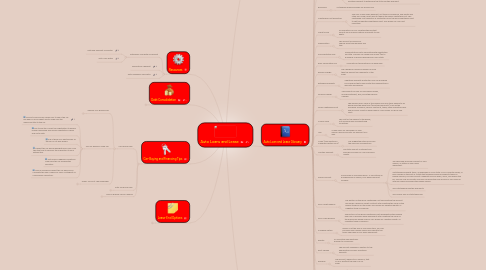

1. Car-Buying and Financing Tips

1.1. Car-Buying Tips

1.1.1. General Car-Buying Tips

1.1.1.1. Learn more about the cars you're interested in and what they cost. Consult a reference guide for a general idea of fair market values:

1.1.1.1.1. Kelley Blue Book

1.1.1.1.2. Edmunds

1.1.1.2. Anticipate all your costs. Fuel, registration fees, maintenance, insurance, and repairs add up.

1.1.1.3. Consider an extended service contract, also known as an extended warranty. If you plan to keep the vehicle longer, it could be worth it.

1.1.1.4. Arrange for financing in advance. Shop with confidence knowing how much you can buy and that you're ready to close the deal.

1.1.2. Tips for Buying a Used Car

1.1.2.1. Consult a service like carfax.com to see if the car has been in an accident and to make sure the owner has title to the car.

1.1.2.2. Ask to see the current car registration to ensure proper ownership and ensure registration is paid and up to date.

1.1.2.3. Ask if there is an existing lien on the car or if it was leased.

1.1.2.4. Inspect the car during daylight hours only. And take the time to perform the inspection to your satisfaction.

1.1.2.5. Test drive in highway conditions. Make sure the car accelerates smoothly.

1.1.2.6. Have a mechanic inspect the car before you complete the deal. Make your offer contingent on a successful inspection.

1.1.3. When You're At The Dealership

1.1.3.1. Take your time and evaluate your options. A hasty decision could cost you.

1.1.3.2. Get the look you want. If you need to order a different color, it shouldn't cost more than the cars on the lot.

1.1.3.3. Make sure you fully understand the offer. If it sounds too good to be true, make sure you check the details.

1.2. Auto-Financing Tips

1.2.1. Your budget – what you can afford

1.2.1.1. Make sure you anticipate all your costs, including fuel, registration fees, maintenance, insurance, and repairs. Depending on your state, you may also be paying sales tax.

1.2.1.2. Calculating these costs will help you determine what you can afford, and how much to borrow.

1.2.2. Factors that determine your interest rate and monthly payments

1.2.2.1. Your credit - we consider your credit rating, your payment history, and the amount of debt you already have.

1.2.2.2. Your income - a stable income that's high enough to pay your debts and other monthly expenses helps you qualify for a better interest rate.

1.2.2.3. Type of vehicle - interest rates on new cars are usually less than for used cars. RVs and motorcycles may also have different rates. Also remember that used cars over 7 years old may not qualify for financing.

1.2.2.4. Term of your loan - financing for a longer term lowers your payment, which can add to your monthly cash flow, but will cost you more over the life of the loan.

1.2.3. Your options if you have less than perfect credit

1.2.3.1. Apply at Wells Fargo knowing they provide less than perfect credit solutions

1.2.3.2. Consider getting a qualified co-signer to improve your terms

1.2.4. What you should confirm before you sign

1.2.4.1. Interest rate – confirm the APR, or annual percentage rate, for your loan and whether it's fixed or adjustable rate

1.2.4.2. Total amount financed – be sure the amount on your loan documents is the same as what you asked for

1.2.4.3. Monthly payments – confirm you can afford to make the payments

1.2.4.4. Potential penalties – can you pay your loan off early without paying a penalty? If not, find out how much you would pay. At Wells Fargo, there are no pre-payment penalties.

1.2.4.5. Possible hidden charges – credit insurance or other fees may be included in your loan. Don't pay for these services unless you need them.

