1. Alyssa Hartwich

2. Citations (APA) Ecn project

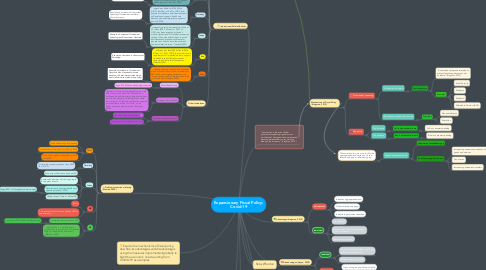

3. Explain the mechanisms of fiscal policy, describe its advantages and disadvantages using the measures implemented globally to fight the economic crisis resulting from COVID-19 as examples

4. Problems countries are facing (Masters,2020)

4.1. China

4.1.1. Demand and exports decrease

4.1.2. Cannot afford to spend as much as in 2008

4.1.3. Government debt of about 60% of GDP since 2008

4.2. Germany

4.2.1. 1st time the economy reduces since 2009 from 3-10%

4.3. Japan

4.3.1. Economy will decrease by about 3%

4.3.2. postponed olympics which was going to bring great income.

4.3.3. Government is boosting health care spending (Jasinski, 2020)

4.3.3.1. Paying 80% of furloughed workers wages

4.3.4. Having taxes of zero or almost 0%

4.4. UK

4.4.1. Brexit

4.4.2. This recession could cause a shrink of 5% in the economy

4.5. US

4.5.1. Unemployment could reach 40%

4.5.1.1. more than 25% in the Great Depression.

4.5.2. “ 'In effect, this is a wartime level of investment into our nation,' said Senate Majority Leader Mitch McConnell. "(Masters, 2020)

5. International Policies/Actions

5.1. United States

5.1.1. Passed the Families First Coronavirus Response Act which provides paid sick leave, free testing, expanded unemployment benefits, and expanded food assistance

5.1.1.1. Passed the Cares Act which includes "$1,200 direct cash payments to individuals making up to $75,000 annually, plus $500 per child. It also extends unemployment benefits and increases weekly payments, delays the 2019 tax-filing deadline by 90 days and suspends federal student-loan payments, with no interest, for six months" (Jasinski, 2020)

5.1.1.1.1. Passed the $8.3 billion Coronavirus Preparedness and Response Supplemental Appropriations Act. The act provided funding for the Centers for Disease Control and Prevention (CDC) and money to purchase coronavirus tests and other medical equipment.

5.2. United Kingdom

5.2.1. Offering interest free loans to small business, extending sick pay, offering rent assistance, and extending unemployment benefits.

5.2.1.1. "Treasury has pledged to pay 80 percent of workers’ salaries for several months to keep companies from resorting to huge layoffs; deferred tax payments; increased unemployment benefits" (Masters, 2020)

5.2.1.1.1. Example of Decreasing Taxes, Increase in Government Transfers, and increasing Government Spending

5.3. Canada

5.3.1. Passed an expanded economic stimulus package which includes payments of C$2,000 a month to unemployed individuals, tax deferments, and postponements of certain mortgage and student loan payments.

5.3.1.1. "The federal government will pay 10% of small businesses’ wage costs for three months and provide them with C$10 billion of cheap loans." (Jasinski, 2020)

5.3.1.1.1. Example of increase in Government Spending, Tax Decrease, and increase in Government Transfers

5.4. France

5.4.1. "...planning €45 billion ($49.7 billion), or 1.8% of GDP, in tax credits and new spending to improve its health system, support small businesses, and prevent unemployment." (Jasinski, 2020)

5.4.1.1. Example of increase in Government Spending

5.5. Germany

5.5.1. "...spend an additional €156 billion (U$172.2 billion), or 4.4% of GDP, from automatic stabilizers, small-business and self-employed support, health care benefits, and unemployment payments." (Jasinski, 2020)

5.5.1.1. Example of increase in Government Spending/Government transfers/ Social insurance

5.6. Japan

5.6.1. "Increased government spending of about ¥2 trillion ($18.3 billion)—or 0.4% of GDP—has been targeted at Japan’s medical system and for funding coronavirus testing. It has also offered loans to small businesses and planned assistance for people out of work due to the outbreak and associated closures." (Jasinski,2020)

5.6.1.1. Example of increased Government Spending and Government Transfers

5.7. Italy

5.7.1. "...will spend at least €25 billion (U$27.6 billion), or 1.5% of GDP, to provide income replacement for impacted workers, support its health care and law-enforcement systems, and help small businesses." (Jasinski,2020)

5.7.1.1. Example of Increase in Government Spending

5.8. China

5.8.1. "...reducing reserve requirements for banks, which will allow them to loan an additional $80 billion to struggling businesses, and indicating that it will cut interest rates in the months ahead."(Masters, 2020)

5.8.1.1. Example of Increase in Government Transfers/ Rise disposable income because of lower interest rates which would allow more costumer spending

5.9. Other Institutions

5.9.1. World Bank Group:

5.9.1.1. up to $12 billion to developing countries

5.9.2. European Central Bank:

5.9.2.1. "Pandemic Emergency Purchase Program, the ECB is set to buy up to 750 billion euros in additional bonds this year to help its members amid the downturn. And further action could be coming, as ECB President Christine Lagarde promised there will be “no limits” on the bank’s defense of the eurozone".(Masters, 2020)

5.9.3. International Monetary Fund:

5.9.3.1. $50 billion loan to members

5.9.3.2. Preference to developing economies

6. Lourdes Molina Curin

7. These mechanisms are used to shift the aggregate demand curve and close a recessionary gap or inflationary gap

7.1. Expansionary fiscal policy

7.1.1. Used during recessionary gap

7.1.2. Increases aggregate demand

7.1.2.1. Increase in government purchases of goods and services

7.1.2.2. Cut in taxes

7.1.2.3. Increase in government transfers

8. "fiscal policy is the use of either government spending—government purchases of final goods and services and government transfers—or tax policy to stabilize the economy." (Krugman, 2015)

9. Advantages (Krugman, 2015)

9.1. Government

9.1.1. Increases aggregate demand

9.1.2. Closes recessionary gaps

9.1.3. Increase in government transfers

9.2. Individual

9.2.1. Tax reduction

9.2.2. Increase in government purchases of goods and services

9.2.3. Increased employment

10. Disadvantages (Hayes, 2020)

10.1. Individual

10.1.1. Increased deficit spending crowds out private sector investment

10.1.2. Often politically motivated

10.2. Government

10.2.1. Is not a long-run equilibrium solution

10.2.2. Could lead to inflation

11. Mechanisms of Fiscal Policy (Krugman, 2015)

11.1. Government spending

11.1.1. Government transfers

11.1.1.1. Social insurance

11.1.1.1.1. "Government programs intended to protect families against economic hardship" (Krugman, 2015)

11.1.1.1.2. Examples

11.1.2. Purchases of goods and services

11.1.2.1. Examples

11.1.2.1.1. National defense

11.1.2.1.2. Education

11.2. Tax policy

11.2.1. Tax increase

11.2.1.1. Fall in disposable income

11.2.1.1.1. Fall in consumer spending

11.2.2. Tax decrease

11.2.2.1. Rise in disposable income

11.2.2.1.1. Rise in consumer spending