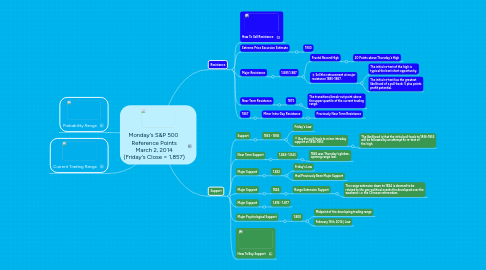

1. Support

1.1. Support

1.1.1. 1853 - 1856

1.1.1.1. Friday's Low

1.1.1.2. Buy the pull-back to minor intraday support at 1856-1853

1.1.1.2.1. The likelihood is that the initial pull-back to 1856-1853 will be followed by an attempt to re-test of the high.

1.2. Near Term Support

1.2.1. 1,846 -1,843

1.2.1.1. 1845 was Thursday's globex, opening range low.

1.3. Major Support

1.3.1. 1,832

1.3.1.1. Friday's Low

1.3.1.2. Had Previously Been Major Support

1.4. Major Support

1.4.1. 1824

1.4.1.1. Range Extension Support

1.4.1.1.1. The range extension down to 1824 is deemed to be related to the geo-political events the developed over the weekend: i.e. the Crimean referendum.

1.5. Major Support

1.5.1. 1,816 - 1,817

1.6. Major Psychological Support

1.6.1. 1,800

1.6.1.1. Midpoint of the developing trading range

1.6.1.2. February 13th, 2014 | Low

1.7. How To Buy Support

2. Resistance

2.1. How To Sell Resistance

2.2. Extreme Price Excursion Estimate

2.2.1. 1900

2.3. Major Resistance

2.3.1. 1,885 1,887

2.3.1.1. Fractal Record High

2.3.1.1.1. 20 Points above Thursday's High

2.3.1.2. Sell the retracement at major resistance 1885-1887.

2.3.1.2.1. The initial re-test of the high is typical the best short opportunity.

2.3.1.2.2. The initial re-test has the greatest likelihood of a pull-back: 5 plus points profit potential.

2.4. Near Term Resistance

2.4.1. 1875

2.4.1.1. The transitional break-out point above the upper quartile of the current trading range.

2.5. 1867

2.5.1. Minor Intra-Day Resistance

2.5.1.1. Previously Near Term Resistance