1.3. Tips on Buying Versus Leasing

1.3.1. Leasing

1.3.1.1. Advantanges

1.3.1.1.1. More car per dollar in monthly payment

1.3.1.1.2. May be better if you enjoy having a new car every few years, don't want to deal with trade-ins, and can predict how many miles you'll drive

1.3.1.2. Disadvantages

1.3.1.2.1. You might not have an asset at the end of the lease

1.3.1.2.2. Less flexibility

1.3.1.2.3. Possibly higher insurance and maintenance costs

1.3.1.2.4. May be charged for excess mileage or ending the lease early

1.3.2. Buying

1.3.2.1. Advantages

1.3.2.1.1. You have an asset when the loan is paid off

1.3.2.1.2. Greater flexibility

1.3.2.1.3. Greater negotiating leverage when you purchase versus lease

1.3.2.2. Disadvantages

1.3.2.2.1. Less car per dollar of monthly payment

2. Resources

2.1. Determine Your Rate & Payment

2.1.1. Rate and Payment Calculator

2.1.2. Auto Loan Rates

2.2. Application Checklist

2.3. Auto Refinance Calculator

3. Debt Consolidation

3.1. Bill Consolidation

3.1.1. 6 Reasons to use your auto loan for bill consolidation:

3.1.1.1. Stretch your income farther

3.1.1.2. Cover all your expenses with a lower monthly payment

3.1.1.3. Access cash to help keep up with rising costs

3.1.1.4. Close your bill consolidation loan in a few days or less

3.1.1.5. You don't have to own a home

3.1.1.6. No direct cost to apply for bill consolidation

3.1.2. When to use your vehicle for bill consolidation:

3.1.2.1. You want to lower your monthly auto payment or rate

3.1.2.2. Your credit score has improved since you originally financed your vehicle

3.1.2.3. Your expenses have gone up but your income has stayed the same

3.1.2.4. You need extra cash to pay off other bills or keep up with day-to-day expenses

3.1.2.5. You want a bill consolidation solution with a quick turn time

3.1.2.6. You don't own a home to leverage for your financial needs

3.2. Auto Loan Consolidation

3.2.1. The benefits of auto consolidation loans

3.2.1.1. Streamline Expenses

3.2.1.1.1. With an auto consolidation loan, you could combine other loan balances into a new auto loan if you refinance more than your current auto loan amount. After the original auto loan is paid off, you could pay a credit card balance or two, for example, with what's left.

3.2.1.2. Refinance one auto loan to lower the payment

3.2.1.2.1. Refinancing one auto loan to reduce your monthly payment may better fit your needs. Many vehicle owners who auto refinance with a Wells Fargo auto consolidation loan actually lower their monthly payment.

3.2.1.3. Access cash from your vehicle

3.2.1.3.1. With an auto consolidation loan, you could unlock cash from your vehicle. In fact, customers who refinanced their auto loans with Wells Fargo received $5,489 or more cash out.

3.3. Credit Card Consolidation

3.3.1. What’s the benefit of a credit card consolidation loan?

3.3.1.1. Combining multiple, high interest rate credit card balances into a lower-rate debt consolidation loan means you can pay less overall interest while you're paying down the balance.

3.3.1.2. A lower-rate credit card consolidation loan may allow you to pay off the total loan amount sooner than you could pay off the same amount at a higher interest rate.

3.3.1.3. Pay less each month for one payment than multiple, higher-rate payments when you combine higher interest rate credit card balances into a lower-rate loan.

3.3.1.4. Besides a higher monthly cash flow, you may even qualify for a lower rate with customer discounts.

3.3.2. How do credit card consolidation loans relate to my car?

3.3.2.1. You can often consolidate higher interest rate credit cards with a lower-rate loan secured by property–a home or vehicle, for example.

3.3.2.2. After paying off their current auto loan, customers can use the vehicle value that’s left to consolidate credit card bills or pay for larger expenses.

3.4. Consolidate Loans

3.4.1. Four more reasons to consolidate loans with your vehicle

3.4.1.1. Benefit from competitive loan pricing – Competitive pricing on debt consolidation refinance could actually mean a lower auto loan rate than you’re paying right now.

3.4.1.2. Count on monthly payments that work with your budget – Our flexible loan terms mean monthly payments you can be comfortable with.

3.4.1.3. Take a break from payments – Receive up to a 45-day break from auto loan payments when you consolidate loans with us.

3.4.1.4. Receive a rate discount – If you’re a Wells Fargo customer, you could get a lower auto loan rate when you consolidate loans and choose automatic payments.

