1. Electronic Cash

1.1. A form of electronic payment that is anonymous and can be spent only once. Good for micro-payment (less than $1) and small payments (less than $10

1.1.1. Micropayments and Small Payments

1.1.1.1. Micropayments being internet payments of less than a dollar. The Small payments are the payments that are between $1 - $10. Electronic cash is fast, easy, and more efficiently used in these areas as opposed to to hastle of credit cards for such small purchases.

1.1.2. Privacy and Security of Electronic cash

1.1.2.1. Consumers want to know whether transactions are vulnerable and whether the electronic currency can br copied, reused, or forged. It must be possible to spend electronic cash only once and electronic cash ought to be anonymous. Security procedures should be in place to guarantee that the entire electronic cash tranaction occurs only between two parties and that the recipient knows that the electronic currency being received is not counterfeit.

1.1.3. Holding Electronic cash: Online and Offline cash

1.1.3.1. Online cash storage means that the consumer does not personally possess electronic cash. Instead, a trusted third party is involved in all transfersof electronic cash and holds the consumers' cash accounts. Offline cash storage is the virtual equivalent of money kept in a wallet. The consumer hangs onto it and no third party is involved in the transaction.

2. Electronic Cash Continued

2.1. Advantages

2.1.1. - Readily exchanged for real cash (unlike Scrip), useful for those who cannot get credit cards. - No need for authorizations as required by payment cards. - Independence: unrelated to any proprietary network or storage device. - Portability: freely transferable between 2 parties (across borders). - Convenience: does not require any special hardware/software.

2.2. Disadvantages

2.2.1. - Not standardized or universally accepted - Security issues: Potential for "double spending" & "money-laundering" - Security issues: Susceptible to forgery.

2.3. How Electronic Cash works

2.3.1. A consumer must open an account with an electronic cash issuer such as Paypal and presesnt proof of identity. The consumer can then withdraw electronic cash by accepting the issuer's Web site and presenting proof of identity, such as digital certificate issued by a certification authority. After the identification is verified, it gives the consumer a specific amount of electronic cash and deducts the same amount from the consumer's account.

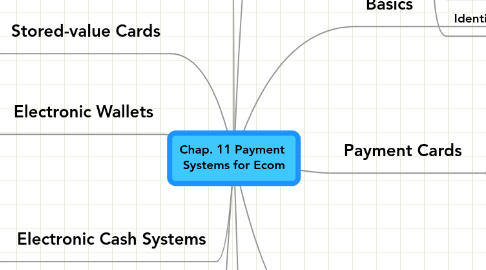

3. Electronic Cash Systems

3.1. CheckFree

3.1.1. largest online bill processor in the world. Provides infrastructure and software that permits users to pay all their bills with online electronic checks.

3.2. Clickshare

3.2.1. Electronic cash system aimed at magazine and newspaper publishers. Clickshare keeps track of transactions and bills the user's ISP. Clickshare tracks where a user travels on the internet.

3.3. PayPal

3.3.1. Electronic payment system that provides processing services to businesses and to indiv- iduals. PayPal earns a profit on the float, which is money that is deposited in PayPal accounts and not used immediately. PayPal eliminates the need to pay for online purchases by writing and mailing checks or using payment cards. To use PayPal, merchants and consumers must register for an account. Customers add money to their accounts by authorizing a transfer from their check- ing account or by using a credit card.

4. Electronic Wallets

4.1. A software utility that holds e-cash, credit card info, owner I.D., address info, and provides this data automatically at Ecom sites. Electronic wallets make shopping more efficient because consumers can just click their wallet to order items quickly.

4.1.1. Client-side E-wallet

4.1.1.1. An electronic wallet the stores a consumer's info on the consumer's own computer although, they are not portable.

4.1.2. Server-side E-wallet

4.1.2.1. An electronic wallet that stores a customer's info on a remote server belonging to a particular merchants or wallet publisher.

4.1.3. Examples

4.1.3.1. Microsoft.Net passport - developed by microsoft. Yahoo! Wallet - offered by the Web portal site Yahoo!

5. Stored-value Cards

5.1. Either an elaborate smart card or a simple plastic card with a magnetic strip that records currency balance, such as a prepaid phone, copy, or bus card.

5.1.1. Magnetic Strip Cards

5.1.1.1. These cards hold value that can be recharged by inserting then into the appropriate machines, inserting currency into the machine, and withdrawing the card; the card's strip stores the increased cash value. These cards are passive and processing must be done on a device into which the card is inserted.

5.1.2. Smart Card

5.1.2.1. A stored-value card that is a plastic card with an embedded microchip that can store info. These cards can store 100 times more info then that of a strip plastic card. They are more safer than conventional credit cards because the info stored on a smart card is encrypted.

