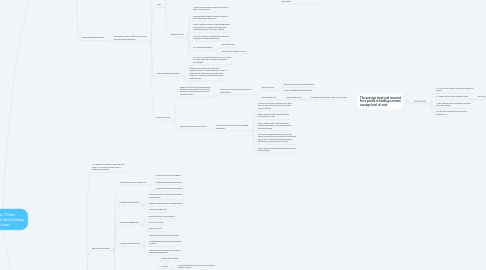

1. Cash management

1.1. Policy

1.1.1. Profitability

1.1.1.1. How the firm manages its cash

1.1.1.1.1. Minimise costs

1.1.1.1.2. Maintain a return

1.1.1.2. Surplus of income over expenditure

1.1.2. Liquidity

1.1.2.1. Ability to pay its supplier on time

1.1.2.1.1. Ensuring

1.1.2.1.2. Planning for its financial needs

1.1.3. Safety

1.1.3.1. Cash & CR transactions should not involve the company in any undue

1.1.3.1.1. CR=Near cash

1.1.3.2. Should

1.1.3.2.1. notes & coins should be secure from theft

1.1.3.2.2. electronic systems should be secure from fraud

1.1.3.2.3. short-term investments should not stand to risk heavy losses

1.1.3.3. Relationship between

1.1.3.3.1. risk

1.1.3.3.2. company concerned

1.1.3.3.3. return

1.2. Manage

1.2.1. Centralised

1.2.1.1. Centrally

1.2.2. Decentralised

1.2.2.1. Distribute responsibility

1.3. Optimising cash balances

1.3.1. financial manager must try to balance liquidity with profitability

1.3.1.1. Deviations from expected cash flows

1.3.1.1.1. Cash budgets can only be estimates of cash flows.

1.3.1.1.2. Cash budget model could be constructed, and the sensitivity of cash flow forecasts to changes in estimates of revenues, costs and so on could be analysed.

1.3.1.2. Float

1.3.1.2.1. amount of money tied up between

1.3.1.2.2. Lengthy float reasons

1.3.1.2.3. Reducing float

1.3.1.3. Cash management models

1.3.1.3.1. designed to indicate minimum and maximum levels of cash holding in order to minimise the costs of holding idle cash balances & maximise interest earned on surplus funds.

1.3.1.4. Baumol's model

1.3.1.4.1. Based on the idea that deciding on optimum cash balances is a similar question to deciding on optimum inventory levels

1.3.1.4.2. Drawbacks of Baumol's model

2. Treasury management

2.1. in a modern enterprise covers various areas, & in a large business may a centralised function.

2.2. Role of the treasurer

2.2.1. Corporate financial objectives

2.2.1.1. Financial aims and strategies

2.2.1.2. Financial and treasury policies

2.2.1.3. Financial and treasury systems

2.2.2. Liquidity management

2.2.2.1. Working capital & money transmission managament

2.2.2.2. Banking relatioships and arrangements

2.2.2.3. Money management

2.2.3. Funding management

2.2.3.1. Funding policies & procedures

2.2.3.2. Sources of funds

2.2.3.3. Types of funds

2.2.4. Currency management

2.2.4.1. Exposure policies and procedures

2.2.4.2. Exchange dealing, including futures & options

2.2.4.3. International monetary economics & exchange regulations

2.2.5. Corporate finance is concerned with matters such as:

2.2.5.1. Raising share capital

2.2.5.2. Its form

2.2.5.2.1. ordinary/preference, or different classes of ordinary shares

2.2.5.3. Obtaining a stock exchange listing, dividend policy

2.2.5.4. Financial information for management

2.2.5.5. Mergers

2.2.5.6. Acquisitions

2.2.5.7. Business sales

2.2.6. Related subjects

2.2.6.1. Corporate taxation

2.2.6.2. Risk management

2.2.6.3. Pension fund investment management

2.3. Centralisation of cash management & treasury functions

2.3.1. Centralised liquidity management

2.3.1.1. Avoid having a mix of cash surpluses & overdrafts in different localised bank A/Cs

2.3.1.2. Facilitates bulk cash flows, so that lower bank charges can be negotiated

2.3.2. Larger volumes of cash are available to invest, giving better short-term investment opportunities

2.3.3. Any borrowing can be arranged in bulk, at lower interest rates than for smaller borrowings

2.3.4. Foreign exchange risk management is likely to be improved in a group of companies

2.3.5. A specialists treasury department can employ experts with knowledge of dealing in forward contracts, futures, options, eurocurrency market, swaps & so on.

2.3.6. The centralised pool of funds required for precautionary purposes will be smaller than the sum of separate precautionary balances required if the department was decentralised

2.3.7. Having a separate profit centre

2.4. Possible advantages of decentralised cash management are as follows:

2.4.1. Sources of finance canbe diversified and can match local assets

2.4.2. Greater autonomy ca be given to subsidiaries & divisions because of the relationships they will have with the decentralised cash management function.

2.4.3. A decentralised treasury may be more respinsive to the needs of individuals operating units.

2.4.4. Since cash balances will not be aggregated at group level

3. The average total cost incurred for a period in holding a certain average level of cash

3.1. (Qi/2)+(FS/Q)

3.1.1. S= amount of cash to be used in each time period

3.1.2. F= fixed cost of obtaining new funds

3.1.2.1. cost per sale/purchase of securities

3.1.3. i= the interest cost of holding cash/near cash equivalents

3.1.4. Q= the total amount to be raised to provide for S