4. Lease-End Options

4.1. Purchasing Your Leased Vehicle

4.1.1. Why purchasing may be your best option:

4.1.1.1. You can own the vehicle you've enjoyed and worked so hard to maintain

4.1.1.2. You will avoid any termination fees, transportation fees, or other costs associated with returning your vehicle

4.1.1.3. If your vehicle has sustained damage that is not the result of normal wear and use, you will avoid paying fees associated with that damage

4.1.1.4. You will avoid the additional cost associated with purchasing a new vehicle

4.1.2. The payoff price of your vehicle may include:

4.1.2.1. The specified purchase amount of your vehicle, as stated in your lease agreement

4.1.2.2. Any outstanding monthly payments

4.1.2.3. Any official fees, property taxes, and state taxes, as applicable

4.1.3. Payment options include:

4.1.3.1. A Check

4.1.3.2. A Wells Fargo Auto Loan

4.2. Trading In Your Leased Vehicle

4.2.1. In some instances, you may be able to trade in your leased vehicle towards the purchase or lease of a new vehicle.

4.2.2. Leased vehicle trade-in considerations:

4.2.2.1. A vehicle is only considered a trade-in when it is purchased from Wells Fargo by the dealer accepting the vehicle trade. If you trade in your vehicle, you must notify us of the return location within one business day of the trade-in.

4.2.2.2. Review your lease agreement and remember that all contractual obligations with Wells Fargo will remain your responsibility. Your contractual obligations end when we receive the full payoff amount.

4.2.2.2.1. If you currently reside, or have resided in the past in a state that assesses personal property taxes on leased vehicles, you will be sent a separate invoice when, and if, we receive the bill. This bill may arrive after you have received the final invoice of your lease or after you have purchased the leased vehicle.

4.2.2.3. Wells Fargo must receive the full payoff amount from the dealer on or before your scheduled termination date. Any difference between the payoff amount and the price the dealer is willing to pay is your responsibility.

4.2.3. Prior to trading in your vehicle:

4.2.3.1. Call us to determine your payoff amount.

4.2.3.1.1. If your lease expires in the next 180 days, call a Lease-End Consultant at 1-800-279-8859, Monday - Friday, 7:00 am - 5:00 pm, Pacific Time.

4.2.3.1.2. If your lease expires in more than 180 days, call 1-800-559-3557 for an automated payoff amount.

4.2.3.2. We will mail you a payoff letter and odometer disclosure statement. Payoff quotes are valid for 10 days.

4.2.3.3. You or your dealer should send the complete payoff amount so we receive it within 10 days of your inquiry. We accept cashier's checks and other types of checks (for example, personal or corporate), but processing of other types of checks may take up to seven additional days.

4.2.3.4. Mail your check, odometer disclosure statement, and the completed section of the payoff letter to

4.2.3.4.1. Wells Fargo Auto Finance PO Box 29715 Phoenix, AZ 85038-9715

4.2.3.4.2. or overnight to: Wells Fargo Auto Finance Auto Lease Payoff Department 711 W Broadway Road Tempe, AZ 85282

4.3. Returning Your Leased Vehicle

4.3.1. If you decide to return your vehicle at the end of your lease, please review your lease agreement carefully. Make sure you understand your contractual obligations.

4.3.2. Returning your vehicle to an authorized location:

4.3.2.1. Unless you have made prior arrangements with our Lease-End Sales Consultants, do not drop off your vehicle at a dealership. You are responsible for the vehicle until it reaches an authorized auction, including maintaining insurance and paying any fees or damages associated with the transportation of the vehicle.

4.3.2.1.1. A Wells Fargo representative will provide the name, address, and phone number of the closest auction location

4.3.2.1.2. Before you return your vehicle, please remove all your personal belongings and clean the car inside and out

4.3.2.1.3. At your convenience, but before your scheduled lease-end termination date, drop off your vehicle at the auction location (remember, you will need to coordinate a ride home from the auction)

4.3.2.1.4. A Wells Fargo representative will contact you if any additional documentation needs to be completed

4.3.2.1.5. A final bill will be mailed to you

4.3.3. What might be included in my final bill:

4.3.3.1. A turn-in fee (listed in your lease agreement)

4.3.3.2. Any official fees or state taxes due

4.3.3.3. Any outstanding payments

4.3.3.4. Transportation fee – only if you do not return your vehicle to the auction location specified by Wells Fargo

4.3.3.5. Excess wear and use charges – only if your vehicle has sustained damage that is not considered normal wear and use

