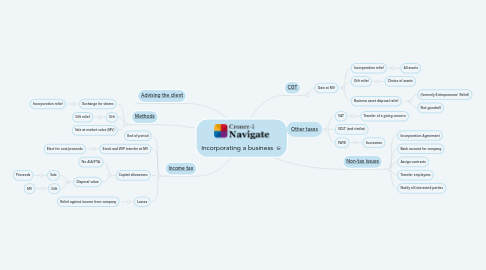

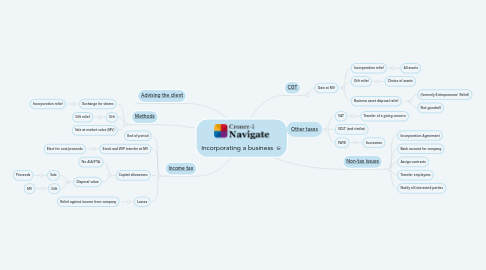

Incorporating a business

저자: Julia Bowyer

1. [Methods](https://library.croneri.co.uk/po-heading-id_3icuPqH7cUCbtXWTw2JB-w)

1.1. Exchange for shares

1.1.1. Incorporation relief

1.2. Gift

1.2.1. Gift relief

1.3. Sale at market value (MV)

2. [Income tax](https://library.croneri.co.uk/po-heading-id_MVvpi4wruEuPM0qV2Ir-Qg)

2.1. End of period

2.2. Stock and WIP transfer at MV

2.2.1. Elect for cost/proceeds

2.3. Capital allowances

2.3.1. No AIA/FYA

2.3.2. Disposal value

2.3.2.1. Sale

2.3.2.1.1. Proceeds

2.3.2.2. Gift

2.3.2.2.1. MV

2.4. Losses

2.4.1. Relief against income from company

3. [Advising the client](https://library.croneri.co.uk/po-heading-id_diY03BhS7kq5S__QGYL6dw)

3.1. Confirm

3.2. Plan

3.3. Act

3.4. Assist

4. [CGT](https://library.croneri.co.uk/po-heading-id_r9CL4hCh5U2IogndL6z8bQ)

4.1. Gain at MV

4.1.1. Incorporation relief

4.1.1.1. All assets

4.1.2. Gift relief

4.1.2.1. Choice of assets

4.1.3. Business asset disposal relief (BADR)

4.1.3.1. Not on goodwill

5. [Other taxes](https://library.croneri.co.uk/po-heading-id_7nBTxcHtc0CgyEUDawrZsA)

5.1. VAT

5.1.1. Transfer of a going concern

5.2. SDLT (and similar)

5.3. PAYE

5.3.1. Succession