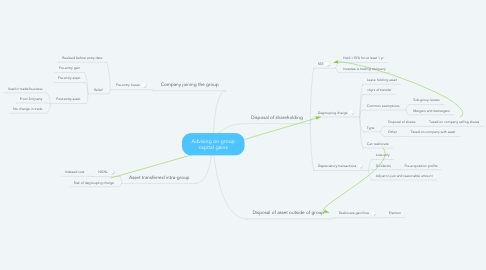

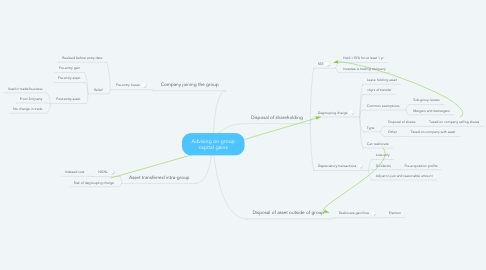

Advising on group capital gains

by Stephen Relf

1. Disposal of shareholding

1.1. SSE

1.1.1. Held >10% for at least 1 yr

1.1.2. Investee is trading company

1.2. Degrouping charge

1.2.1. Leave holding asset

1.2.2. <6yrs of transfer

1.2.3. Common exemptions

1.2.3.1. Sub-group leaves

1.2.3.2. Mergers and demergers

1.2.4. Type

1.2.4.1. Disposal of shares

1.2.4.1.1. Taxed on company selling shares

1.2.4.2. Other

1.2.4.2.1. Taxed on company with asset

1.2.5. Can reallocate

1.3. Depreciatory transactions

1.3.1. Loss only

1.3.2. Dividends

1.3.2.1. Pre-acquisition profits

1.3.3. Adjust to just and reasonable amount

2. Disposal of asset outside of group

2.1. Reallocate gain/loss

2.1.1. Election

3. Asset transferred intra-group

3.1. NGNL

3.1.1. Indexed cost

3.2. Risk of degrouping charge

4. Company joining the group

4.1. Pre-entry losses

4.1.1. Realised before entry date

4.1.2. Relief

4.1.2.1. Pre-entry gain

4.1.2.2. Pre-entry asset

4.1.2.3. Post-entry asset

4.1.2.3.1. Used in trade/business

4.1.2.3.2. From 3rd party

4.1.2.3.3. No change in trade