4.3.3.6. Registration fees

4.3.3.7. Early termination liability – only if you return your vehicle 60 days or more from the lease termination date

4.3.4. To get more information or to return your vehicle:

4.3.4.1. Call your Wells Fargo Lease-End Sales Consultant at 1-800-279-8859

4.3.4.2. We will mail you a payoff letter and odometer statement. Payoff quotes are valid for 10 days.

4.3.4.3. When we call you to schedule your appointment time, we'll advise you of any fees due.

5. Auto Loan and Lease Glossary

5.1. Adjusted Capitalized Cost

5.1.1. The amount capitalized at the beginning of the lease, equal to the gross capitalized cost minus the capitalized cost reduction. This amount is sometimes referred to as "adjusted cap cost" or "net capitalized cost."

5.2. APR (Annual Percentage Rate)

5.2.1. The cost of a loan, including the interest rate and other fees.

5.3. Automobile Lease

5.3.1. A contract by which one party (Lessor) gives to another (Lessees) the use and possession of an automobile for a specified time and for fixed payments.

5.4. Base Monthly Payment

5.4.1. The portion of the monthly payment that covers depreciation, any amortized amounts, and rent charges. It is calculated by adding the amount of depreciation, any other amortized amounts, and rent charges, and dividing the total by the number of months in the lease. Monthly sales/use taxes are added to this base monthly payment to determine the total monthly payment.

5.5. Blue Book

5.5.1. A standard reference guide for pricing cars.

5.6. Capitalized Cost Reduction

5.6.1. The sum of any down payment, net trade-in allowance, and rebate and other non-cash credit used to reduce the gross capitalized cost. The capitalized cost reduction is subtracted from the gross capitalized cost to get the adjusted capitalized cost. Also known as "cap cost reduction."

5.7. Credit Score

5.7.1. An evaluation of your creditworthiness that reflects your financial history and ability to pay debts.

5.8. Depreciation

5.8.1. The amount of value your vehicle loses through wear and tear.

5.9. Documentation Fee

5.9.1. Administrative costs associated with registration and title. This fee can range from under $50 to hundreds of dollars depending on your state.

5.10. Early Termination Fee

5.10.1. A penalty for terminating a car lease early.

5.11. Excess Mileage

5.11.1. The charge for driving a leased car more than the amount you agreed to in the lease.

5.12. Extended Warranty

5.12.1. Additional warranty protection you can purchase for problems that surface after the manufacturer's warranty has expired.

5.13. Finance Charge

5.13.1. The amount you pay for borrowing money, including interest, fees, and other service charges.

5.14. Gross Capitalized Cost

5.14.1. The agreed-upon value of the vehicle plus any items agreed to be paid during the lease term (amortized amounts), such as the following: insurance, service contracts, taxes, bank acquisition fees and any prior credit or lease balance. Also known as "gross cap cost."

5.15. Invoice Price

5.15.1. The cost of the vehicle to the dealer, not including any manufacturing incentives.

5.16. Lien

5.16.1. A legal claim on ownership on your vehicle used as security for payment of a loan.

5.17. MSRP (Manufacturer's Suggested Retail Price)

5.17.1. The suggested retail price from the vehicle's manufacturer.

5.18. Monthly Payment

5.18.1. The total amount of interest and principal you pay for a car loan each month.

5.19. Payoff Amount

5.19.1. Also known as "purchase price." If you intend on purchasing your vehicle, your payoff amount includes:

5.19.1.1. The specified purchase amount of your vehicle, as stated in your lease agreement.

5.19.1.2. Outstanding property taxes, as applicable in your state. If you currently reside, or have resided in the past in a state that assesses personal property taxes on leased vehicles, you will be sent a separate invoice when, and if, we receive the bill. This bill may arrive after you have received the final invoice of your lease or after you have purchased the leased vehicle.

5.19.1.3. Any outstanding monthly payments.

5.19.1.4. Any official fees or state taxes due.

5.20. Prior Credit Balance

5.20.1. The portion of the gross capitalized cost representing the amount due under a previous credit contract after crediting the value of the vehicle traded in on the lease. Also known as "negative equity" or "negative trade-in balance."

5.21. Prior Lease Balance

5.21.1. The portion of the gross capitalized cost representing the balance due from a previous lease agreement after crediting the value of the previously leased vehicle. Also known as "negative equity" or "negative trade-in balance."