6. Threats to Pay- ment systems

6.1. Phishing

6.1.1. A technique used for committing fraud against the customers of online businesses. In a phishing attack, the attacker sends email messages to a large audience who might have an account from a targeted web site. This message tells the recipient that his account has been compromised and it is necessary for the recipient to log in to the account to correct the matter. However, once logged in, the perpetrator can access the recipient's personal info and make purchases or perform withdrawals.

7. Key Definitions

7.1. Scrip

7.1.1. digital cash minted by a company instead of by a government.

7.2. Payment card

7.2.1. all types of plastic cards that consumers use to make purchases.

7.3. EMV standard

7.3.1. a single standard for the handling of payment card transactions developed cooperatively by Visa, Mastercard, and Mastercard Europe.

7.4. Open Loop System

7.4.1. Payment card arrangement involving a consumer and his or her bank, a merchant and its bank, and a third party such as Visa that processes transactions between the consumer and merchant.

7.5. Closed Loop System

7.5.1. Payment card arrangement involving a consumer, a merchant, and a payment card company such as AMEX that processes transactions between the consumer and merchant without involving banks.

7.6. Customer issuing banks

7.6.1. Member-run organizations that issue credit cards to individual consumers.

7.7. Merchant bank

7.7.1. A bank that does business with sellers that want to accept payment cards.

7.8. Merchant Account

7.8.1. An account that a merchant must hold with a bank that allows the merchant to process payment card transactions.

7.9. Chargeback

7.9.1. Process in which a merchant bank retrieves the money it placed in a merchant account as a result of a cardholder successfully contesting a charge.

7.10. Payment processing service providers

7.10.1. Third party company that handles payment card processing for online businesses.

7.11. Anonymous electronic cash

7.11.1. electronic cash that cannot be traced back to the person who spent it.

7.12. Identity theft

7.12.1. criminal act in which the perpetrator gathers personal info about a victum and then uses that info to obtain credit.

8. Online Payment Basics

8.1. Today there are four basic payment methods - Cash, Cheque, Debit Card, and Credit Cards account for more than 90% of all consumer payment in the USA. Credit cards are by far the most popular method that consumers use to pay for online purchases. 85% of purchases online use credit card, 95% in the United States, only 5% of all credit card transactions, accounts for 50% of all credit card fraud.

9. Payment Cards

9.1. The main categories of payment cards are credit cards, debit cards, and charge cards.

9.1.1. Credit Card

9.1.1.1. A payment card that has a spending limit based on the cardholder's credit limit. A minimum monthly payment payment must be made against the balance on the card, and interest is charged on the unpaid balance. Ex: Visa, Mastercard

9.1.2. Debit Card

9.1.2.1. A payment card that is directly linked to the cardholder's bank account and transfers it to the seller's bank account. Debit cards are issued by the cardholder's bank.

9.1.3. Charge Card

9.1.3.1. A card with no preset spending limit. The entire amount charged to the card must be paid in full each month. Ex: American Express.

9.1.4. Single Use Card

9.1.4.1. A payment card with disposable numbers, which gives consumers a unique card number that is valid for one transaction only.

9.2. Advantages of Payment Cards

9.2.1. 1. Consumer protection from fraud. The consumer protection act limits the cardholder's liability to $50 if the card is used fraudulently. 2. Worldwide acceptance. Payment cards can be used anywhere in the world, and the currency conversion if needed is handled by the card issuer. 3. Merchant protection. When a merchant accepts payment cards for online payment or for orders over the phone, the merchant can authen- ticate and authorize purchases using a payment card processing network. 4. Merchant assurance from issuing companies.

9.3. Disadvantages of Payment Cards

9.3.1. 1. Costs to merchants per transaction plus monthly fees. These fees can add up, but merchants view them as a cost of doing business. 2. Costs to consumers as they also pay fees which include annual fees.

10. Payment Acceptance and Processing

10.1. General steps taken once the merchant receives a consumer's payment card info: 1. The merchant authenticates the payment card to ensure it is valid and not stolen. 2. The merchant than checks with the payment card issuer to ensure that credit of funds are available and puts a hold on the credit line or the funds needed to cover the charge. 3. Settlement occurs, usually a few days after the purchase, which means that funds travel between banks and are placed into the merchant's account.

10.2. Processing Pay- ments Online

10.2.1. Software packaged with Ecom software can handle payment card processing automatically, or merchants can contract with a third party to handle payment card processing. General merchant card processing services include: ICVERIFY and WebAuthorize. These processing services connect directly to a network of banks known as the Automated Clearing House (ACH).