1. Set 4 Payment of salary

1.1. Constitution of salary

1.1.1. Remuneration including allowances payable to an employee for work done under contract of service

1.1.2. Does not include

1.1.2.1. Accommodation/utilities

1.1.2.2. Retrenchment benefits

1.1.2.3. CPF

1.1.2.4. Gratuity payable on discharge/retirement

1.1.2.5. Reimbursement for expenses incurred during work

1.1.2.6. Travelling allowance

1.1.3. How to Pay

1.1.3.1. Cash/Cheque

1.1.3.2. Bank transfer

1.1.4. When to Pay

1.1.4.1. Salary within 7 days

1.1.4.2. Overtime within 14 days

1.2. Authorised salary deductions

1.2.1. Absence from work

1.2.1.1. Authorised

1.2.1.1.1. Incomplete month formula

1.2.1.2. Unauthorised

1.2.1.2.1. Gross rate of pay

1.2.2. Damage/Loss of goods/money

1.2.2.1. Damage of goods entrusted to employee due to neglect

1.2.2.1.1. Must hold inquiry

1.2.2.2. 1 time lump-sum payment

1.2.2.3. Cannot exceed 25% of employee's 1 month salary

1.2.3. Actual costs of meals supplied at request of employee

1.2.4. CPF contributions (employer's share)

1.2.5. House accommodations, amenities & services supplied by employer and accepted by employee

1.2.5.1. Deductions cannot exceed 25% of employee 1 month salary

1.2.5.2. Deductions cannot exceed value of accommodations etc supplied

1.2.6. Recovery of advances

1.2.6.1. Advances

1.2.6.1.1. Deducted in installments not more than 12 months

1.2.6.2. Loans

1.2.6.2.1. Deduct in installments

1.2.6.3. Overpaid salary

1.2.6.3.1. Employer can recover full amount

1.2.7. Contributions to a scheme at employee's written request

1.2.8. Payment to an registered co-operative society with employer's written consent

1.2.8.1. Subscription, entrance fees, etc with written consent of employee (e.g. subscribe to union)

1.2.9. Other purpose approved by Minister

1.2.9.1. Employer must seek approval from MOM

1.2.10. Max amount of deductions

1.2.10.1. 50% of total salary in any 1 salary period

1.2.10.1.1. Does not include

1.2.10.2. If contract of service terminated

1.2.10.2.1. Deductions may exceed 50%

1.2.10.2.2. Foreign worker just left employment

1.3. Type of pay

1.3.1. Basic rate of Pay

1.3.1.1. Total amt of $ including wage adjustments and increments an employee is entitled to under contract of service

1.3.1.2. Excludes

1.3.1.2.1. Overtime

1.3.1.2.2. Bonus

1.3.1.2.3. Annual Wage Supplement (AWS)

1.3.1.2.4. Reimbursement of special expenses incurred in course of employment

1.3.1.2.5. Productivity incentive payments

1.3.1.2.6. Any allowance

1.3.2. Gross rate of Pay

1.3.2.1. Total amt of $ including allowances employees are entitled to under contract of service

1.3.2.2. Excludes

1.3.2.2.1. Overtime

1.3.2.2.2. Bonus

1.3.2.2.3. AWS

1.3.2.2.4. Reimbursement of special expenses incurred in course of employment

1.3.2.2.5. Productivity incentive payment

1.3.2.2.6. TRAVEL, FOOD AND HOUSING ALLOWANCES

1.3.3. Main difference

1.3.3.1. Basic pay

1.3.3.1.1. Exclude all allowances

1.3.3.1.2. Used to compute pay for work on rest day/public holiday

1.3.3.2. Gross pay

1.3.3.2.1. Basic rate of pay + allowances EXCLUDING travel, food and housing allowances

1.3.3.2.2. Used to calculate

1.4. Formula for basic/gross pay and incomplete month of pay

1.4.1. Daily

1.4.1.1. Salary deduction for unauthorised absence from work

1.4.1.2. Basic rate

1.4.1.2.1. (12 x monthly basic rate) / (52 x average no. of days an employee is required to work in a week)