5.22. Purchase Option

5.22.1. Before or at the end of your lease term, you can purchase your leased vehicle according to the terms specified in your lease agreement.

5.23. Rebate

5.23.1. An incentive manufacturers provide to consumers.

5.24. Rent Charge

5.24.1. The amount charged in addition to the depreciation and any amortized amounts.

5.25. Residual

5.25.1. The amount, agreed to in advance, that a car is worth at the end of a car lease.

5.26. Sales/Use Taxes

5.26.1. Sales/use taxes are assessed on both leased and purchased vehicles.

5.27. Termination or Turn-In Fee

5.27.1. A fee charged by a lessor to cover the costs of taking possession of the leased vehicle at the end of the lease.

5.28. Title

5.28.1. A document that verifies a vehicle's ownership.

5.29. Trade-In Allowance

5.29.1. The amount the dealer agrees to pay for your trade-in when you buy a new car.

5.30. VIN (Vehicle Identification Number)

5.30.1. The unique 17-digit number found on every car.

6. Auto Finance

6.1. Why refinance your loan?

6.1.1. Lower auto loan rate. Check the rate you agreed to when you first signed your auto loan. If rates have fallen or if your credit has improved since you first financed your car, you may qualify for a lower rate and a lower monthly payment.

6.1.2. Flexible loan terms. Changing your loan terms could allow you to pay off your loan sooner, freeing up the amount of your monthly car payment. Or, you could reduce your monthly loan payment and use the extra money in other ways.

6.1.3. Cash outlet. You may be able to refinance your current auto loan and receive cash to use however you like.

7. Auto Loan Refinance

7.1. Cash Out Refinance

7.1.1. Understanding cash out refinance loans

7.1.1.1. Obtaining a cash out refinance loan means applying for a new loan to pay off an existing loan on a vehicle or home and receiving cash after it is repaid. You may seek a vehicle cash out refinance loan to:

7.1.1.1.1. Change your auto loan terms

7.1.1.1.2. Access Cash

7.1.1.1.3. Restructure (consolidate) other credit accounts

7.1.2. Other tips

7.1.2.1. Refinance loan terms

7.1.2.1.1. Shorter loan terms mean fewer monthly payments on your vehicle. For a break in your monthly expenses, extend the cash out refinance loan term for a lower monthly payment.

7.1.2.2. Pay less interest

7.1.2.2.1. Vehicle refinance loans with lower APRs mean paying less overall interest if the repayment terms decrease or remain unchanged.

7.1.2.3. Manage fewer accounts

7.1.2.3.1. Combine other accounts into an auto cash out refinance loan and pay fewer monthly bills. Then, make your vehical cash out refinance loan payment online to spend less time managing your expenses.

7.1.2.4. Depend on consistent payments

7.1.2.4.1. A fixed-rate vehicle refinance loan means the same payment amount each month.

7.1.2.5. Take a pause in your payment cycle

7.1.2.5.1. With a cash out refinance auto loan, you may be able to skip the next month's payment, depending on the next auto loan payment due date and when you close the cash out refinance loan.

7.1.3. Consider a cash out refinance if:

7.1.3.1. you want a lower monthly auto loan payment or rate

7.1.3.2. you qualify for better terms than when you originally financed your vehicle

7.1.3.3. your expenses have increased, and you could benefit from a lower monthly payment

7.1.3.4. you rent or have already accessed available equity from your home

7.2. Refinance My Car

7.2.1. Should I refinance my car loan? Looking at your specific situation is the best way to decide. However, you might refinance a car loan if:

7.2.1.1. Your credit score has improved since first financing your vehicle

7.2.1.2. Your expenses have risen, but your income hasn’t

7.2.1.3. You need extra cash for an emergency

7.2.1.4. You want to lower your monthly auto payment or rate

7.2.1.5. You’d like a reliable financial option with a quick turn time

7.2.1.6. You rent your home

7.2.2. What are the benefits if I refinance my car?

7.2.2.1. Lower your interest rate

7.2.2.2. Reduce your monthly payments

7.2.2.3. Improve your auto loan terms

7.2.2.4. Access cash for your financial needs

7.2.2.5. Consolidate high interest debt to a lower-rate car loan

7.2.2.6. Receive additional customer discounts