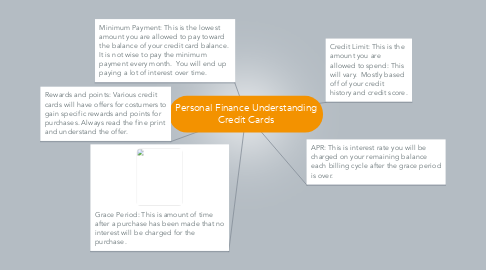

Personal Finance Understanding Credit Cards

by Craig Amrein

1. Grace Period: This is amount of time after a purchase has been made that no interest will be charged for the purchase.

2. Rewards and points: Various credit cards will have offers for costumers to gain specific rewards and points for purchases. Always read the fine print and understand the offer.

3. Minimum Payment: This is the lowest amount you are allowed to pay toward the balance of your credit card balance. It is not wise to pay the minimum payment every month. You will end up paying a lot of interest over time.

4. Credit Limit: This is the amount you are allowed to spend: This will vary. Mostly based off of your credit history and credit score.

5. APR: This is interest rate you will be charged on your remaining balance each billing cycle after the grace period is over.