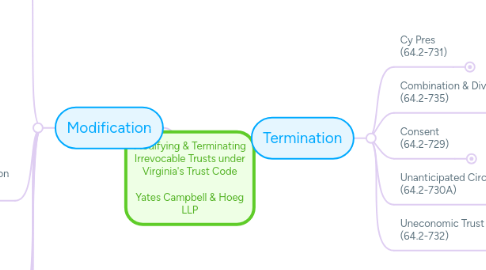

1. Modification

1.1. Decanting (64.2-778.1)

1.1.1. Elements

1.1.1.1. Trustee other than "Interested Trustee"

1.1.1.2. Power to make discretionary distributions

1.1.1.3. 2nd trust must meet requirements in C OR be a "special needs trust"

1.1.1.3.1. Same beneficiaries

1.1.1.3.2. No acceleration of future interests

1.1.1.3.3. Ascertainable standard (if in original trust)

1.1.1.3.4. No reduction of income/annuity/unitrust interest

1.1.1.3.5. No changes to charitable/marital deduction qualification

1.1.1.3.6. No delaying of vesting of remainder in 2503(b) and (c) trusts

1.1.1.3.7. Preserve withdrawal powers

1.1.1.3.8. Power of appointment subject to Sec. 55-12.1-13.3

1.1.1.4. In a written instrument, signed and acknowledged by the trustee, including certain details, filed with trust documents

1.1.1.5. Written notes to grantor, qualified beneficiaries, and trust advisor 60 days before

1.1.1.6. Trust instrument does not preclude decanting

1.1.1.7. Trustee's exercise of power is subject to fiduciary duties in original trust

1.1.2. Who can seek

1.1.2.1. Only trustee can decant

1.1.2.2. Trustee or beneficiaries can seek court approval

1.2. Combination & Division (64.2-735)

1.2.1. Elements

1.2.1.1. Notice to the qualified beneficiaries

1.2.1.2. Cannot materially impair the rights of any beneficiary

1.2.1.3. Cannot adversely affect achievement of the purposes of the trust

1.2.2. Who can seek

1.2.2.1. Only trustee can combine/divide

1.3. Consent (64.2-729)

1.3.1. Elements

1.3.1.1. Modification is not inconsistent with a material purpose of the trust OR consent of the settlor

1.3.1.2. Noncharitable irrevocable trust

1.3.1.3. Consent of ALL of the beneficiaries OR (1) all other requirements of section met and (2) interests of non-consenting beneficiary will be adequately protected

1.3.2. Who can seek

1.3.2.1. Trustee or beneficiary ( 64.2-728B)

1.3.3. Notes

1.3.3.1. With the settlor, the court "shall" enter the order modifying/terminating the trust

1.3.3.2. Without the settlor, the court "may" allow the modification or termination.

1.4. Unanticipated Circumstances (64.2-730A)

1.4.1. Elements

1.4.1.1. Because of circumstances not anticipated by the settlor, modification will further the purposes of the trust

1.4.1.2. To extent practicable, modification consistent with settlor's probable intention

1.4.2. Who can seek

1.4.2.1. Trustee or beneficiary may seek court approval (64.2-728B)

1.4.3. Notes

1.4.3.1. The code section does not specify whose involvement is necessary to terminate a trust due to unanticipated circumstances.

1.5. Inability to Administer (64.2-730B)

1.5.1. Elements

1.5.1.1. Continuation of the trust on existing terms would be (1) impracticable, (2) wasteful, OR (3) impair the trust's administration.

1.5.1.2. Modification of administrative terms only

1.5.2. Who can seek

1.5.2.1. Trustee or beneficiary may seek court approval (64.2-728B)

1.6. Reformation/Mistake (64.2-733)

1.6.1. Elements

1.6.1.1. clear and convincing evidence that mistake of fact or law (in expression or inducement) affected (1) the settlor's intent AND (2) the terms of the trust

1.6.1.2. Conform the terms to the settlor's intent

1.6.2. Who can seek

1.6.2.1. Trustee or beneficiary may seek court approval (64.2-728B)

1.7. Cy Pres (64.2-731)

1.7.1. Elements

1.7.1.1. Charitable purpose becomes unlawful, impracticable, impossible to achieve, or wasteful

1.7.1.2. Make trust or use of property consistent with settlor's charitable purposes

1.7.1.3. If trust terms call for distribution to noncharitable beneficiary, at time of such distribution, (1) there is no living settlor with a reversion OR (2) at least 21 years have elapsed since trust's creation

1.7.2. Who can seek

1.7.2.1. Trustee, settlor, or beneficiary may seek court approval (64.2-728B)

1.7.3. Notes

1.7.3.1. Review caselaw before use!

1.7.3.2. See 64.2-736 for alternative (but requires consent of attorney general)

1.8. Tax Objectives (64.2-734)

1.8.1. Elements

1.8.1.1. Modification not contrary to the settlor's probable intention

1.8.1.2. Modification will achieve the settlor's tax objectives

1.8.2. Who can seek

1.8.2.1. Trustee or beneficiary may seek court approval (64.2-728B)

1.9. Uneconomic Trust (64.2-732)

1.9.1. Elements

1.9.1.1. Notice to the qualified beneficiaries

1.9.1.2. Trust property value <$100,000

1.9.1.3. Trustee concludes value of property insufficient to justify costs of administration

1.9.1.4. Not a conservation or preservation easement

1.9.2. Who can seek

1.9.2.1. Trustee

1.9.2.2. Trustee or beneficiary may seek court approval (64.2-728B)

2. Termination

2.1. Cy Pres (64.2-731)

2.1.1. Elements

2.1.1.1. Charitable purpose becomes unlawful, impracticable, impossible to achieve, or wasteful

2.1.1.2. If trust terms call for distribution to noncharitable beneficiary, at time of such distribution, (1) there is no living settlor with a reversion OR (2) at least 21 years have elapsed since trust's creation

