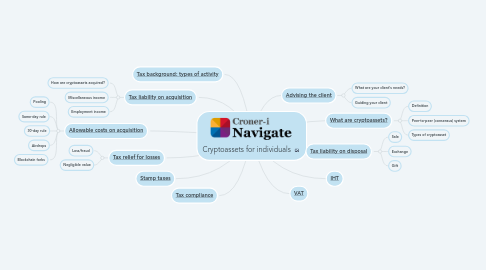

Cryptoassets for individuals

作者:stephanie webber

1. [Tax background: types of activity](https://library.croneri.co.uk/po-heading-id_RaL5hrenGkOacaQrtcTiQQ)

2. [Tax liability on acquisition](https://library.croneri.co.uk/po-heading-id_JuyeQ9WXBUqo9jaQUOjrFg)

2.1. How are cryptoassets acquired?

2.2. Miscellaneous income

2.3. Employment income

3. [Tax relief for losses](https://library.croneri.co.uk/po-heading-id_CnLysvGTGkiibYXFtIEQTg)

3.1. Loss/fraud

3.2. Negligible value

4. [Stamp taxes](https://library.croneri.co.uk/po-heading-id_hqU34qJDhke2kZPGK7z-Eg)

5. [Tax compliance](https://library.croneri.co.uk/po-heading-id_c3K05ga15UqEwWekZ3ziCg)

6. [VAT](https://library.croneri.co.uk/po-heading-id_FHp45hlFZUGO4MYlUJFcew)

7. [IHT](https://library.croneri.co.uk/po-heading-id_Hldxq5YWEkS263ByzTY5Yg)

8. [Advising the client](https://library.croneri.co.uk/po-heading-id_WqhE8_UjZ0y4kws9y7nEjg)

8.1. What are your client's needs?

8.2. Guiding your client

9. [Tax liability on disposal](https://library.croneri.co.uk/po-heading-id_n9fe8XAMIk6I547fSnxzcQ)

9.1. Sale

9.2. Exchange

9.3. Gift

10. [What are cryptoassets?](https://library.croneri.co.uk/po-heading-id_gLiUAnewtkmEzv-0JOOooA)

10.1. Definition

10.2. Peer-to-peer (consensus) system

10.3. Types of cryptoasset

11. [Allowable costs on acquisition](https://library.croneri.co.uk/po-heading-id_EgEG4LtMhU2nENAXGJzSaA)

11.1. Pooling

11.2. Same-day rule

11.3. 30-day rule

11.4. Airdrops

11.5. Blockchain forks