1.4.1.3. Gross rate

1.4.1.3.1. ( 12 x monthly gross rate) / (52 x average no. of days an employee is required to work in a week)

1.4.2. Incomplete Month of Work

1.4.2.1. [ ( monthly gross rate / total no. of working days in that month ) x total no. of days of actual work of employee in the month ]

2. Set 5: Hours of Work, Overtime, Rest Days & Other Conditions of Service

2.1. Learning Objective 1: Coverage under Part IV EA

2.1.1. Applicable to:

2.1.1.1. Workmen earning a basic monthly salary up to $4500

2.1.1.2. Non workmen earning a basic monthly salary up to $2500

2.1.2. Not applicable to:

2.1.2.1. All Managers & Executives

2.1.3. If covered:

2.1.3.1. hrs of work regulated and entitled to breaks, overtime pay and rest days

2.2. Learning Objective 2: Hours of Work

2.2.1. Definition

2.2.1.1. period where employees are at the disposal of the employer and expected to carry out duties assigned, excludes rest, breaks and meal times

2.2.2. 'week'

2.2.2.1. continuous period of 7 days starting from Monday and ending on Sunday

2.2.3. generally not required to work more than 6 consecutive hrs

2.2.3.1. if continuous up to 8 hrs, break must be at least 45mins

2.2.4. Work Patterns

2.2.4.1. not more than 5 days

2.2.4.1.1. up to 9 hrs per day or 44 hrs per week

2.2.4.2. more than 5 days a week

2.2.4.2.1. up to 8 hrs per day or 44 hrs per week

2.2.4.3. less than 44 hrs every alternate week

2.2.4.3.1. up to 48 hrs per week, but max 88 hrs in any continuous 2 week period

2.2.4.4. shift work of up to 12 hrs a day

2.2.4.4.1. up to an average of 44 hrs over a continuous 3 week period

2.2.5. max hrs of work

2.2.5.1. not more than 12 hrs per day, including OT except:

2.2.5.1.1. accident or threat of accident

2.2.5.1.2. work that is essential to the life of the community, national defence or security

2.2.5.1.3. urgent work to be done to plant or machinery

2.2.5.1.4. work interruption that was impossible to forsee

2.2.6. Overtime(OT)

2.2.6.1. definition

2.2.6.1.1. no. of hrs worked in any 1 day or in any 1 week in excess of the normal hrs of work, excluding breaks

2.2.6.2. no provision to allow employer to provide time off in lieu of OT pay

2.2.6.3. not compulsory except emergencies and for certain essential services

2.2.6.4. must be at request of the employer

2.2.6.5. who can claim?

2.2.6.5.1. non workmen earning up to $2500

2.2.6.5.2. workmen earning up to $4500

2.2.6.6. rate

2.2.6.6.1. min 1.5 times of employees' hourly basic rate of pay

2.2.6.6.2. payable for non workmen is capped at salary lvl of $2250, or hrly rate of $11.80

2.2.6.7. formula

2.2.6.7.1. Hourly basic rate of pay*1.5*no. of OT hrs worked

2.2.6.8. OT payment must be made within 14 days after the last day of the salary period

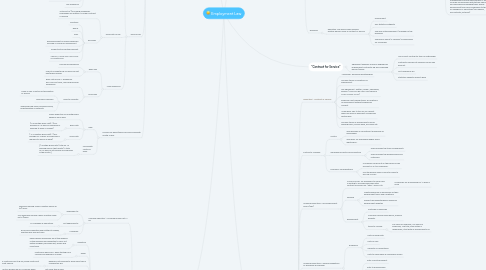

3. "Contract for Service"

3.1. Agreement whereby a person engaged as independent contractor eg self-employed person/vendor

3.1.1. Has a client-contractor type of relationship

3.1.2. Contractor carries out business on his own account

3.1.3. Not covered by EA

3.1.4. Statutory benefits doesn't apply

4. Set 2 : Coverage of Employment Act (Part 1)

4.1. A contract of service is an employment agreement between an employee and an employer. Contracts are commonly in writing, but can be based on verbal agreements.

