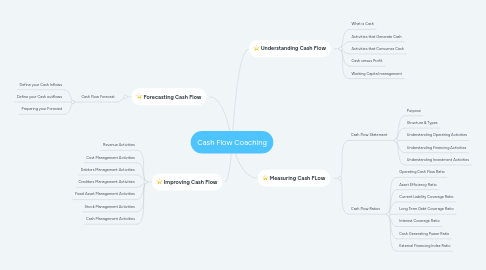

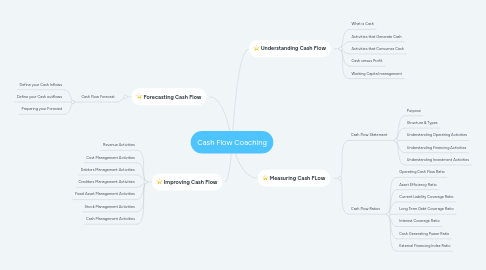

Cash Flow Coaching

by Arno Wakfer

1. Improving Cash Flow

1.1. Revenue Activities

1.2. Cost Management Activities

1.3. Debtors Management Activities

1.4. Creditors Management Activities

1.5. Fixed Asset Management Activities

1.6. Stock Management Activities

1.7. Cash Management Activities

2. Forecasting Cash Flow

2.1. Cash Flow Forecast

2.1.1. Define your Cash Inflows

2.1.2. Define your Cash outflows

2.1.3. Preparing your Forecast

3. Understanding Cash Flow

3.1. What is Cash

3.2. Activities that Generate Cash

3.3. Activities that Consumes Cash

3.4. Cash versus Profit

3.5. Working Capital management

4. Measuring Cash FLow

4.1. Cash Flow Statement

4.1.1. Purpose

4.1.2. Structure & Types

4.1.3. Understanding Operating Activities

4.1.4. Understanding Financing Activities

4.1.5. Understanding Investment Activities

4.2. Cash Flow Ratios

4.2.1. Operating Cash Flow Ratio

4.2.2. Asset Efficiency Ratio

4.2.3. Current Liability Coverage Ratio

4.2.4. Long Term Debt Coverage Ratio

4.2.5. Interest Coverage Ratio

4.2.6. Cash Generating Power Ratio

4.2.7. External Financing Index Ratio