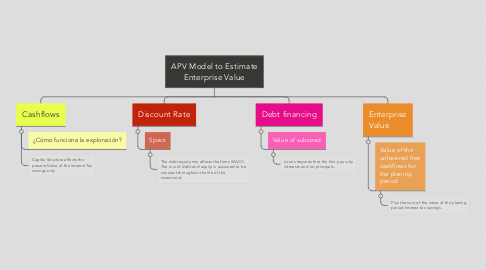

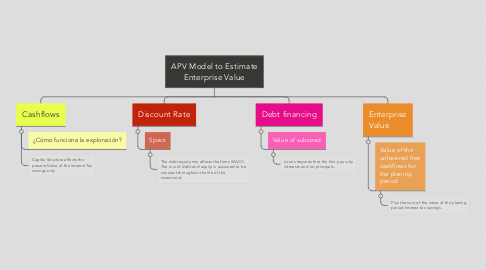

APV Model to Estimate Enterprise Value

by Manuel Martinez

1. Cashflows

1.1. ¿Cómo funciona la exploración?

1.2. Capitla Structure affects the present Value of the interest Tax savings only

2. Debt financing

2.1. Value of subsized

2.1.1. Loans requires that the firm pay only interests and no principals.

3. Discount Rate

3.1. Specs

3.1.1. The debt equity mix affects the firms WACC. The mix of debt and equity is assumed to be constant throughout the life of the investment.

4. Enterprise Value

4.1. Value of the unlevered free cashflows for the planing period

4.1.1. Plus the sum of the value of the planing period interest tax savings.