4.2. Coverage of Employment Act

4.2.1. Covers: 1) Employee working under a contract of service with an employer. 2) Local & Foreign employees 3) Hourly / daily/monthly/piece-rated 4) Full time, part time( <35 hours/week), temporary, contract employees

4.2.2. Does not covers: 1) Managers & Executives (monthly basic salary >$4500) 2) Seafarers 3) Domestic workers 4) Civil servants & statutory board employees

4.3. Coverage of Part IV of EA (provides for hours of work, overtime. rest days, annual leave and other conditions of service

4.3.1. Covers : 1) Workmen earning a basic salary up to $4500 2) Non workmen earning a basic monthly salary up to $2500

4.3.1.1. Workman : Work mainly involves manual labour and includes 1) any skilled/unskilled person engaged in manual work (includes artisan or apprentice but not seafarer and domestic worker) 2) any person (other than clerical staff in a transport company) who operates or maintains commercial vehicles with passengers 3) any person employed to supervise manual workers but also performs manual work more than half their total working time 4) any person specified in the First Schedule of the Employment Act (eg: Cleaners, Constructive Workers, Labourers, Machine Operators & Assemblers, Metal & Machinery Workers, Train, Bus, Lorry & Van Drivers, Train & Bus Inspectors, Piece-rated workmen employed in premises of employer)

4.3.1.2. Non-workman : Other employee (other than workman) earning a monthly basic salary up to $2500 (eg; Admin staff, retail / accounts assistants

4.3.2. Does not covers: All Managers & Executives

4.3.2.1. Factors determining whether an employee is employed in an Executive/Managerial position

4.3.2.1.1. Generally, professionals, managers and executives (PMEs) refer to employees : 1) whose highest education qualification is a diploma or above 2) who have been employed and have had work experience in a PME job

4.3.2.1.2. Manager / Executive - Employees with executive and supervisory functions and duties/authority include one or all of the following : 1) influencing or making decisions on issues such as recruitment, discipline, termination of employment, performance assessment and reward 2) formulating strategies and policies of the enterprise 3) managing and running the business 4) also includes professionals with tertiary education and specialised knowledge/skills whose employment terms are comparable to those of managers or executives (eg: lawyers, accountants, lecturers)

4.4. Employer

4.4.1. Definition: any person who employs another person under a contract of service

4.4.1.1. Government

4.4.1.2. Any statutory authority

4.4.1.3. The duly authorised agent / manager of the employer

4.4.1.4. The person owns/ is carrying/ is responsible for a business

5. Set 3: Contract of Service

5.1. Objective 1: Contract of Service

5.1.1. - Employer- Employee Relationships

5.1.2. Includes terms & conditions of employment

5.1.3. Any agreement : written, verbal , expressed, implied ( CANNOT BE LESS FAVORABLE THAN THOSE IN EA)

5.1.4. Employer cant change terms & conditions of employment without employee's consent

5.1.5. If new hires fails to turn up, EA doesnt apply because no employer & employee relationship

5.1.6. Includes terms of employment such as working hours, annual leave, sick leave etc

5.2. Factors to consider:

5.2.1. control

5.2.1.1. Who decides on recruitment & dismissal of employees?

5.2.1.2. Who pays for employees wages and in what ways ?

5.2.2. ownership of factors of production

5.2.2.1. Who provides the tools & equipment?

5.2.2.2. Who provides the working place and materials?

5.2.3. Economic Considerations

5.2.3.1. If business carried out on the person's own account or is it for employer?

5.2.3.2. Can the person share in profit or liable to any risk of loss?

5.3. Learning Objective 2: Key Employment Terms (KET)

5.3.1. COMPULSORY for employers to issue KETs in writing to all employees who enter contract of service on / after 1 April 2016

