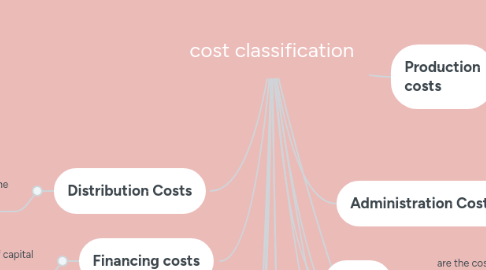

1. Distribution Costs

1.1. are those that are generated by taking the product or service to the final consumer

1.1.1. packaging

1.1.1.1. the storage

1.1.1.1.1. and the transport

2. Financing costs

2.1. are those generated by the use of capital resources

3. Historical

3.1. are past costs, which were generated in a previous period

3.1.1. Defaults

3.1.1.1. are costs that are calculated based on statistical methods and that are used to prepare budgets

3.1.1.1.1. Period costs

4. According to the control you have over your consumption

4.1. Controllable Costs

4.1.1. They are those costs on which the organization's management (either supervisors, assistant managers, managers

4.1.1.1. Uncontrollable Costs

4.1.1.1.1. are those costs over which there is no authority for their control. Example the value of the lease to pay is an uncontrollable cost

5. De acuerdo con el tipo de desembolso en el que se ha incurrido

5.1. Out-of-pocket costs

5.1.1. are those that generate a real cash outflow

5.1.1.1. Opportunity costs

5.1.1.1.1. is the cost that is generated when making a determination that entails the resignation of another alternative

6. According to their behavior

6.1. In relation to the volume of activity: that is, its variability

6.1.1. Fixed costs

6.1.1.1. are those costs that remain constant over a period of time determined, regardless of production volume

6.1.1.1.1. Variable costs

7. it is known for the whole company or for a set of products. It's hard associate them with a specific product or service

8. Relevant Costs

9. relevant costs are those that are modified when making one or the other decision. On occasions coincide with variable costs

9.1. Non-Relevant Costs

9.1.1. son aquellos costos que independiente de la decisión que se tome en la empresa permanecerán constantes. En ocasiones coinciden con los costos fijos

10. Production costs

10.1. are classified into

10.1.1. direct raw material

10.1.1.1. Direct Labor

10.1.1.1.1. costos indirectos de fabricación

10.1.1.1.2. the effort exerted by employees in the production process, through which raw materials are transformed

10.1.1.2. set of materials that will be subjected to transformation during the production process

11. Administration Costs

11.1. are those generated in the administrative areas of the company

12. direct

12.1. are the costs that can be easily identified with the product, service, process or Department. Direct costs are Direct Material and Direct Labor

13. Indirect

14. According to its importance in organizational decision making

15. According to the type of cost incurred

15.1. Disbursable

15.1.1. involved an outflow of cash, for which they can be registered in the information generated by accounting

15.1.1.1. Of opportunity

15.1.1.1.1. It originates when making a certain decision, which causes the resignation of another option type