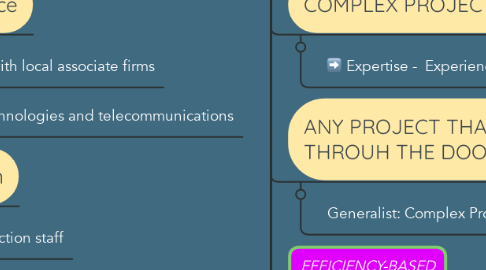

1. FIRMS BUSINESS MODEL

1.1. COMPLEX PROJECTS

1.1.1. Expertise - Experience

1.2. ANY PROJECT THAT COMES THROUH THE DOOR

1.2.1. Generalist: Complex Projects

1.3. EFFICIENCY-BASED

1.3.1. Specialists: Routine Project

1.4. EXPERIENCE-BASED

1.4.1. Generalist: Complex Project

1.5. EXPERTISE-BASED

1.5.1. Specialist: Complex Projects

1.6. SPECIALIST

1.7. GENERALIST

1.8. Strategic

1.9. Opportunistic

1.9.1. Most start this way

1.10. Expertise-Based

1.10.1. Profitability depends on high hourly rates for services

1.10.2. Administrative help advisable to free principals to do billable work

1.10.3. Service offering deep knowledge/exceptional talent "starchitects"

1.11. Experienced-Based

1.11.1. Initial management challenge is to match project task to "pay-grade"

1.11.2. Ability to organize and deliver significant and complicated projects

1.11.3. True Experience-Based:Proficient at solving non-routine and complex design problems

1.11.4. Most small firm leaders use this model

1.11.5. deep experience but engage in routine projects

1.12. Efficiency-Based

1.12.1. Profitability depends on volume and productivity

1.12.2. Focused on less-expensive project delivery

1.12.3. Narrow range of services

1.12.4. Clients looking for standard solutions and quick turn arounds

1.12.5. Do Significant amount of routine work

1.12.5.1. Hire less experience for production assistance

1.13. Self Awareness

1.13.1. Tolerance for risk

1.13.1.1. Mitigated by careful choice of clients and projects

1.13.1.2. Provide health insurance

1.13.1.3. Following best practices n terms of agreeements and documentation

1.13.2. Level of Comfort with collaboration

1.13.2.1. Control-centered practices

1.13.2.1.1. Solo Practitioners

1.13.2.1.2. Sharing only minimum necessary for subconsultants

1.13.2.2. Collaboration-centered practices

1.13.2.2.1. Information, knowledge, drawings (or models) are shared with team participates

1.13.2.2.2. IPD: Integrated Project Delivery

2. Closely Held/Subchapter S Corporation

2.1. The most common legal structure for firms(28%)

2.2. S Subchapter: no more than 100 stockholders. US or residents may not elect to pay federal taxes

2.2.1. Individual stockholder's tax return (avoiding double taxation)

2.2.1.1. Profits in the form of dividends

2.2.1.2. Limited amount of corporate losses

2.2.2. To ensure ownership remains in corporation a stockholder agreement contains restrictions on the transfer of stock

2.3. Some stockholders also act as corporate director and officers

2.4. Owned by stockholders actively engaged in the practice

2.5. Sole Proprietorship

2.5.1. Tax Perspective: a Disregarded entity. All Income is files thru owner's tax return and only taxed there.

2.5.2. May be given its own name. In legal terms not independent identity

2.5.3. No liability protection

2.5.4. Disssolves upon owner's death

2.5.5. raising capital and establishing credit depends on the personal's credit rating and assets

2.6. LLC

2.6.1. Participants: MEMBERS and MANAGERS

2.6.1.1. Members are owners of LLC

2.6.1.1.1. Personal assets other than ownership are protected against liability for business claim except for fraud or extreme wrongdoing

