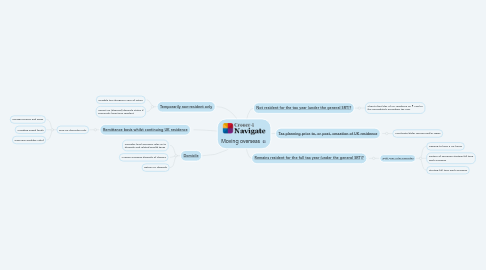

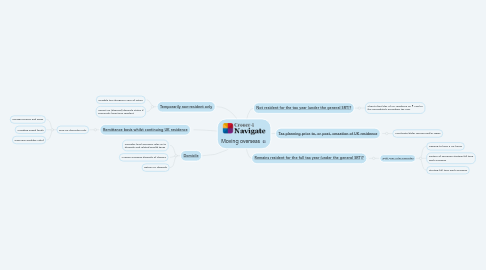

Moving overseas

作者:Julia Bowyer

1. [Tax consequences of a split year](https://library.croneri.co.uk/po-heading-id_ORtkZbP8CE2IovGxrvkRzg)

1.1. 'UK part'

1.1.1. Taxable on worldwide income & gains

1.2. 'Overseas part'

1.2.1. Income tax on UK source income only

1.2.2. CGT: disposal of UK residential property (from 5/4/15), and commercial property (from 5/4/19)

1.3. Other considerations

1.3.1. Form P85

1.3.2. Self-assessment tax return

1.3.3. Non-resident CGT returns

1.3.4. Register for non-resident landlords scheme

1.3.5. Double tax treaties

1.3.6. Liability to NI whilst working abroad

2. [Tax planning prior to, or post, cessation of UK residence](https://library.croneri.co.uk/po-heading-id_vV4U2UB8P02gZhNU1Dz2jg)

2.1. 'Ring fence' income & gains

2.2. Accelerate/defer income and/or gains

2.3. Replace assets

2.4. Gift assets to spouse

2.5. Main residence election

2.6. Impact on savings/pensions

3. [When does UK residence cease?](https://library.croneri.co.uk/po-heading-id_XPZVpF74m0CPwdiwEBU4NA)

3.1. Not resident for the tax year (under the general SRT)

3.1.1. Client's final day of UK residence on 5 April in the immediately preceding tax year

3.2. Remains resident for the full tax year (under the general SRT)

3.2.1. 'Split year' rules override?

3.2.1.1. Case 1: Starting full time work overseas

3.2.1.2. Case 2: Partner of someone starting full time work overseas

3.2.1.3. Case 3: Ceasing to have a UK home