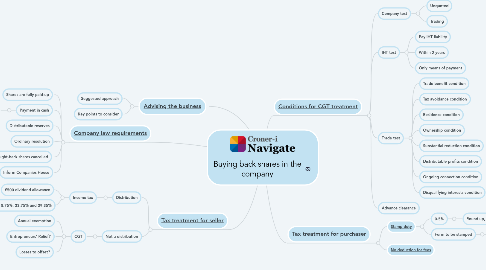

Buying back shares in the company

par Martin Jackson

1. [Company law requirements](https://library.croneri.co.uk/po-heading-id_HZ03cquLKkK0mHcoc-i2XQ)

1.1. Shares are fully paid-up

1.2. Payment in cash

1.2.1. Not loan account

1.3. Distributable reserves

1.4. Ordinary resolution

1.5. Bought-back shares cancelled

1.6. Inform Companies House

1.6.1. Deadline: 28 days

2. [Tax treatment for seller](https://library.croneri.co.uk/po-heading-id_apeoMwIAO02C-hpgGWnmPw)

2.1. Distribution

2.1.1. Income tax

2.1.1.1. £500 dividend allowance

2.1.1.2. Rates 8.75%, 33.75% and 39.35%

2.2. Not a distribution

2.2.1. CGT

2.2.1.1. Annual exemption

2.2.1.2. Entrepreneurs' Relief?

2.2.1.3. Losses to offset?

3. [Advising the business](https://library.croneri.co.uk/po-heading-id_jUwuP2XAPka7LNTo2jVdkg)

3.1. Suggested approach

3.2. Key points to consider

4. [Conditions for CGT treatment](https://library.croneri.co.uk/po-heading-id_YeI0SCRBiUul6TXdOMS0xw)

4.1. Company test

4.1.1. Unquoted

4.1.2. Trading

4.2. IHT test

4.2.1. Pay IHT liability

4.2.2. Within 2 years

4.2.3. Only means of payment

4.3. Trade test

4.3.1. Trade benefit condition

4.3.2. Tax avoidance condition

4.3.3. Residence condition

4.3.4. Ownership condition

4.3.5. Substantial reduction condition

4.3.6. Distributable profits condition

4.3.7. Ongoing connection condition

4.3.8. Disqualifying interests condition

4.4. Advance clearance

5. Tax treatment for purchaser

5.1. [Stamp duty](https://library.croneri.co.uk/po-heading-id_e8Ercp7okUmhTXBYXJNtUQ)

5.1.1. 0.5%

5.1.1.1. Round up, £5

5.1.2. Form to be stamped

5.1.2.1. Deadline: 30 days