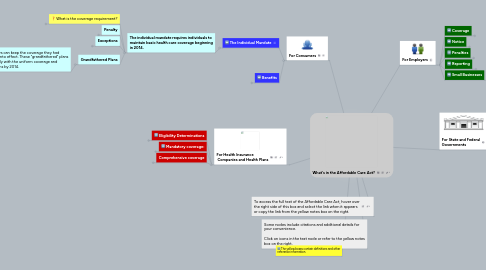

1. For Consumers

1.1. The Individual Mandate

1.1.1. The individual mandate requires individuals to maintain basic health care coverage beginning in 2014.

1.1.1.1. What is the coverage requirement?

1.1.1.1.1. There are 10 "essential health benefits" outlined in the law:

1.1.1.2. Penalty

1.1.1.2.1. Individuals who do not purchase health insurance for themselves and/or their dependents will face a tax penalty.

1.1.1.3. Exceptions

1.1.1.3.1. Some individuals have been excepted from the individual mandate. This means they will not be penalized for being without insurance.

1.1.1.3.2. Individuals who are insured through another source or combination of sources automatically satisfy the individual mandate.

1.1.1.4. Grandfathered Plans

1.1.1.4.1. Healthcare consumers can keep the coverage they had before the law went into effect. These "grandfathered" plans are required to comply with the uniform coverage and medical loss provisions by 2014.

1.2. Benefits

1.2.1. Premium and Cost Sharing Subsidies

1.2.1.1. Eligibility

1.2.1.1.1. Families with incomes at or below 400% poverty level.

1.2.1.1.2. Individuals with incomes between 100 - 250% of the poverty level.

1.2.2. Care For Dependents

1.2.2.1. Requires health plans to make coverage available for an unmarried, adult child until age 26.

1.2.3. Preventative Care

1.2.3.1. The law requires preventive services be provided with no cost sharing for consumers.

1.2.3.1.1. Screening and Counseling

1.2.3.1.2. Routine Immunizations

1.2.3.1.3. Childhood Preventive Services

1.2.3.1.4. Preventive Services for Women

1.2.4. Medicaid

1.2.4.1. Medicaid coverage is extended to individuals under age 65 who have incomes at or below 133% of the federal poverty line.

2. For Health Insurance Companies and Health Plans

2.1. Eligibility Determinations

2.1.1. Insurers may not restrict coverage based on:

2.1.1.1. any preexisting condition exclusion

2.1.1.1.1. Insurance companies are prohibited from denying coverage to children under the age of 19 due to a pre-existing condition. (As of September 23, 2010)

2.1.1.1.2. insurance companies will be prohibited from refusing to sell coverage or renew policies to adults because of pre-existing medical conditions. (Effective beginning 2014)

2.1.1.2. any health status-related factor.

2.1.1.2.1. Examples:

2.1.1.3. Annual limitations on the dollar value of benefits

2.1.1.4. lifetime limits on the dollar value of benefits

2.1.2. Health plans retain the right to discriminate based on other factors:

2.1.2.1. Age

2.1.2.2. Geographic Area

2.1.2.3. Tobacco Use

2.1.2.4. Number of Family members.

2.1.2.5. fraud or intentional misrepresentation of material fact

2.2. Mandatory coverage:

2.2.1. State health plans are required to: (1) accept every employer and individual in the state that applies for coverage; and (2) renew or continue coverage at the option of the plan sponsor or the individual, as applicable.

2.3. Comprehensive coverage

2.3.1. Minimum essential health services

2.3.1.1. What are the minimum essential health services?

2.3.1.1.1. (1) Ambulatory patient services.

2.3.1.1.2. (2) Emergency services.

2.3.1.1.3. (3) Hospitalization.

2.3.1.1.4. (4) Maternity and newborn care.

2.3.1.1.5. (5) Mental health and substance use disorder services, including behavioral health treatment.

2.3.1.1.6. (6) Prescription drugs.

2.3.1.1.7. (7) Rehabilitative and habilitative services and devices.

2.3.1.1.8. (8) Laboratory services.

2.3.1.1.9. (9) Preventive and wellness services and chronic disease management.

2.3.1.1.10. (10) Pediatric services, including oral and vision care.

