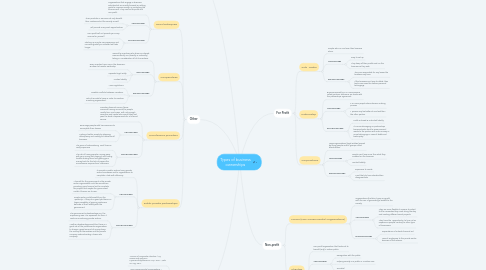

1. Marcela Delgado A01177208 Nicole Arrache A011177295

2. Other

2.1. Social Enterprise

2.1.1. Organizations that engage in business activities but are mostly focused on setting goals to improve society, or protecting the environment. They can be for-profit and non-profit.

2.1.2. ADVANTAGES

2.1.2.1. Their products or services not only benefit their customers but the society as well.

2.1.2.2. Will provide many work opportunities

2.1.3. DISADVANTAGES

2.1.3.1. Non-profit will not provide you many income for yourself

2.1.3.2. Starting up may be very expensive and recovering what you invested will take longer

2.2. Cooperatives

2.2.1. Owned by members who share an interest. Democratically run (directly or indirectly) taking in consideration all of its members.

2.2.2. ADVANTAGES

2.2.2.1. Every member has a say in the decisions. & easier to transfer ownership

2.2.2.2. Separate legal entity

2.2.2.3. Limites liability

2.2.3. DISADVANTAGES

2.2.3.1. More regulations

2.2.3.2. Possible conflicts between members.

2.2.3.3. Lots of records to keep in order to maintain a working organization.

2.3. Microfinance providers

2.3.1. Providing financial service (loans, insurance, saving accounts) to people mostly from rural areas with not enough resources and capital who would likely not pass the bank's requirements for a financial service.

2.3.2. ADVANTAGES

2.3.2.1. Encourage people with low resources to accomplish their dreams

2.3.2.2. Making a better society by stopping delinquency and making an honest small business.

2.3.3. DISADVANTAGES

2.3.3.1. The price of administering small loans is really expensive

2.3.3.2. The risk of having people running away with your money not paying it and having trouble finding them and getting your money back for the lack of papers the microfinance requires from customers.

2.4. Public private partnerships

2.4.1. It consists in public sectors hiring private sector businesses and/or organisations to complete a task with efficiency.

2.4.2. ADVANTAGES

2.4.2.1. A benefit for the government is the private sector organization could be sometimes providing more financial aid to complete the project that maybe the government couldn't finance on its own.

2.4.2.2. Private sector could benefit from the “publicity”, if they do a good job there is a larger possibility of gaining customers because of their liability with the government.

2.4.3. DISADVANTAGES

2.4.3.1. The government's disadvantage is in the supervising area, it is expensive for them t continue monitoring private sectors.

2.4.3.2. Another disadvantage would be, there is a great risk of the private sector organization to charge a great amount of money, keep the money for themselves and the private company subcontracting a lower rate company.

3. BIBLIOGRAPHY

3.1. "Forms Of Corporate Structure | My Community Futures." Mycommunityfutures.ca. N.p., 2017. Web. 23 Aug. 2017.

3.2. "Non-Governmental Organizations." Gdrc.org. N.p., 2017. Web. 23 Aug. 2017.

3.3. IBDP Business Management HL . (2017). Retrieved August 23, 2017, from Log in to Kognity | Kognity

3.4. Garfinkel, J. (2017, July 28). Pros and cons of becoming a charity. Retrieved August 23, 2017, from Pros and cons of becoming a charity — Knowhow Nonprofit

4. Non-profit

4.1. NGO’s (Non Governmental Organisations)

4.1.1. Organisations that don't gain any profit with the aim of generating a benefit to the society.

4.1.2. ADVANTAGES

4.1.2.1. They are more flexible it is easier to adapt to the necessities they meet along the way and creating different social projects.

4.1.2.2. They have the “opportunity” to hire not so experience people contrary to other type of businesses.

4.1.3. DISADVANTAGES

4.1.3.1. Dependence of outside financial aid

4.1.3.2. Loss of employees to the private sector, because of the salaries.

4.2. Charities

4.2.1. Non profit organization that looks out to benefit (only) a certain public

4.2.2. ADVANTAGES

4.2.2.1. Recognition with the public

4.2.2.2. Helping society or a public in a certain area

4.2.2.3. Tax relief

4.2.3. DISADVANTAGES

4.2.3.1. Charity doesn't gain a profit, and can only give a salary to people working on it if the Charity Commission's grants the permission, therefore it is an extra work most times for its “employees”

4.2.3.2. A lot of regulations and requirements are asked to run a charity.

5. For Profit

5.1. Sole Trader

5.1.1. People who run and own their business alone.

5.1.2. ADVANTAGES

5.1.2.1. Easy to set up

5.1.2.2. They keep all their profits and run the business as they wish

5.1.3. DISADVANTAGES

5.1.3.1. They are responsible for any losses the business may have

5.1.3.2. If the business can’t pay its debts, then banks can seize the owner’s personal belongings.

5.2. Partnership

5.2.1. Business owned by 2 or more persons called partners, decisions are made with the partnerships agreement.

5.2.2. ADVANTAGES

5.2.2.1. 2 or more people share decision making process

5.2.2.2. 1 person may be better at one task than the other partner

5.2.3. DISADVANTAGES

5.2.3.1. Profit is shared & unlimited liability

5.2.3.2. It is more damaging on partnerships because banks tend to seize personal assets to the partner with more money or more belongings in case of debts and bankruptcy.

5.3. Corporations

5.3.1. Large organisations (legal entities) owned by many people and/or groups called shareholders.

5.3.2. ADVANTAGES

5.3.2.1. People can’t lose more than what they invested on the business

5.3.2.2. Limited liability

5.3.3. DISADVANTAGES

5.3.3.1. Expensive to create

5.3.3.2. Most likely to have shareholders disagreements