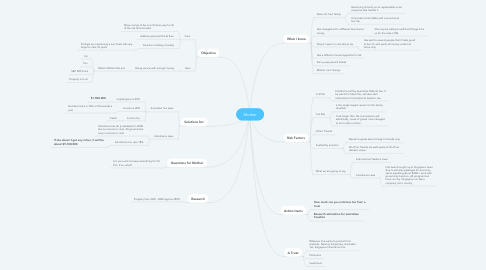

1. What I know

1.1. Does not trust family

1.1.1. Reasoning is family is not replaceable so let everyone else handle it

1.1.2. Only feels comfortable with conventional low risk

1.2. Has changed with a different face due to money

1.2.1. She may be willing to withhold things from us for the sake of $$.

1.3. Doesn't seem to care about tax

1.3.1. Has said to several people that it feels good to be rich and wants all money under her name only

1.4. Has a different mental appetite for risk

1.5. Penny wise pound foolish

1.6. Mother cant change

2. Risk Factors

2.1. C.S Peh

2.1.1. Entitled to half by Australian Defacto law. If he wants to follow this, will also alert authorities to International taxation law

2.2. Yan Ren

2.2.1. is the single largest reason for the family downfall.

2.2.2. Took larger than life commissions self admittedly, cause of greed. Has managed to lie to other mother.

2.3. Other 'friends'

2.4. Fuelled by emotion

2.4.1. Needs to speak about things to friends only

2.4.2. All of her friends are well aware of all of her taxation issues

2.5. What we are going to say

2.5.1. International Taxation Laws

2.5.2. Inheritance Laws

2.5.2.1. Has been brought up in Singapore news due to stimulus packages for economy alone equalling about $40B. I work with government sectors. All programmes have run dry. Singapore run like a company not a country

3. Objective

3.1. Ours

3.1.1. Move money to be out of harms way for all of the risk factors listed

3.1.2. Address personal first & then

3.1.3. Give her a feeling of safety

3.1.3.1. Perhaps by maintaining a sum thats still very large for next 25 years

3.2. Hers

3.2.1. Being secure with enough money

3.2.1.1. Match inflation/No evil

3.2.1.1.1. Urs

3.2.1.1.2. You

3.2.1.1.3. S&P 500 Fund

3.2.1.1.4. Property in trust

4. Solutions for:

4.1. Australian Tax Laws

4.1.1. Capital gains is 30%

4.1.1.1. $1,500,000

4.1.2. Income is 40%

4.1.2.1. Number terms is 100's of thousands a year

4.1.3. Income tax

4.1.3.1. Yields

4.2. Inheritance Laws

4.2.1. Inheritance tax ob ly abolished in 2008 due to economic crisis. All government now in economic crisis

4.2.2. Inheritance tax was 18%

4.2.2.1. If she doesn't get any richer, it will be about $5,760,000