2.6.1.1.2. Remains liable for their own negligence even when acting on behalf of the corporation

2.6.1.2. Managers are elected by members

2.6.1.2.1. Typically responsible for both policy and day-to-day managements of the LLC

2.6.1.2.2. Have fiduciary duty to act in their best interest

2.6.2. Closely held

2.6.2.1. May also act as managers

2.6.2.2. Owned by members actively engaged in the practice

2.6.3. Tax Purpose: May elect to be treated as

2.6.3.1. If, will not pay federal taxes instead, a member's share of income and losses are passed thru the individual tax return

2.6.3.1.1. Sole Proprietorship

2.6.3.1.2. partnership

2.6.3.2. Corporation

2.7. LLP -Limited Liability Partnership

2.7.1. Offers liability protection not available to general partnerships

2.7.2. Personal assets protected except for fraud and extreme wrongdoing

2.7.3. Written partnership and LLP Certificate filed with Secretary of State's Office

2.8. JOINT VENTURES

2.8.1. temporary associations for a specific project. should have formal, written agreement including duties and responsibilities, profits and losses, and how work is to be completed

2.8.2. like partnership but cannot be sued similarly to corporations

2.8.3. "TEAMING AGREEMENTS" or " MEMORANDUM of UNDERSTANDING" is established and can be used for PRIME-CONSULTANT agreement

3. Business Corporation

3.1. Most Common form of legal entity

3.2. disadvant. initial costs

3.3. advantage - reduced liability and tax benefits

3.4. Participants / Officers

3.4.1. Officers

3.4.1.1. Elected by Directors

3.4.1.2. Carry day-to-day management of the corporation

3.4.2. Stockholder / Shareholders

3.4.2.1. Owners. Have Shares of stock

3.4.2.2. each shareholder only liable to the extent of their investment. personal assets are protected and its easy to raise capital unlike sole proprietorship. taxed at double rate but also taxed on their dividends (aka double taxation)

3.4.3. Directors

3.4.3.1. Elected by stockholders

3.4.3.2. Responsible for broad policy decisions

3.4.3.3. Have Fiduciary duty to act in their best interests

3.5. Professional Corporation

3.5.1. Rarely selected in states where architects may also practice as business corporation

3.5.2. Subject to further restrictions on ownership, liability protection, and insurance

3.5.3. In some states the professional corporation is the only only permitted for a firm

3.5.4. similar to corpo. except that liability for malpractice is limited to the person responsible for the act

3.6. Publicly Traded /Subchapter C Corporation

3.6.1. Limited overlap among participants

3.6.2. Controlling ownership is typically held by outside stockholders not actively involved in management of firm

3.6.3. Large firms with publicly trade in the stock exchange

3.6.4. Taxes paid on their income

3.6.5. Double Taxation

3.6.5.1. After-tax credit profits can be passed through to the stockholders in form of dividents to be taxed a second time in the stockholder's individual tax return

3.6.6. General partnership

3.6.6.1. Does not pay federal taxes. Each partner's share of income passed thru individual's tax return

3.6.6.2. Every state has their Uniform Partnership Act: Defining ownership and control of a partnership

3.6.6.3. 2 or more architects

3.6.6.4. All partner actively participate in management

3.6.6.5. Each general partner is potentially liable for the other. Up to their personal assets

3.6.7. Limited partnership

3.6.7.1. one GENERAL partner and one LIMITED partner at least. limited partners have NO SAY IN MNGT and only liable TO THE EXTENT OF THEIR INVESTMENT.

3.6.7.2. partners are LIABLE for each other. taxed at individual rates.

