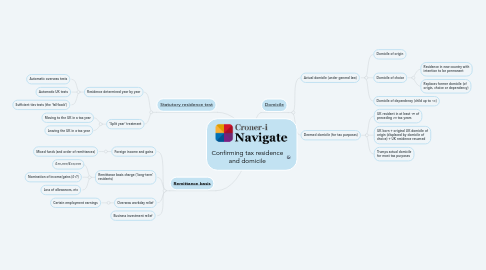

1. [Statutory residence test](https://library.croneri.co.uk/po-heading-id_5woTdEID20u9CFmuSBXNag)

1.1. Residence determined year by year

1.1.1. Automatic overseas tests

1.1.2. Automatic UK tests

1.1.3. Sufficient ties tests (the 'fall-back')

1.2. 'Split year' treatment

1.2.1. Moving to the UK in a tax year

1.2.2. Leaving the UK in a tax year

2. [Remittance basis](https://library.croneri.co.uk/po-heading-id_R4gvQLSOZk-eNpE9rDc60g)

2.1. Foreign income and gains

2.1.1. Mixed funds (and order of remittances)

2.2. Remittance basis charge ('long-term' residents)

2.2.1. £30,000/£60,000

2.2.2. Nomination of income/gains (£1?)

2.2.3. Loss of allowances, etc

2.3. Overseas workday relief

2.3.1. Certain employment earnings

2.4. Business investment relief

3. [Domicile](https://library.croneri.co.uk/po-heading-id_E_kTbIG_nUyIcG_1ICglAw)

3.1. Actual domicile (under general law)

3.1.1. Domicile of origin

3.1.2. Domicile of choice

3.1.2.1. Residence in new country with intention to be permanent

3.1.2.2. Replaces former domicile (of origin, choice or dependency)

3.1.3. Domicile of dependency (child up to 16)

3.2. Deemed domicile (for tax purposes)

3.2.1. UK resident in at least 15 of preceding 20 tax years

3.2.2. UK born + original UK domicile of origin (displaced by domicile of choice) + UK residence resumed

3.2.3. Trumps actual domicile for most tax purposes