1. What portion of assets are supplied by creditors?

2. Current Ratio: Current Assets / Current Liabilities

2.1. Higher the ration, the more buffer

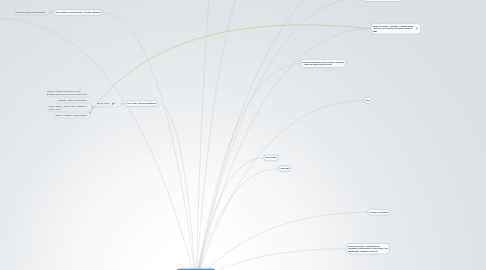

3. Ch 2: Basic Financial Statements

3.1. Balance Sheet

3.1.1. Assets - Economic resources of a firm, generally used to produce cash inflow for firm

3.1.2. Liabilities - debts of an enterprise

3.1.3. Owner's equity - residual claim of owners on Assets of firm

3.1.4. Assets = Liabilities + Owner's Equity

4. Ch 5: Analysis of Financial Statements

4.1. Allows users to make predictions about performance.

4.2. Users and Objectives Statemt Analysis

4.2.1. Users of Statements

4.2.1.1. Investors - shareholders

4.2.1.1.1. Look at liquidity and financial strength

4.2.1.2. Creditors - suppliers of those who lend credit

4.2.1.2.1. look at long-term financial performance and financial strength

4.2.1.3. Managers - not primary users

4.3. Comparative Analysis

4.3.1. Consistancy is important - how does a company's performance compare over time?

4.3.1.1. Gross Margin Ratio: Gross Profit/Gross Sales

4.3.1.1.1. shows markup of price

4.3.2. What about against others in same industry?

4.3.3. vertical - compares compnents with a base item (total assets) and expresses components as percentage og the base

4.3.4. Percentage Comparisons

4.3.4.1. horizontal - changes from year to year

4.3.5. Ratio Analysis - expresses relationship of key balance sheet components and expresses them in ratio form.

4.4. Operating Performance

4.4.1. Profit Margin Ratio: Net Income/Net Sales

4.4.1.1. Primary measure of companies operating performance

4.4.2. Asset Turnover Ratio: Net Sales/Average Total Assets

4.4.2.1. depects investment efficiency. Sales dollars per dollar invested.

4.4.3. Return on Assets (ROA): Net Income / Average Total Assets = (Net Income/Sales) X (Sales/ Average Total Assets)

4.4.4. Return on Equity (ROE): Net Income / Average Shareholders' Equity

4.4.4.1. Inventory Turnover: Cost of Goods Sold / Average Inventory

4.4.4.1.1. How fast inventory is sold and replaced.

4.4.4.2. Show income earned for every dollar invested by owners

4.4.5. Earnings per Share (EPS): Net Income Available for Common Shares / Average # of Common Shares Outstanding

4.4.5.1. How many dividends to each share of stock?

4.4.6. Price - Earnings Ratio (P/E): Market Price per Share / Earnings per Share

4.4.6.1. Best overall indicator of efficiency of investment in and use of assets.

4.4.6.2. How much in excess of current earnings are investors willing to pay for share?

4.4.7. Payout Ratio: Dividends / Net Income

4.4.7.1. What perportion of net income goes to shareholders

4.4.8. Times Interest Earned: Profit before Taxes and Interest / Interest

4.4.8.1. How many times a company's earnings cover its interest - assess probability of meeting interest obligations

4.5. Liquidity

4.5.1. Working Capitol: Current Assets - Current Liabilities

4.5.1.1. Guage ability to meet short term obligations

4.5.2. Quick Ratio: Cash, MktSecurities, Accts Rec. / Current Liabilities

4.5.2.1. Recievables Turnover: Net Sales / Average Accounts Receivable

4.5.2.1.1. how fast accounts recievable are turned into cash

4.5.2.2. Current Ratio but excludes inventories and prepaid expenses.

4.5.2.3. Stockholders' Equity to Assets: Stck Eq / Total Assets

4.5.2.3.1. Opposite of Debt / Assets

4.5.3. Operating Cycle: Days Inventory + Days Recievable

4.5.3.1. How Fast it takes to complete cycle of cash to Inventory to Accounts Recievable to Cash.

4.5.4. Accounts Payable Turmover: Purchases / Average Accounts Payable

4.5.4.1. companies in cahs binds will stretch their credits owed.

4.6. Financial Strength

4.6.1. Debt to Equity: Deby / Equity

4.6.1.1. How much debt in perportion to its equity

4.6.2. Debt to Total Assets Ratio: Total Liabilities / Total Assets

5. Noncash expenses - amortization of intangibles, depreciation of plant assets, and depreciation of natural resources.

6. In liability accounts, increases on right, decreases on left.

7. purchase/sale of property, plant & equipment, long-term investemnts. Non-current assets

8. Definition- Measrable change in balance sheet

9. Intro

10. Looks at changes in accounts to measure cash flow

10.1. From business operations - see note

10.2. issuance/repaymetn of debt, issuance/repurchase of stock, payments of dividends

11. Decrease in liabilities

12. Reflects all accounts recievable, but accounts recievable cannot be used to buy things.

12.1. New node

12.2. Used to be working capital statement, not cash flow

13. New node

14. Brief History

15. Ledger Accounts

15.1. Accounts systematize accumulation of transactions

15.2. Each account corresponds to and summarizes changes in a balance sheet Item

15.3. T-account - Title of account, 2 columns.

15.4. Accounting Conventions

15.4.1. In asset accounts, increases on left and decreases on right

16. Decreases in owner's equity

17. Cash flow (simplistically) is net income mnus depreciation expense

17.1. More precisely - sum of net income plus noncash expenses minus noncash revenues

18. Relates to Assets = liabilities + owners equity. Assets on left, liability and owners equity on right.

19. Financial Statements only tell part of the story - cash flow analysis tells the rest.

20. Ch 3: Accounting Cycle

20.1. Transactions

20.1.1. Money must change hands. Signing lease as opposed to paying first month's rent.

20.1.2. Internal - such as depreciation

20.1.3. External - paying to outside entity

20.2. Cycle Summary

20.3. Debits and Credits

20.3.1. Debit - left hand

20.3.2. Credit - right hand

20.3.3. Avoid thinking in terms of up or down. Gets confusing.

20.3.4. Owner's equity accounts - increases on right decreases on left.

20.4. Adjustments

20.4.1. Liquidity matters as well - investors and creditors use this.

20.4.1.1. Made for internal purposes, such as per-paid rent being used up.

20.4.2. Identify what, how much, and from which accounts.

21. Ch 4: Cash Flow Analysis

21.1. Statement of Cash Flows

21.1.1. Net Income is not the same as a change i the company's cash - included are things such as depreciation.

21.1.1.1. Cash flow analysis shows the major sources and uses of cash.

21.1.2. Increase in Owner's Equity

21.1.3. Basics

21.1.3.1. Noncash revenues - accrued revenues not collected.

21.1.3.2. General rule:

21.1.3.2.1. Cash inflows / outflows - sources of cash coming in or out.

21.1.3.2.2. If Noncash assets or liabilities increase, cash is flowing in. If noncash assets or liabilities decrease cash is flowing out.

21.1.3.3. Uses of Cash

21.1.3.3.1. Increase in noncash assets

21.1.4. Sources of Cash

21.1.4.1. Increase in iabilities

21.1.5. Indirect Method

21.1.5.1. From investing activities - purchases and sales of investments

21.1.5.2. Financing Activities - effects of financing transactions

21.1.5.2.1. Looks at cash activity to measure cash flow

21.1.6. Direct Method