5.3.1.1. covered by EA & employed for 14 days & more

5.3.2. Purpose

5.3.2.1. Create awareness in employees of their employment terms and conditions

5.3.2.2. Prevent misunderstanding & minimise employment disputes

5.3.3. Requirement

5.3.3.1. Softcopy or hardcopy

5.3.3.2. Common KETs eg leave policy, medical benefits

5.3.3.3. Items to include:

5.3.3.3.1. Full name of employer, Full name of employee, Job title, main duties & responsible, Start date of employment ETC

5.4. Learning Objective 3: Implied Obligations of Employee & Employer

5.4.1. Employee

5.4.1.1. Duty of good faith

5.4.1.2. Duty of care

5.4.1.3. capacity & Competence

5.4.1.4. Duty to obey lawful & reasonable orders

5.4.2. Employer

5.4.2.1. Duty of mutual respect

5.4.2.2. Duty to provide work

5.4.2.3. Duty to indemnify employee for any personal loss suffered whilst carrying out employers instruction

5.4.2.4. duty of care

5.4.2.5. duty of not to disclose confidential info pertaining to the employee

5.5. Learning objective 4: Termination of a contract of service

5.5.1. Termination can be with or without notice or due to misconduct

5.5.1.1. Company must be prepared to justify termination of contract in case employee appeals to MOM if there was unfair dismissal.

5.5.2. WHEN

5.5.2.1. Expiry of contract terms/ completed project

5.5.2.2. Frustration eg death , long term illness

5.5.2.3. Employee resigned /employer dismissed an employeee

5.5.2.3.1. Give advance notice in advance

5.5.2.3.2. WITHOUT NOTICE

5.5.2.4. Wilful breach of contract by employer or employee

5.6. Learning Objective 6: Dismissal due to misconduct

5.6.1. Terminate of contract of service of an employee by his employer

5.6.1.1. may be with or without notices & on the ground of misconduct.

5.6.1.1.1. THEFT, DISHONESTY

5.6.2. Inquiry into misconduct

5.6.2.1. TOP: Follow rules of natural justice

5.6.2.1.1. Adequate notice to employee

5.6.2.2. MID: Person hearing the inquiry should not be in a position which may be bias

5.6.2.2.1. Specific allegations/charges

5.6.2.2.2. Hearing before an impartial tribunal

5.6.2.3. BOTTOM: Employee being investigate for misconduct should have opportunity to present his case or respond to charges or allegations

5.6.2.3.1. Decision made in good faith

5.6.3. 2 Cardinal Principles:

5.6.3.1. 1. No man shall be a judge in his own cause

5.6.3.2. 2. No man shall be condemned unheard

5.6.4. Purpose of inquiry:

5.6.4.1. Suspension period cant exceed 1 week

5.6.4.2. employee should be paid at least half of his salary suspension

5.7. Learning Objective 6: Appeal against unfair dismissal

5.7.1. Employee who feels that his dismissal was without just case or excuse may appeal to MOM to be reinstated to his former job

5.7.1.1. Appeal in writing and received by MOM by one month from last day of employment

5.8. Learning Objective 7 : Transfer of employment

5.8.1. Restructuring of organisation

5.8.1.1. Merger ( Esso or Mobile )

5.8.1.2. Takeover (UOB acquire OUB)

5.8.1.3. Setting up a subsidiary

5.8.2. Employee Rights

5.8.2.1. Be reasonable notice of transfer and matters relating to transfer

5.8.2.2. Existing terms and conditions of employment is preserved under new employer

5.8.3. Obligations of current employer

5.8.3.1. Notify affected employees/union of impending transfer

5.8.4. Obligations of new emplyer

5.8.4.1. Take over the previous employer;s rights and owers , duties and liabilities, recognicse past service records

5.8.5. Commisoner for labour is empowered to

5.8.5.1. Delay or prohibit transfer of employee concerned

5.8.5.2. order transfer of employee and set terms that are considered just