1. Bargaining Power of Suppliers

1.1. Bargaining power of suppliers: their ability to increase the costs of the industry in significant ways

1.2. Powerful suppliers negatively impact industry profitability bu increasing cost of production for companies

1.3. Powerful suppliers = threat

1.4. Weak suppliers = opportunity

1.5. When are suppliers most powerful?

1.5.1. The product they supply has few or no substitutes - companies are then dependent on suppliers and have diminished bargaining power

1.5.2. The industry in not an important customer of the supplier

1.5.3. Switching to a different supplier is not really a viable option for the company

1.5.4. A supplier has the ability to threaten to enter the customers' industry and use their product to become a direct competitor in the industry

1.5.5. Companies do not have the capability to be able to threaten to produce their own inputs

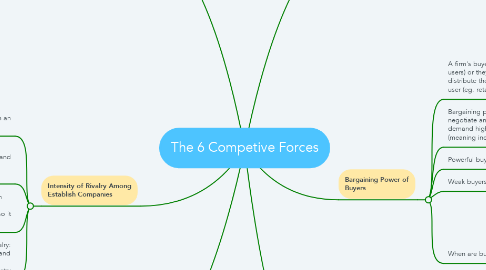

2. Intensity of Rivalry Among Establish Companies

2.1. Rivalry: the competitive struggle to increase market share between firms in an industry

2.2. Firms can compete using price (very common), product design, advertising and promotional spending, direct-selling efforts, after-sales service and support.

2.3. Intense rivalry queezes profits out of an industry because prices are lowered or costs are increased and raises costs - so it is a threat to profitability

2.3.1. Less intense rivalry means higher profits for the different firms in the industry

2.4. Factors affecting the intensity of rivalry: industry competitive structure, demand conditions, cost conditions and the condition of exit barriers in the industry

3. Threat of Substitutes

3.1. Refers to the extent to which there are other products that can satisfy the same customer need

3.2. Many substitutes = threat (inhibits the ability of the company to increase the price of the product, which affects profits)

3.3. Fewer substitutes = opportunity (companies can raise prices and increase profits)

4. Risk of Entry

4.1. Higher risk of entry = profitability of established firms ins under threat

4.2. Risk of entry is determined by industry attractiveness (profitability) and ease of entry

4.3. High cost of entry is a dissuading factor to potential competitors

4.4. Key barriers to entry: economies of scale, absolute cost advantages, brand loyalty, customer switching costs, government regulation

5. Bargaining Power of Buyers

5.1. A firm's buyers can be individuals (end users) or they can be those that will distribute the product/service to the end user (eg. retailers)

5.2. Bargaining power of buyers: their ability to negotiate and bring prices down or to demand higher quality of product/service (meaning increased costs for the company)

5.3. Powerful buyers = threat

5.4. Weak buyers = opportunity

5.5. When are buyers most powerful?

5.5.1. Industry with many companies offering the same product or service

5.5.2. Buyer purchases large quantities - can negotiate prices down using their purchasing power

5.5.3. Low switching costs within the industry

5.5.4. Buyers are able to threaten to enter the industry and make their own product

6. Power of Complement Providers

6.1. Complementors: companies that sell products that add value to products of companies in an industry (when the product is used with the complementary product there is greater customer satisfaction)

6.2. When complements greatly influence demand for the firm's product, profits within the industry are dependent on adequate supply of the complementary product

6.2.1. Unattractive complements can negatively affect industry growth and profits

6.3. Strong complementors: extract profit from the industry they provide complements for

6.3.1. Strong complementors = threat