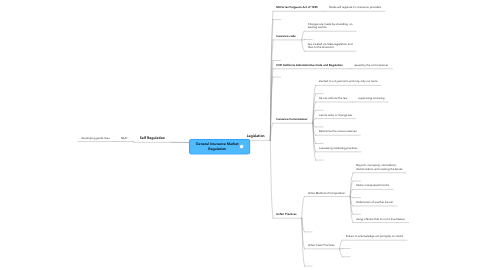

1. Legislation

1.1. McCarran Ferguson Act of 1945

1.1.1. States will regulate it's insurance providers

1.2. .

1.3. Insurance code

1.3.1. Changes are made by amending an existing section

1.3.2. .

1.3.3. Are created via State legislation and then to the Governor.

1.4. .

1.5. CCR California Administrative Code and Regulation

1.5.1. issued by the commissioner

1.6. .

1.7. Insruance Commissioner

1.7.1. elected to a 4 year term and may only run twice

1.7.2. .

1.7.3. He can enforce the law

1.7.3.1. supervising Licensing

1.7.4. .

1.7.5. cannot write or change law

1.7.6. .

1.7.7. Determine the insurer reserves

1.7.8. .

1.7.9. overseeing marketing practices

1.7.10. .

1.8. Unfair Practices

1.8.1. Unfair Method of Competition

1.8.1.1. Boycott, monopoly, intimidation, discrimination and cooking the books

1.8.1.2. .

1.8.1.3. Name misrepresents terms

1.8.1.4. .

1.8.1.5. Defamation of another Insurer

1.8.1.6. .

1.8.1.7. Using a Name that its not it true Nature

1.8.2. .

1.8.3. Unfair Claim Practices

1.8.3.1. Failure to acknowledge act promptly on claims

1.8.3.2. .

1.8.3.3. .

1.8.4. .

2. Self Regulation

2.1. NAIC

2.1.1. developing guide lines