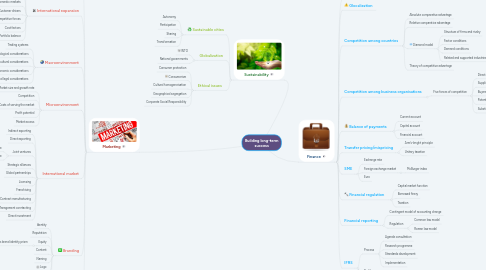

1. Marketing

1.1. Global marketplace

1.1.1. Transnational company

1.1.2. Global firm

1.2. International expansion

1.2.1. Saturated domestic markets

1.2.2. Small domestic markets

1.2.3. Low-growth domestic markets

1.2.4. Customer drivers

1.2.5. Competitive forces

1.2.6. Cost factors

1.2.7. Portfolio balance

1.3. Macroenvironment

1.3.1. Trading systems

1.3.2. Technological considerations

1.3.3. Socio-cultural considerations

1.3.4. Economic considerations

1.3.5. Political and legal considerations

1.4. Microenvironment

1.4.1. Market size and growth rate

1.4.2. Competition

1.4.3. Costs of serving the market

1.4.4. Profit potential

1.4.5. Market access

1.5. International market

1.5.1. Indirect exporting

1.5.2. Direct exporting

1.5.3. Joint ventures

1.5.3.1. Equity joint venture

1.5.3.2. Contractual joint venture

1.5.4. Strategic alliances

1.5.5. Global partnerships

1.5.6. Licensing

1.5.7. Franchising

1.5.8. Contract manufacturing

1.5.9. Management conrtacting

1.5.10. Direct investment

1.6. Branding

1.6.1. Identity

1.6.2. Reputation

1.6.3. Equity

1.6.3.1. Kapferer’s brand identity prism

1.6.4. Content

1.6.5. Naming

1.6.6. Logo

1.6.7. Packaging and labeling

1.7. Marketing function

1.7.1. Convergence

1.7.2. Divergence

1.7.3. Crossvergence

2. Sustainability

2.1. Sustainable cities

2.1.1. Autonomy

2.1.2. Participation

2.1.3. Sharing

2.1.4. Transformation

2.2. Globalization

2.2.1. WTO

2.2.2. National governments

2.3. Ethical issues

2.3.1. Consumer protection

2.3.2. Consumerism

2.3.3. Cultural homogeneisation

2.3.4. Geographical segregation

2.3.5. Corporate Social Responsibility

3. Finance

3.1. International trade

3.2. Glocalization

3.3. Competition among countries

3.3.1. Absolute comparative advantage

3.3.2. Relative comparative advantage

3.3.3. Diamond model

3.3.3.1. Structure of firms and rivalry

3.3.3.2. Factor conditions

3.3.3.3. Demand conditions

3.3.3.4. Related and supported industries

3.3.4. Theory of competitive advantage

3.4. Competition among business organisations

3.4.1. Five forces of competition

3.4.1.1. Direct industry competitors

3.4.1.2. Suppliers

3.4.1.3. Buyers

3.4.1.4. Potential entrants

3.4.1.5. Substitute goods and services

3.5. Balance of payments

3.5.1. Current account

3.5.2. Capital account

3.5.3. Financial account

3.6. Transfer pricing/mispricing

3.6.1. Arm’s-lenght principle

3.6.2. Unitary taxation

3.7. SME

3.7.1. Exchange rate

3.7.2. Foreign exchange market

3.7.2.1. McBurger index

3.7.3. Euro

3.8. Financial regulation

3.8.1. Capital market function

3.8.2. Borrowed finery

3.8.3. Taxation

3.9. Financial reporting

3.9.1. Contingent model of accounting change

3.9.2. Regulation

3.9.2.1. Common law model

3.9.2.2. Roman law model

3.10. IFRS

3.10.1. Process

3.10.1.1. Agenda consultation

3.10.1.2. Research programme

3.10.1.3. Standards development

3.10.1.4. Implementation

3.10.2. Profiles

3.10.3. IAS Standards

3.10.4. IFRS for SMEs Standards