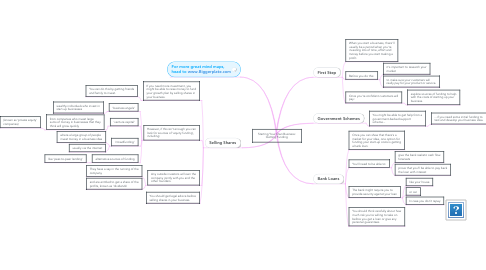

1. First Step

1.1. When you start a business, there’ll usually be a period when you’re investing lots of time, effort and money before you start making a profit.

1.2. Before you do this:

1.2.1. it’s important to research your market

1.2.2. to make sure your customers will really pay for your product or service.

1.3. Once you’re confident customers will pay:

1.3.1. explore sources of funding to help with the costs of starting up your business.

2. Government Schemes

2.1. You might be able to get help from a government-backed support scheme...

2.1.1. ...if you need some initial funding to test and develop your business idea.

3. Bank Loans

3.1. Once you can show that there’s a market for your idea, one option for funding your start-up costs is getting a bank loan.

3.2. You’ll need to be able to:

3.2.1. give the bank realistic cash flow forecasts

3.2.2. prove that you’ll be able to pay back the loan with interest

3.3. The bank might require you to provide security against your loan

3.3.1. like your house

3.3.2. or car

3.3.3. In case you don't repay

3.4. You should think carefully about how much risk you’re willing to take on before you get a loan or give any personal guarantees

4. Selling Shares

4.1. If you need more investment, you might be able to raise money to fund your growth plan by selling shares in your business.

4.1.1. You can do this by getting friends and family to invest.

4.2. However, if this isn’t enough you can look for sources of ‘equity funding’, including:

4.2.1. ‘business angels’

4.2.1.1. wealthy individuals who invest in start-up businesses

4.2.2. ‘venture capital’

4.2.2.1. from companies who invest large sums of money in businesses that they think will grow quickly

4.2.2.1.1. (known as ‘private equity’ companies)

4.2.3. ‘crowdfunding’

4.2.3.1. where a large group of people invest money in a business idea

4.2.3.2. usually via the internet

4.2.4. alternative sources of funding

4.2.4.1. like ‘peer-to-peer lending'

4.3. Any outside investors will own the company jointly with you and the other founders.

4.3.1. They have a say in the running of the company

4.3.2. and are entitled to get a share of the profits, known as ‘dividends'