2.3.2. Additional services

2.3.2.1. Coverage for young adults up to age 26.

2.3.2.2. Wellness Programs

2.3.2.3. Coverage for emergency services

3. To access the full text of the Affordable Care Act, hover over the right side of this box and select the link when it appears or copy the link from the yellow notes box on the right.

4. Some nodes include citations and additional details for your convenience. Click on icons in the text node or refer to the yellow notes box on the right.

5. The yellow boxes contain definitions and other reference information.

6. For Employers

6.1. Coverage

6.1.1. What is the requirement to offer coverage?

6.1.1.1. Employers are not required to provide coverage. Instead, large employers face penalties for choosing not to provide health insurance to their employees and dependents of their employees.

6.1.1.1.1. Plans must include “essential health benefits.”

6.2. Notice

6.2.1. Employers must provide notice to employees about certain aspects of the health insurance plan.

6.2.1.1. Employers must give notice of:

6.2.1.1.1. an Exchange

6.2.1.1.2. the availability of a tax credit for premium assistance

6.2.1.1.3. the loss of an employer's contribution to an employer-provided health benefit plan if the employee purchases a plan through an Exchange.

6.3. Penalties

6.3.1. Employers who do not comply with the law will be subject to a fine. The fine is based on whether the employer offers health insurance to the workforce, whether it is accessible, and whether the insurance is affordable.

6.3.1.1. Does the employer offer health insurance to full time employees?

6.3.1.1.1. The employer does not offer health insurance.

6.3.1.1.2. The employer does offer health insurance.

6.4. Reporting

6.4.1. Employers must report certain information regarding the health insurance coverage provided to their full-time employees.

6.4.1.1. (1) whether such employers provide their full-time employees (and their dependents) the opportunity to enroll in minimum essential coverage under an eligible employer-sponsored plan.

6.4.1.2. (2) the length of any waiting period for such coverage.

6.4.1.3. (3) the months during which such coverage was available.

6.4.1.4. (4) the monthly premium for the lowest cost option in each of the enrollment categories under the plan.

6.4.1.5. (5) the employer's share of the total allowed costs of benefits provided under the plan.

6.4.1.6. (6) identifying information about the employer and full-time employees.

6.5. Small Businesses

6.5.1. The size of the employer and the amount of average annual wages paid to its workforce determine whether a business is exempt from any provision of the law and what benefits are available.

6.5.1.1. Fewer than 25 full time equivalent employees and average annual wages of less than $50,000.

6.5.1.1.1. The Small Business Tax Credit

6.5.1.2. A business with fewer then 50 full time equivalent employees will not be subject to the penalty.

6.5.1.3. Businesses with fewer the 100 employees may participate in state-based exchanges that make it easier to find high quality coverage and compare prices.

7. For State and Federal Governments

7.1. States

7.1.1. States will create the American Health Benefit Exchanges

7.1.1.1. Consumer health exchanges will allow individuals to purchase health insurance.

7.1.1.1.1. Eligibility

7.1.1.1.2. Assistance

7.1.1.2. Small business health benefit exchanges will allow employers to purchase insurance

7.1.1.2.1. Eligibility

7.1.1.3. What is an Exchange?

7.1.1.3.1. A government agency or nonprofit entity.

7.2. Federal Government

7.2.1. Federal Employees

7.2.1.1. There will not be a public plan option. Instead, public employees will purchase insurance through health benefit exchanges developed by the Office of Personnel Management

7.2.1.1.1. At least two multi-state plans will be developed to provide coverage for federal employees.

7.2.1.1.2. The government will fund non-profit, member-run insurance co-ops in each state

7.2.2. Creating standards and guidelines for Health Benefit Exchanges.

7.2.2.1. The Secretary of Health and Human Services will develop reporting requirements for health plans.

7.2.2.1.1. Health plans will report premium increases, plan details, and outcome measures as described in the law.

7.2.2.2. The Secretary of Health and Human Services will create standards for advertisements directed to consumers.

7.2.3. Consumer websites

7.2.3.1. The Secretary of Health and Human Services will develop websites where consumers and businesses in each state can find affordable health insurance.

7.2.4. High Risk Insurance Pools

7.2.4.1. High risk insurance pools provide coverage to individuals with a preexisting condition until 2014.