4. STARTING AN ARCHITECTURAL FIRM

4.1. Global Practice

4.1.1. collaboration with local associate firms

4.1.2. Advance in technologies and telecommunications

4.2. Collaboration

4.2.1. Contract Production staff

4.2.2. Constructions phase with contractors

4.2.3. Consultants

4.2.4. Architect-Led Design-Build

4.3. Infrastructure

4.3.1. File-sharing technologies

4.3.2. BIM

4.3.3. Online project communications

4.3.4. Multiplatform collaboration

4.4. Writing a Business Plan

4.4.1. Marketing

4.4.1.1. Relationship-building and networking plan

4.4.1.2. Target market

4.4.1.3. Key differentiators

4.4.1.4. Image and brand

4.4.1.5. External market conditions and competition

4.4.2. FInance

4.4.2.1. Revenue goals over time

4.4.2.2. Scenario plans for firm revenue and staffing over time

4.4.2.3. Profit plan over time

4.4.2.4. Operating budget expectations over time

4.4.2.5. Financial expectations of owners

4.4.3. Operations

4.4.3.1. Organization Structure

4.4.3.2. Project delivery model

4.4.3.3. Technology upgrades and integration

4.4.3.4. Knowledge acquisition and development

4.4.3.5. Promotion, recruitment, and compensation

4.4.4. Purpose

4.4.4.1. Firm Future, including transition plan

4.4.4.2. Project Types? Client Types?

4.4.4.3. Core Competence an Core Weaknesses

4.4.4.4. Firm Size

4.4.4.5. Market Opportunities and threats to market position

4.4.4.6. Career Contentment and Disposition of Owners

4.4.4.7. Philosophy / Core Values

4.4.5. Documentation of intentions and proactive measures to accomplish goals

5. Why Firms Fail

5.1. 1. Lack of or inability to execute a business plan

5.2. 2. Slim or no-revenue pro forma (projections)

