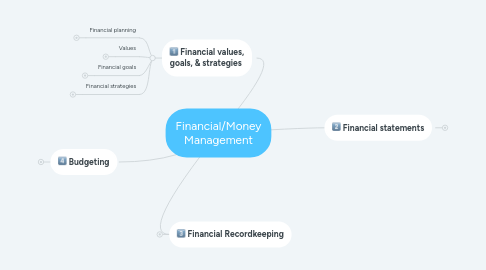

1. Financial values, goals, & strategies

1.1. Financial planning

1.1.1. developing & implementing a coordinated series of financial plans

1.2. Values

1.2.1. fundamental beliefs about what is

1.2.1.1. important

1.2.1.2. desirable

1.2.1.3. worthwhile

1.3. Financial goals

1.3.1. specific objectives for financial plans

1.4. Financial strategies

1.4.1. pre-established action plans implemented in specific situations

2. Financial statements

2.1. data that describe someone's current financial condition

2.2. Balance sheet

2.2.1. assets

2.2.1.1. the things you own

2.2.1.2. classifications

2.2.1.2.1. monetary

2.2.1.2.2. tangible

2.2.1.2.3. investment

2.2.2. liabilities

2.2.2.1. what you owe

2.2.3. net worth

2.2.3.1. = assets - liabilities

2.3. Income statement

2.3.1. income

2.3.1.1. where your money comes from

2.3.1.2. wages

2.3.2. expenses

2.3.2.1. where you money goes

2.3.2.2. cost of living

2.3.2.3. types:

2.3.2.3.1. fixed

2.3.2.3.2. variable

2.3.3. net income

2.3.3.1. income > expenses

2.3.4. net loss

2.3.4.1. income < expenses

3. Financial Recordkeeping

3.1. see what to keep on page 80

4. Budgeting

4.1. process of recording planned and actual income & expenditures

4.2. Goals:

4.2.1. long-term

4.2.1.1. financial targets > 5 years in future

4.2.2. intermediate-term

4.2.2.1. financial targets 1-5 years in future

4.2.3. short-term

4.2.3.1. financial targets < 1 year in future

4.3. Budget estimates

4.3.1. Income types

4.3.1.1. disposable income

4.3.1.1.1. take home pay

4.3.1.2. discretionary income

4.3.1.2.1. money left over after paying for necessities