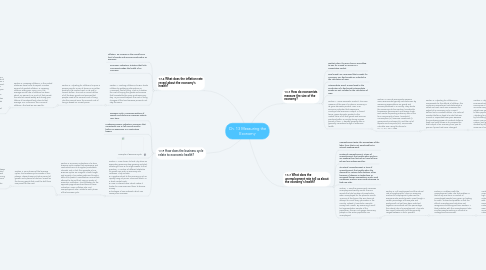

1. 13.4 What does the inflation rate reveal about the economy's health?

1.1. Inflation: an increase in the overall price level of goods and services produced in an economy.

1.2. Economic Indicators: statistics that help economists judge the health of an economy.

1.3. Section 1: Tracking inflation? The BLS tracks inflation by gathering information on Americans' cost of living. That is, it studies the cost of buying the goods and services that households like yours purchase every day. As you would expect, the cost of living changes all the time because prices do not stay the same.

1.3.1. Section 2: Adjusting for inflation? he price a person pays for a pair of shoes or any other product is its nominal cost, or its cost in current dollars. The cost in current dollars of all the basic goods and services that people need is the nominal cost of living. Like the nominal GDP, the nominal cost of living is based on current prices.

1.3.1.1. Section 3: Creeping inflation? In the United States we have come to expect a certain amount of gradual inflation, or creeping inflation, every year. Since 1913, the average annual rate of inflation has been about 3.2 percent. For much of that period, the rate has varied widely. But during your lifetime it has stayed fairly close to that average. For Americans, this is normal inflation—the level we are used to.

1.3.1.1.1. Section 4: The economic cost of inflation? Between 2000 and 2012, the annual rate of inflation in the United States ranged from a low of -0.4 percent to a high of 3.8 percent. Whether inflation at these relatively low levels is “healthy” for the economy is open to debate. However, we do know that inflation of any amount exacts economic costs. Loss of purchasing power. Inflation erodes purchasing power—the amount of goods and services that can be bought with a given amount of money. As a result, it undermines one of the basic functions of money: its use as a store of value.

2. 13.5 How does the business cycle relate to economic health?

2.1. Business Cycle: a recurring pattern of growth and decline in economic activity over time.

2.2. Leading Economic Indicators: measures that consistently rise or fall several months before an expansion or a contraction begins.

2.3. Example of Business Cycle

2.4. Section 1: From boom to bust Why does an expanding economy stop growing and start shrinking? There is no single answer to that question. A number of different obstacles to growth can push an economy into recession. They include: • a negative shock to the economy, such as rapidly rising oil prices, a terrorist attack, or a stock market crash. • a rise in interest rates, which makes it harder for consumers and firms to borrow money. • shortages of raw materials, which can cause price increases.

2.4.1. Section 2: economic indicators? The term business cycle implies that expansions and contractions occur at regular, predictable intervals. But in fact, the opposite is true. Business cycles are irregular in both length and severity. This makes peaks and troughs difficult to predict. Nonetheless, economists attempt to do just that, using a variety of economic indicators. The illustration on the opposite page shows how three of these indicators—GDP, inflation rate, and unemployment rate—relate to each phase of the business cycle.

2.4.1.1. Section 3: Four phases of the business cycle? The business cycle consists of four phases. These phases include a period of growth and a period of decline, as well as the turning points that mark the shift from one period to the next.

2.4.1.1.1. Section 4: Changing? Economies are always changing. Or, as economics writer Charles Wheelan puts it, they “proceed in fits and starts.” Wheelan is referring to the recurring periods of growth and decline in economic activity that all economies experience. Economists call this recurring pattern the business cycle.

3. 13.2 How do economists measure the size of the economy?

3.1. Market Value: the price buyers are willing to pay for a good or service in a competitive market.

3.2. Final Good: any new good that is ready for consumer use; final goods are included in the calculation of GDP.

3.3. Intermediate Good: a good used in the production of a final good; intermediate goods are not included in the calculation of GDP.

3.4. Section 1: Gross Domestic Product: The main measure of the size of a nation's economy is its gross domestic product. GDP is an economic indicator that measures a country's total economic output. In formal terms, gross domestic product is the market value of all final goods and services produced within a country during a given period of time. A steadily growing GDP is generally considered a sign of economic health.

3.4.1. Section 2: How do economists measure GDP? Economists typically calculate GDP by measuring expenditures on goods and services produced in a country. They divide the economy into four sectors: households, businesses, government, and foreign trade. Each sector's spending makes up one of the four components of GDP: household consumption (C), business investment (I), government purchases (G), and the net of exports minus imports (NX). Economists calculate GDP using this formula: C + I + G + NX = GDP

3.4.1.1. Section 3: Adjusting for inflation? To compensate for the effects of inflation, the Commerce Department calculates what is called real GDP. Real GDP measures the output of an economy not in current dollars, but in constant dollars. The value of constant dollars is fixed at a rate that was current in a specified base year. Because the purchasing power of constant dollars is fixed, real GDP allows us to compare the total output of an economy from year to year as if prices had never changed.

3.4.1.1.1. Section 4: Adjusting for population? Economists also use GDP to compare the economies of individual countries. To make accurate comparisons, economists must adjust GDP yet again. This time they do so to take population size into account. Adjusting for population is accomplished by calculating per capita GDP. Per capita means “per person.” Per capita GDP is a nation's real gross domestic product divided by its population. It is an accepted measure of a society's standard of living.

4. 13.3 What does the unemployment rate tell us about the economy's health?

4.1. Unemployment Rate: the percentage of the labor force that is not employed but is actively seeking work.

4.2. Frictional Unemployment: a type of unemployment that results when workers are seeking their first job or have left one job and are seeking another.

4.3. Structural Unemployment: a type of unemployment that results when the demand for certain skills declines, often because of changes in technology or increased foreign competition; under such conditions, workers may need retraining to find new jobs.

4.4. Section 1: How the government measures unemployment? Every month, the BLS reports the total number of people who were unemployed for the previous month. To arrive at this figure, the BLS does not attempt to count every job seeker in the country. Instead, it conducts a sample survey each month. By examining a small but representative sample of the population, the BLS can gauge how many people in the entire population are unemployed.

4.4.1. Section 2: Full employment and the natural rate of employment? When an economy reaches full employment, jobs exist for everyone who wants to work, even though a certain percentage of those jobs and workers will not yet have been matched together. Economists call this percentage the natural rate of unemployment. This rate has varied historically, but has generally ranged between 4 and 6 percent.

4.4.1.1. Section 3: Problems with the unemployment rate? The first problem is that at any one time, a number of unemployed people have given up looking for work. The second problem is that the official unemployment rate does not recognize involuntary part-time workers. A third problem with the unemployment rate involves people working in informal or underground economies.

4.4.1.1.1. Section 4: The economic costs of high unemployment? The main economic cost of high unemployment is lost potential output. The smaller the number of people who are working, the fewer goods and services the economy can generate. Potential output is lost because labor resources are not being fully utilized. An increasing unemployment rate, then, means a decreasing real GDP.