5.3. 3. Limited Business Opportunities

5.4. Operations

5.4.1. Align continuing education with purpose

5.4.2. Operation budgets

5.4.3. Market operational successes

5.4.4. Improve production processes

5.5. Marketing

5.5.1. Align message w/purpose

5.5.2. Marketing budget

5.5.3. Outreach to new prospects

5.5.4. Improve marketing processes

5.6. Financial Setup

5.6.1. Marketing

5.6.1.1. Social Media

5.6.1.1.1. 1. Who is potential audience

5.6.1.1.2. 2.Motivations and objectives behind

5.6.1.1.3. 3. Commitment and level of effort to maintain applications

5.6.2. Financial Resources

5.6.2.1. SBA Loans

5.6.3. Infrastructure

5.6.3.1. Telecommunications

5.6.4. Logistics

5.6.4.1. Facilities

5.6.4.1.1. Shared offices

5.6.4.1.2. Rental Office Spaces or "executive" suites

5.6.4.1.3. Coworking Spaces

5.6.4.1.4. Virtual Offices

5.7. Considerations

5.7.1. Informal Management Practices

5.7.1.1. Titles define responsibilities for project and firm management

5.7.1.1.1. Associates

5.7.1.1.2. Principal

5.7.2. Actions on behalf of the firm

5.7.2.1. Signing contracts

5.7.2.2. Issuing letters and drawings.

5.7.2.3. Legal documents

5.7.3. Purpose

5.7.3.1. Ethical & Socially responsible

5.7.3.2. Image, reputation & brand

5.7.3.3. Align w/business model

5.7.3.4. Financial Goals

5.7.4. Finance

5.7.4.1. Community Giving

5.7.4.2. Reduced waste

5.7.4.3. Budget tracking and control

5.7.4.4. Financial Planning

5.7.5. Government Filing Requirements

5.7.5.1. Secretary of State's Offices

5.7.5.2. State Architectural Registration Board

5.7.5.2.1. COA: Certificate of Authorization

6. WHY?

6.1. Why Business Use Strategic Planning

6.1.1. Create positive changes and outcomes that align with values and professional aspirations

6.2. DESIGNING A FIRM

6.2.1. Programming

6.2.1.1. Determine Client's need

6.2.2. Schematic Design

6.2.2.1. Creative, big picture Concepts

6.2.3. Design Development

6.2.3.1. More Defined building Systems

6.2.4. Construction Documents

6.2.4.1. Detailed drawings and specifications

6.2.5. Construction Contract Administration

6.2.5.1. Assessing and maintaining progress

6.3. STRATEGIC PLAN

6.3.1. 1. MISSION

6.3.1.1. Purpose of the Firm

6.3.1.1.1. Mission Statement

6.3.2. 2. ViISION

6.3.2.1. Firm's aspirations for the future

6.3.2.1.1. well articulated vision regardless of size

6.3.2.1.2. Time-oriented (5 to 10 years)

6.3.3. Goals in Management

6.3.3.1. Quantifiable, measure targets

6.3.4. Strategies

6.3.4.1. Good Ideas to pish the firm in the righ direction

6.3.5. Action Plans

6.3.5.1. Who is going to do what, and by when?

6.3.6. Implementation and Communications

6.3.6.1. Sharing the plan and keeping in track

7. PLAN

7.1. PREPARING FOR PLANNING

7.1.1. Conducting Research

7.1.1.1. External Resources

7.1.1.1.1. Industry and general business reports: publications

7.1.1.1.2. Published data

7.1.1.1.3. Firm's own survey of marketplace perceptions

7.1.1.2. Internal Resources

7.1.1.2.1. Employee Survey

7.1.1.2.2. Interviews with key managers

7.1.1.2.3. Financial Reports

7.1.2. Analyzing the Findings

7.1.2.1. EXAMINE: Objectively and Dispassionately

7.1.2.2. SWOT: Strengths, Weaknesses, Opportunities, Threats

7.1.2.2.1. TOP Row: Internal Factors of strength and weaknesses

7.1.2.2.2. LEFT Column: Positive items. RIGHT Column: Negative items.

7.1.3. Preparing the Strategic Planning Team

7.1.3.1. Provide Results

7.1.3.2. Give homework assignments

7.1.3.3. Obtaining valid input into the planning process

7.2. DEVELOPING THE PLAN

7.2.1. Strategic Planning Team

7.2.1.1. Operations

7.2.1.2. Administrative

7.2.1.3. Size of the Team

7.2.1.3.1. 6-12

7.2.1.4. Responsibilities of the Team

7.2.2. Planning Workshop

7.2.2.1. Set up WORKSHOP. "Special" atmosphere to brainstorm

7.2.2.2. Prioritize issues and initiatives to be included in workshop

7.2.2.3. CONCENSUS: Even those with different ideas are convinced by the group's actions

7.3. IMPLEMENTING THE STRATEGIC PLAN

7.3.1. Implementing the Plan

7.3.1.1. Implementing into EVERY DAY's job

7.3.1.2. Consider the champion to be "project manager" with firm leader as "principal-in-charge" for the entire plan

7.3.1.3. Regular meetings

7.3.1.4. Manage established deadlines by using agenda

7.3.1.5. Keep plan active and relevant

7.3.2. Communicating the Plan

7.3.2.1. Involve the entire staff

7.3.2.2. Communicate its highlights to all staff members

7.3.2.3. Share the entire plan

7.3.2.4. Report progress often

7.3.2.5. Use plan as opportunity for open and transparent communication

7.4. MAINTAINING A STRATEGIC PLANNINC CULTURE

7.4.1. Talk about it

7.4.1.1. Firm leaders discussion with stakeholders

7.4.1.2. Communication to all staff

7.4.2. The firm leader's role

7.4.2.1. Rally others to share a vision for future

7.4.2.2. Determine how to get there

7.4.3. Updating the plan

7.4.3.1. keep it fresh

7.4.3.2. keep it up-tp-date

7.4.3.3. Keep it relevant

8. STRATEGIC PLAN

8.1. 3. ISSUES AND INITIATIVES

8.1.1. What works, what doesn't work, what opportunites lie ahead?

8.1.1.1. Issues: obstacles, circumstances, attitudes that stand in the way of a firm's achieving its vision

8.1.1.1.1. Topics

8.1.1.2. Initiatives: positive ideas and activities that would proper the firm to its vision

8.1.1.2.1. Context

8.1.1.3. Engage w/ third party consultant

8.1.1.4. Written report