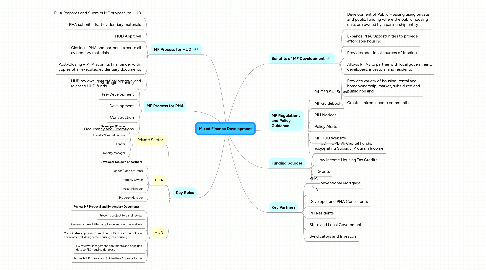

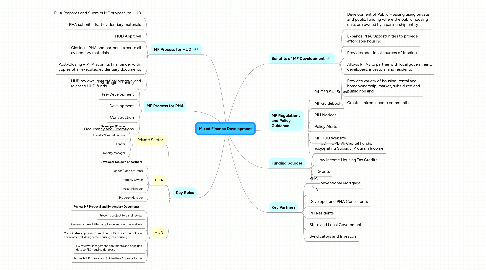

Mixed Finance Development

создатель Lex Luke

1. MF Process for HUD

1.1. PHA Prepares and Submits MF proposal to HUD

1.2. PHA submits draft evidentiary materials

1.3. HUD Approval

1.4. Closing - PHA and partners execute all evidentiary materials

1.5. Post-Closing – PHA submits final binder with copies of all executed evidentiary documents

1.6. HUD reviews, grants final approval and releases HUD funds

2. MF Process for PHA

2.1. Strategic Planning

2.2. Pre-Development

2.3. Development

2.4. Construction

2.5. Occupancy and Operations

3. Key Roles

3.1. Private Sector

3.1.1. Developer/Owner

3.1.2. Investor/Limited Partner

3.1.3. Lender

3.1.4. Property Manager

3.2. PHA

3.2.1. Developer (on own or partner)

3.2.2. Lender (Loan or Grant)

3.2.3. Property Owner

3.2.4. Asset Manager

3.2.5. Property Manager

3.3. HUD

3.3.1. Review MF Proposal and Evidentiary Documents

3.3.2. Presents project to panel review

3.3.3. Reviews accessibility compliance and secures waivers

3.3.4. Coordinates approvals from other HUD offices (demolition, environmental, designated housing, fair housing)

3.3.5. FO review Management documents and adds unit data to PIC housing database

3.3.6. Issues MF Proposal and Evidentiary Approval Letter