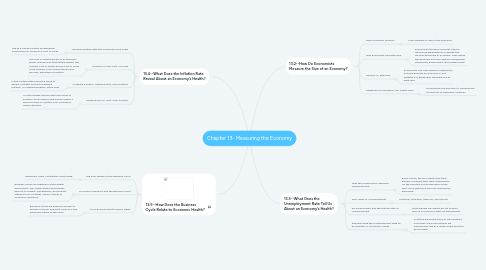

1. 13.2--How Do Economists Measure the Size of an Economy?

1.1. Gross Domestic Product-

1.1.1. Main measure of size of the economy.

1.2. How Economist calculate GDP.

1.2.1. Economists typically calculate GDP by measuring expenditures on goods and services produced in a country. They divide the economy into four sectors: households, businesses, government, and foreign trade.

1.3. Nominal vs. Real GDP

1.3.1. Economists use GDP figures to determine not only how big an economy is, but whether it is growing or shrinking and at what rate.

1.4. Adjusting for Population: Per Capita GDP

1.4.1. Economists also use GDP to compare the economies of individual countries.

2. 13.3--What Does the Unemployment Rate Tell Us About an Economy’s Health?

2.1. How the Government Measures Unemployment

2.1.1. Every month, the BLS reports the total number of people who were unemployed for the previous month.Members of the labor force who have jobs are classified as employed.

2.2. Four Types of Unemployment

2.2.1. frictional, structural, seasonal, and cyclical

2.3. Full Employment and the Natural Rate of Unemployment

2.3.1. Some people will always be out of work, even in an economy with full employment.

2.4. Problems with the Unemployment Rate as an Indicator of Economic Health

2.4.1. In determining how many of the country's more than 315 million people are unemployed, the BLS makes every effort to be accurate.

3. 13.4--What Does the Inflation Rate Reveal About an Economy’s Health?

3.1. Tracking Inflation with the Consumer Price Index

3.1.1. The BLS tracks inflation by gathering information on Americans' cost of living.

3.2. Nominal vs. Real Cost of Living

3.2.1. The cost in current dollars of all the basic goods and services that people need is the nominal cost of living.The real cost of living is the nominal cost of basic goods and services, adjusted for inflation.

3.3. Creeping inflation, Hyperinflation, and Deflation

3.3.1. In the United States we have come to expect a certain amount of gradual inflation, or creeping inflation, every year.

3.4. Demand-Pull vs. Cost-Push Inflation

3.4.1. You are already familiar with one cause of inflation: an increase in the money supply.A second cause of inflation is an increase in overall demand.

4. 13.5--How Does the Business Cycle Relate to Economic Health?

4.1. The Four Phases of the Business Cycle

4.1.1. Expansion, peak, contraction and trough.

4.2. Economic Indicators and the Business Cycle

4.2.1. Business cycles are irregular in both length and severity. This makes peaks and troughs difficult to predict. Nonetheless, economists attempt to do just that, using a variety of economic indicators.

4.3. From Boom to Bust to Boom Again

4.3.1. Business cycles are popularly known as periods of boom and bust. A boom is the expansion phase of the cycle.