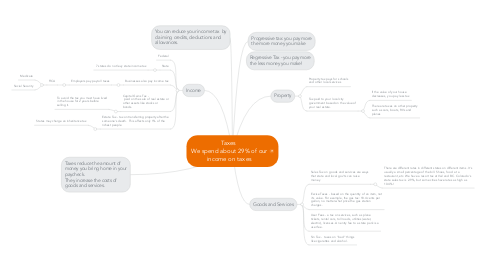

Taxes We spend about 29% of our income on taxes

by Erica Laczi

1. Income

1.1. Federal

1.2. State

1.2.1. 7 states do not levy state income tax

1.3. Businesses also pay income tax

1.3.1. Employers pay payroll taxes

1.3.1.1. FICA

1.3.1.1.1. Medicare

1.3.1.1.2. Social Security

1.4. Capital Gains Tax - paid on the sale of real estate or other assets like stocks or bonds.

1.4.1. To avoid the tax you must have lived in the house for 2 years before selling it.

1.5. Estate Tax - tax on transferring property after the someone's death. This affects only 1% of the richest people

1.5.1. States may charge an inheritance tax

2. You can reduce your income tax by claiming credits, deductions and allowances.

3. Taxes reduce the amount of money you bring home in your paycheck. They increase the costs of goods and services.

4. Progressive tax: you pay more the more money you make

5. Property

5.1. Property tax pays for schools and other local services

5.2. Tax paid to your local city government based on the value of your real estate.

5.2.1. If the value of your house decreases, you pay less tax

5.2.2. There are taxes on other property such as cars, boats, RVs and planes

6. Goods and Services

6.1. Sales Tax on goods and services are ways that state and local gov'ts can raise money

6.1.1. There are different rates in different states on different items. It's usually a small percentage of the bill. Shoes, food at a restaurant, etc. We have a resort tax at Vail and BC. Colorado's state sales tax is 2.9%, but some cities have rates as high as 10.4%!