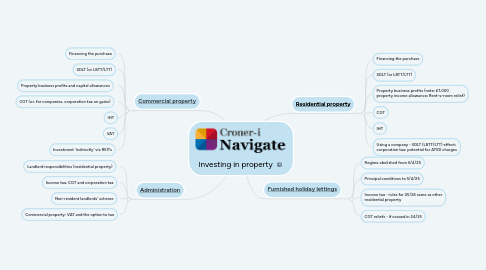

Investing in property

von stephanie webber

1. [Commercial property](https://library.croneri.co.uk/po-heading-id_m6HnaCe7rkyoiVm3OWjWmg)

1.1. Financing the purchase

1.2. SDLT (or LBTT/LTT)

1.3. Property business profits and capital allowances

1.4. CGT (or, for companies, corporation tax on gains)

1.5. IHT

1.6. VAT

1.7. Investment 'indirectly' via REITs

2. [Administration](https://library.croneri.co.uk/po-heading-id_NTBXxtKNHEWwugR2ENJZYw)

2.1. Landlord responsibilities (residential property)

2.2. Income tax, CGT and corporation tax

2.3. Non-resident landlords' scheme

2.4. Commercial property: VAT and the option to tax

3. [Residential property](https://library.croneri.co.uk/po-heading-id__n2pqSeaEUWgohS9uHvrGQ)

3.1. Financing the purchase

3.2. SDLT (or LBTT/LTT)

3.3. Property business profits (note: £1,000 property income allowance; Rent-a-room relief)

3.4. CGT

3.5. IHT

3.6. Using a company - SDLT (LBTT/LTT) effect; corporation tax; potential for ATED charges

4. [Furnished holiday lettings](https://library.croneri.co.uk/po-heading-id_0_dn2MS00E6ortCGsgFvrQ)

4.1. Regime abolished from 6/4/25

4.2. Principal conditions to 5/4/25

4.3. Income tax - rules for 25/26 same as other residential property

4.4. CGT reliefs - if ceased in 24/25