Chapter 13- Measuring the Economy

by Abby Sklebar

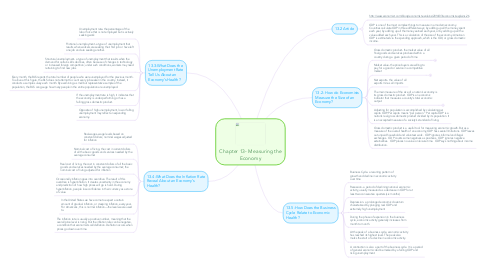

1. 13.3-What Does the Unemployment Rate Tell Us About an Economy’s Health?

1.1. Unemployment rate- the percentage of the labor force that is not employed but is actively seeking work

1.2. Frictional unemployment- a type of unemployment that results when workers are seeking their first job or have left one job and are seeking another.

1.3. Structural unemployment- a type of unemployment that results when the demand for certain skills declines, often because of changes in technology or increased foreign competition; under such conditions, workers may need retraining to find new jobs

1.4. Every month, the BLS reports the total number of people who were unemployed for the previous month. To arrive at this figure, the BLS does not attempt to count every job seeker in the country. Instead, it conducts a sample survey each month. By examining a small but representative sample of the population, the BLS can gauge how many people in the entire population are unemployed.

1.5. If the unemployment rate is high, it indicates that the economy is under-performing or has a falling gross domestic product.

1.6. Opposite of high unemployment, low or falling unemployment may reflect an expanding economy.

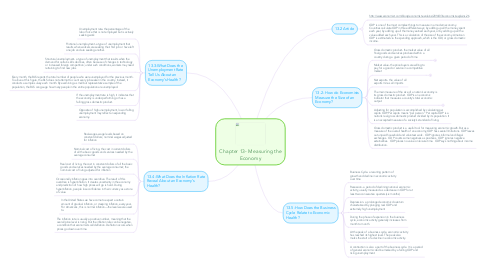

2. 13.4-What Does the Inflation Rate Reveal About an Economy’s Health?

2.1. Real wages- wage levels based on constant dollars; nominal wages adjusted for inflation

2.2. Nominal cost of living- the cost in current dollars of all the basic goods and services needed by the average consumer

2.3. Real cost of living- the cost in constant dollars of all the basic goods and services needed by the average consumer; the nominal cost of living adjusted for inflation

2.4. Occasionally inflation goes into overdrive. The result of this overdrive is hyperinflation. It creates uncertainty in the economy and prediction of how high prices will go is hard. During hyperinflation, people lose confidence in their currency as a store of value.

2.5. In the United States we have come to expect a certain amount of gradual inflation, or creeping inflation, every year. For Americans, this is normal inflation—the level we are used to.

2.6. The inflation rate is usually a positive number, meaning that the overall price level is rising. But the inflation rate can be negative, a condition that economists call deflation. Deflation occurs when prices go down over time.

3. 13.2- How do Economists Measure the Size of an Economy?

3.1. Gross domestic product- the market value of all final goods and services produced within a country during a given period of time

3.1.1. Task

3.1.2. Prerequisites

3.2. Market value- the price buyers are willing to pay for a good or service in a competitive market

3.2.1. Task

3.2.2. Prerequisites

3.3. Net exports- the value of all exports minus all imports

3.4. The main measure of the size of a nation’s economy is its gross domestic product. GDP is an economic indicator that measures a country’s total economic output.

3.4.1. Task

3.4.2. Prerequisites