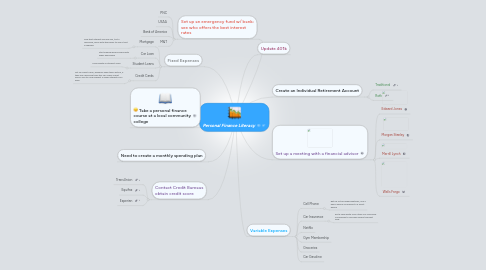

Personal Finance Literacy

by Tierra Brown

1. Contact Credit Bureaus obtain credit score

1.1. TransUnion

1.2. Equifax

1.3. Experian

2. Take a personal finance course at a local community college

3. Fixed Expenses

3.1. Mortgage

3.1.1. now that interest and are low, try to refinance, work with the banks to see if that is feasible

3.2. Car Loan

3.2.1. start making double payments when applicable

3.3. Student Loans

3.3.1. consolidate all student loans

3.4. Credit Cards

3.4.1. cut up credit cards, however keep them active, if they are cancelled then this can lower credit score; also try and request a lower interest from bank

4. Set up an emergency fund w/ bank; see who offers the best interest rates

4.1. PNC

4.2. USAA

4.3. Bank of America

4.4. M&T

5. Need to create a monthly spending plan

6. Create an Individual Retirement Account

6.1. Traditional

6.2. Roth

7. Set up a meeting with a financial advisor

7.1. Edward Jones

7.2. Morgan Stanley

7.3. Merrill Lynch

7.4. Wells Fargo

8. Variable Expenses

8.1. Cell Phone

8.1.1. get rid of the added features, use a basic device as oppose to a smart phone

8.2. Car Insurance

8.2.1. get a new quote from other car insurance companies to see who offers the best deal