1. Equity Market

1.1. Common

1.1.1. A share giving the holder the right to vote Also known as voting share or ordinary share.

1.2. Preferred

1.2.1. Has priority in term of dividend and rights on liquidation, over common stock. Include fixed rate of dividend, carries no voting rights and option of convertibility into common stock (in some cases).

1.3. Cumulative Preferred

1.3.1. Type of preferred stock in which the dividends are cumulative.

1.4. Non-Cumulative Preferred

1.4.1. similar characters as common stocks but the dividend are fixed and non-cumulative.

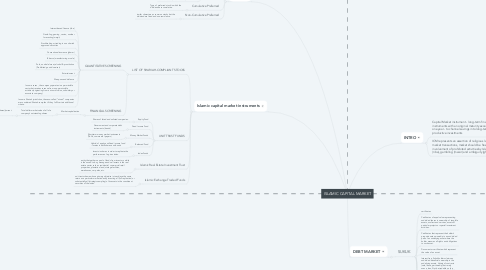

2. Islamic capital market instruments

2.1. LIST OF SHARIAH-COMPLIANT STOCKS

2.1.1. QUANTITATIVE SCREENING

2.1.1.1. Interest-based finance (riba)

2.1.1.2. Gambling, gaming, casino, number forecasting (maysir)

2.1.1.3. Stockbroking or trading in non shariah approved securities

2.1.1.4. Conventional insurance (gharar)

2.1.1.5. Tobacco (manufacturing or sale)

2.1.1.6. Pork, non-halal meat, alcohol & prostitution (Prohibited goods/services)

2.1.1.7. Entertainment

2.1.1.8. Weapons and defence

2.1.1.9. In some cases , the company operates in a permissible sector but receives revenue from non-permissible activities (originating from a minor division, subsidiary or associate company).

2.1.1.10. In some Shariah jurisdiction, these so-called “mixed” companies are considered Shariah-compliant if they fulfil certain additional criteria.

2.1.2. FINANCIAL SCREENING

2.1.2.1. Market capitalisation

2.1.2.1.1. Total dollar market value of all of a company’s outstanding shares

2.2. UNIT TRUST FUNDS

2.2.1. Equity Fund

2.2.1.1. Shares of listed and unlisted companies.

2.2.2. Fixed Income Fund

2.2.2.1. Government and corporate debt instruments (bonds)

2.2.3. Money Market Funds

2.2.3.1. Short-term money market instruments (T-bills, commercial papers)

2.2.4. Balanced Fund

2.2.4.1. Hybrid of equity and fixed income fund - Invests in both shares and bonds

2.2.5. Index Funds

2.2.5.1. Invests in shares in order to replicate the performance of a given index.

2.3. Islamic Real Estate Investment Trust

2.3.1. entity that gathers a pool of funds from investors, which is then used to buy, manage and sell assets in the real estate sector such as residential, commercial retail properties, plantation land, storage facilities, warehouses, car parks, etc.

2.4. Islamic Exchange Traded Funds

2.4.1. unit trust scheme whose primary objective is to achieve the same return as a particular market index by investing all (full replication) or substantially all (strategic sampling) of its assets in the constituent securities of the index.

3. INTRO

3.1. Capital Market instrument - long-term financial instruments with an original maturity exceeding one year - to channel savings into long-term productive investments

3.2. ICM represents an assertion of religious law in the capital market transactions, market should be free from the involvement of prohibited activities by Islam such as usury (riba), gambling (maisir) and ambiguity (gharar).

4. DEBT MARKET

4.1. SUKUK

4.1.1. certificates

4.1.2. Certificates of equal value representing undivided shares in ownership of tangible assets, usufruct and services, assets of particular projects or special investment activities.

4.1.3. Certificates that represent the holder’s proportionate ownership in an undivided part of an underlying asset where the holder assumes all rights and obligations to such asset.

4.1.4. Document or certificate which represent the value of an asset.

4.1.5. Interest free, Sukuk holders claims an undivided beneficial ownership in the underlying assets, Variety of contracts (sale, lease, partnership) but rarely uses a loan, Not be tradable on the secondary market and instead is held until maturity or sold at par.

4.1.6. SALE-BASED

4.1.7. Lease-based

4.1.8. Equity-based