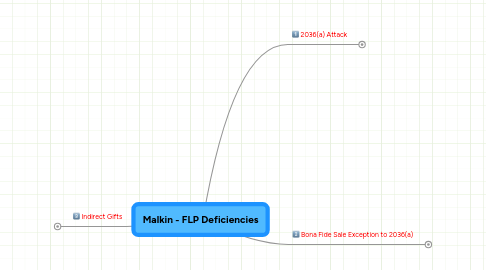

1. 2036(a) Attack

1.1. Statute

1.1.1. "The value of the gross estate shall include the value of all property to the extent of any interest therein of which the decedent has at any time made a transfer (except in case of a bona fide sale for an adequate and full consideration in money or money's worth), by trust or otherwise, under which he has retained for his life or for any period not ascertainable without reference to his death or for any period which does not in fact end before his death-- (1) the possession or enjoyment of, or the right to the income from, the property"

1.2. Problem Facts

1.2.1. Decedent transferred stock to the partnership, which stock was then pledged to secure repayment of personal obligations of the decedent

1.3. Conclusion

1.3.1. Such retained use of the transferred stock evidenced an express or implied agreement at the time of the transfer that the transferor would retain the present economic benefits of the property, thus resulting in the inclusion of the value of the stock under Section 2036(a)

2. Bona Fide Sale Exception to 2036(a)

2.1. Citing Estate of Bongard v. Commissioner, 124 T.C. 95, 118 (2005), the court requires that for the bona fide sale for adequate and full consideration exception to apply, there must be (a) the existence of a legitimate and significant nontax reason for creating the family limited partnership, and (b) the transferors received partnership interests proportionate to the value of the property transferred.

2.2. Nontax reasons for formation of partnership claimed by taxpayer, and Court responses

2.2.1. Allowed decedent to provide for his children by preserving the upside potential value of the shares and keeping that growth in his children's hands and not his hands

2.2.1.1. Rejected because reason for FLP must provide the transferor some potential for benefit other than the potential estate tax advantages that might result from holding assets in the partnership form

2.2.2. The FLP allowed decedent to prevent a sale of the transferred stock, thus protecting the company from a sale of shares that would “undoubtedly depress the value of the shares” and avoiding the appearance that decedent was “losing confidence in the upside potential” of the company

2.2.2.1. Rejected because only the decedent transferred in shares - he could have controlled his shares by keeping them in his own name

2.2.3. The FLP allowed decedent “to centralize management of the family's wealth.”

2.2.3.1. However, since decedent transferred almost all of the assets, there was no pooling of family assets

3. Indirect Gifts

3.1. Decedent transferred LLC's to the partnership before the other "partners" were in existence (they were trusts created after the date of the transfers to the partnership

3.2. Thus, at time of transfer to the partnership, there was only one partner

3.3. Under the authority of Shepherd v. Commissioner, 115 T.C. 376 (2000), affd. 283 F.3d 1258 (11th Cir. 2002), this resulted in a transfer of LLC interests to the trusts, not a transfer of partnership interests

3.3.1. And thus, partnership value adjustments are not applicable