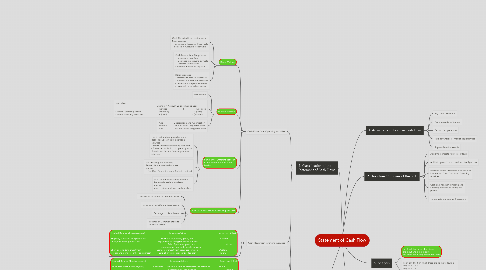

1. 4. Classification of the Statement of Cash Flows

1.1. Cash Flows from Operating Activities

1.1.1. Direct Method

1.1.1.1. Cash Collected from customers = Sales revenue + Decrease in Accounts Receivable - Increase in Accounts Receivable

1.1.1.2. Cash Payments to Suppliers = + Increase in inventory + Decrease in accounts payable - Decrease in inventory - Increase in account payable

1.1.1.3. Other expenses = + Increase in prepaid expenses + Decrease in accrued expenses - Decrease in prepaid expenses - Increase in accrued expenses

1.1.2. In-direct Method

1.1.2.1. Net Income

1.1.2.2. Use Table Change in Account Balance During Year Increase l Decrease Current Operating Assets - (Subtract) + (Add) Current operating Liabilities + (Add) - (Subtract)

1.1.2.3. Add Depreciation and Amortization Subtract Gain on sale of long-term asset Add Loss on sale of long-term asset

1.1.3. Summery of Different between Direct Method and In-direct Method

1.1.3.1. The Direct Method provides more detail about cash from operating activities - Shows individual operating cash flow. - Shows reconciliation of operating cash flows to net income in a supplemental schedule.

1.1.3.2. The investing and financing Section for the two methods are identical. - Net Cash flow is the same for both method

1.1.3.3. A lot of firm use in-direct method because is easier than direct method. and in-direct method hardly analyze.

1.1.4. Non Cash investing and financing activities

1.1.4.1. Conversion of bonds to Common Stock

1.1.4.2. Issuance of debt to purchase assets

1.1.4.3. Exchange of plant Assets

1.1.4.4. Issuance of Common Stock to purchase Assets

1.2. Cash Flows from Inversting Activities

1.2.1. Related Balance Sheet Account(s) Financing Activity Cash Flow Effect Property, plant and equipment and Purchase of property, plant, and Outflow intangible asset (patents, etc.) equipment or intangible assets for cash Sale of property, plant, and Inflow equipment or intangible assets for cash Short or long term investment Purchase of investment securities for cash Outflow (stocks and bonds of other companies) Sale of investment securities for cash Inflow

1.3. Cash Flow from Financing Activities

1.3.1. Related Balance Sheet Account(s) Financing Activity Cash Flow Effect Short term debt (notes payable) Borrowing Cash from banks or other financial institution Inflow Repayment of loan principal Outflow Long-Term Debt Issuance of bonds for cash Inflow Repayment of bond principal Outflow Common Stock and additional Issuance of bonds for cash Inflow paid-in capital Repurchase (retirement) of stock with Cash Outflow Retained Earnings Payment of Cash dividends Outflow

1.4. Non-cash Investing and Financing Activities (Have not studied)

2. 3. Type of Cash

2.1. Cash (Currency)

2.2. Cash Equivalent

2.2.1. Short-Term, Highly liquid investments.

2.2.2. Readily convertible into cash

2.2.3. So near maturity that they present insignificant risk of changes in value (<= 3 months)

3. 1. Advantage of Positive Cash Flow

3.1. Pay Debts when due

3.2. Pay Dividends to Owners

3.3. Expand its operations

3.4. Take advantage of market opportunities

3.5. Replace Needed Assets

4. 2. Usefulnes/Purposes of the SCF

4.1. Ability to generate future cash flows

4.2. Ability to pay dividends and meet obligations

4.3. Reasons for the Difference between Net Income and Cash flow from Operating Activities

4.4. Cash and noncash investing and financing transaction during the period

4.5. To evaluate management decisions

5. 5. Analysis

5.1. Point out the Firms which there are input and out put same but there are management not same

5.2. Point out The firm which there are as the following; Negative CFO Negative CFI Positive CFF And we should train 7 another case also ( All 8 Type)

6. 4.1

6.1. CFO

6.1.1. Some information from Income Statement

6.1.2. Some information from Statement of Financial Position

6.2. CFI

6.2.1. Some Asset from Statement of Financial Position

6.3. CFF

6.3.1. Some Liabilities or Stock Holder's Equity from Statement of Financial Position