1. FIXED ASSETS

1.1. How much fixed assets do you have today and what are the fixed asset types?

1.1.1. 80 aproxima.

1.1.2. Installations, miscellaneous equipment, computer equipment, furniture and equipment, financial leasing (laptops), constructions in progress, software licenses.

1.2. Do you have differences in the calculation of valuation, depreciation, adjustments, between management accounting and tax accounting? Which?

1.2.1. There are no differences.

1.3. Do you have differences in the calculation of valuation, depreciation, adjustments, between management accounting and corporate accounting? Which?

1.3.1. There are no differences.

2. ACCOUNTING ENTRY

2.1. What kind of accounting entries are made other than those generated in the transactions already reviewed?

2.1.1. Depreciation, Payroll, Taxes, provision of expenses without vouchers, interest, loans, adjustments and / or reclassifications, leasing.

2.2. Activate Latam Deductible field to be able to differentiate deductible expenses from non-deductibles.

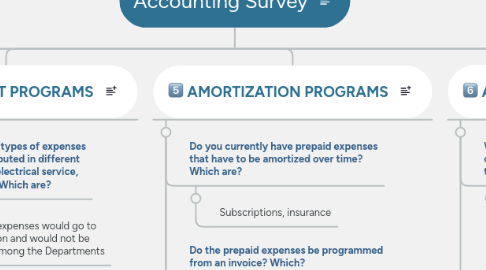

3. AMORTIZATION PROGRAMS

3.1. Do you currently have prepaid expenses that have to be amortized over time? Which are?

3.1.1. Subscriptions, insurance

3.2. Do the prepaid expenses be programmed from an invoice? Which?

3.2.1. Subscriptions yes. Insurance, the bill comes later.

3.3. The expenses paid in advance must be programmed from a provision (accounting entry)? Which?

3.3.1. Insurance can be paid before you have the bill.

4. MULTIBOOKING

4.1. Do you currently have accounting / financial information that needs to be prepared with different accounting criteria?

4.1.1. The tax information is the same as the accounting and corporate information.

4.2. Do you currently have accounting / financial information that needs to be prepared with different account plans?

4.2.1. The financial statements group accounts by reporting to Corporate, but not by accounting account.

5. ASSIGNMENT PROGRAMS

5.1. Do you have today types of expenses that must be distributed in different Departments (eg, electrical service, Water, rent, etc.)? Which are?

5.1.1. The general expenses would go to Administration and would not be distributed among the Departments

6. EXPENSE REPORT

6.1. What types of expenses do you manage in the petty cash, Refunds, Deliveries to Surrender

6.1.1. As petty cash have Tebca cards

6.1.2. Tebca card is used cash for mobility (rides).

6.1.3. Refunds: Travel expenses, utilities

6.1.4. Deliveries: travel expenses, purchase of fixed assets and general purchases

6.2. In which currencies can you have the expenses that are handled in the Expense Reports?

6.2.1. Soles, USD y euros.

6.3. In what currency is the employee given to the employee either by reimbursing petty cash, reimbursing expenses incurred by the employee, or delivering money to be rendered?

6.3.1. When travel expenses are reimbursed in dollars at the exchange rate.

6.4. The expenses that are handled in the expense reports should go to record purchases?

6.4.1. Yes, those with proof of payment

6.5. Do you have expenses in Petty cash, Refunds, Deliveries with Detractions

6.5.1. No

6.6. Do you have expenses in Petty Cash, Refunds, Deliveries to be with retentions?

6.6.1. No

6.7. Do you have expenses in Petty Cash, Refunds, Deliveries with receipts For fees and must be reported in PLAME Third Parties?

6.7.1. Can happen that they have, these would not go out in smartstart report of receipts by fees.

6.8. Approximately how many vouchers Payment / receipts may be in a Petty Cash?

6.8.1. 50 to 70 vouchers. It is given once a month.

6.9. Approximately how many vouchers Payment / receipts may be in one Reimbursement of employee expenses?

6.9.1. 20 to 30 vouchers, approx 10 a month

6.10. Approximately how many vouchers Payment / receipts may be in one Delivery to Rendir?

6.10.1. Up to about 10, Up to about 5

6.11. Create a type of report (Latam Type of report) Tebca for the control of the same.

7. LICENSE / ROLES

7.1. What user profiles are they going to have and what general permissions do they want?

7.1.1. Expense Report Role

7.1.1.1. Employee Center

7.1.1.2. Delimited by department

7.1.2. Counter Role

7.1.2.1. Same as Sales and Purchases Flow

8. REPORTS

8.1. What financial statements do you require?

8.1.1. Financial Situation, Results, Cash Flow (indirect), Statement of Net Assets (not available)

8.2. Corporate financial reports

8.2.1. Reporting in USD to Corp.

8.2.2. Converts from soles to dollars from the State of Situation is at the closing exchange rate.

8.2.3. It is converted from soles to dollars of income statement to average exchange rate and the difference is carried to equity.

8.2.4. Financial Statements: Financial Situation and Results, Detailed Results

9. BUDGET

9.1. Do you have a budget organized by account?

9.1.1. No, it's by concepts

9.2. Do you have a budget organized by department?

9.2.1. Yes

9.3. Is the monthly budget cumulative or restrictive per month?

9.3.1. Is cumulative

9.4. In which currency is the budget handled?

9.4.1. soles