2.1.2. Who can seek

2.1.2.1. Trustee, beneficiary, or settlor ( 64.2-728B)

2.1.3. Notes

2.1.3.1. Review caselaw before use!

2.1.4. Uses

2.1.4.1. Distibute property consistently with settlor's charitable purposes

2.2. Combination & Division (64.2-735)

2.2.1. Elements

2.2.1.1. Notice to the qualified beneficiaries

2.2.1.2. Cannot materially impair the rights of any beneficiary

2.2.1.3. Cannot adversely affect achievement of the purposes of the trust

2.2.2. Who can seek

2.2.2.1. Trustee

2.2.3. Possible Uses

2.2.3.1. Eliminate small trusts through (modification and) combination

2.3. Consent (64.2-729)

2.3.1. Elements

2.3.1.1. Trust is not necessary to achieve any material purpose of the trust OR consent of the settlor

2.3.1.2. Noncharitable irrevocable trust

2.3.1.3. Consent of all of the beneficiaries OR (1) all other requirements of section met and (2) interests of non-consenting beneficiary will be adequately protected

2.3.2. Who can seek

2.3.2.1. Trustee or beneficiary (64.2-728B)

2.3.3. Notes

2.3.3.1. Adverse tax consequences?

2.3.3.2. Telephones, Inc. v. LaPrade, 206 Va. 388 (1965); Schmucker v. Walker, 226 Va. 582 (1984)

2.3.4. Uses

2.3.4.1. Relatively easy to use, if you have the settlor's consent (material purposes don't matter)

2.4. Unanticipated Circumstances (64.2-730A)

2.4.1. Elements

2.4.1.1. Circumstances not anticipated by the settlor

2.4.1.2. Termination will further the purposes of the trust

2.4.1.3. Upon termination, the trustee distributes the trust property consistently with the purposes of the trust

2.4.2. Who can seek

2.4.2.1. Trustee or beneficiary (64.2-728B)

2.4.3. Note

2.4.3.1. Ladysmith Rescue Squad, Inc. v. Newlin, 280 Va 195, 202 (2010)

2.5. Uneconomic Trust (64.2-732)

2.5.1. Elements

2.5.1.1. Notice to the qualified beneficiaries

2.5.1.2. Trust property value <$100,000

2.5.1.3. Trustee concludes value of property insufficient to justify costs of administration

2.5.1.4. Not a conservation or preservation easement

2.5.2. Who can seek

2.5.2.1. Trustee

2.5.3. Uses

2.5.3.1. Terminate a small trust

3. NJSA

3.1. Elements

3.1.1. Consent of all "interested persons"

3.1.2. Does not violate a material purpose of the trust

3.1.3. Includes terms and conditions that could be properly approved by the court

3.1.4. Not a conservation or preservation easement

3.2. Who can seek

3.2.1. Any interested person may petition the court to approve a nonjudicial settlement agreement

3.3. Uses

3.3.1. Can be entered into "with respect to any matter involving a trust"

3.3.1.1. 1. The interpretation or construction of the terms of the trust

3.3.1.2. 2. The approval of a trustee's report or accounting

3.3.1.3. 3. Direction to a trustee to refrain from performing a particular act or the grant to a trustee of any necessary or desirable power

3.3.1.4. 4. The resignation or appointment of a trustee and the determination of a trustee's compensation

3.3.1.5. 5. Transfer of a trust's principal place of administration

3.3.1.6. 6. Liability of a trustee for an action relating to the trust

3.3.2. Avoid court involvement

4. Virtual Representation

4.1. No conflict of interest with respect to the question or dispute

4.2. Who can be represented

4.2.1. Taker in default of exercise of general testamentary power of appointment (64.2-715)

4.2.1.1. By holder of a general testamentary power of appointment

4.2.2. Incapacitated person/ward (64.2-716)

4.2.2.1. By guardian or conservator

4.2.2.2. By another having a substantially identical interest with respect to the particular question or dispute, if otherwise unrepresented

4.2.3. Beneficiaries of trust or estate (64.2-716)

4.2.3.1. By fiduciary (trustee, personal representative, guardian/conservator, agent)

4.2.4. Minor or unborn person (64.2-716 & 717)

4.2.4.1. By parent, if no guardian appointed

4.2.4.2. By grandparent or more remote ancestor, if not otherwise represented by fiduciary or parent

4.2.4.3. By another having a substantially identical interest with respect to the particular question or dispute, if otherwise unrepresented by an ancestor or fiduciary

4.2.5. Identity or location unknown and not reasonably ascertainable (64.2-717)

4.2.5.1. By another having a substantially identical interest with respect to the particular question or dispute

5. Qualified Beneficiary (64.2-701)

5.1. Living or then-existing beneficiary

5.1.1. (i) distributee or permissible distributee of trust income or principal on the date qualification is determined

5.1.2. (ii) would be a distributee or permissible distributee of trust income or principal if the interests of the distributees described in clause (i) terminated on the date qualification is determined

5.1.3. would be a distributee or permissible distributee of trust income or principal if the trust terminated on that date