1. THE MONEY MARKETS

1.1. DEFINITION

1.1.1. The money markets are a collection of in which commercial banks and other businesses adjust their liquidity position by borrowing, lending, or investing for short periods of time.

1.1.2. The Federal Reserve System conducts monetary policy in the money markets, and the Treasury Department uses the money markets to finance the day-to-day operations of the federal government.

1.2. MONEY MARKET INSTRUMENTS

1.2.1. CHARACTERTISTICS

1.2.1.1. Short maturities (usually 90 days or less)

1.2.1.2. Highly liquid (active secondary markets)

1.2.1.3. Low risk of default

1.2.2. TYPE OF MONEY MARKET INSTRUMENTS

1.2.2.1. CORPORATE BONDS

1.2.2.1.1. These are long-term bonds issued by corporations with very strong credit ratings.

1.2.2.1.2. bondholders’ returns are fixed (they receive only the amount of interest that is promised plus the repayment of the principal at the end of the loan contract)

1.2.2.1.3. typically have maturities from 5 to 30 years

1.2.2.1.4. their secondary market is not as active as for equity securities

1.2.2.2. TREASURY BILLS

1.2.2.2.1. direct obligations of the U.S. government

1.2.2.2.2. maturity: 3 months - 1 year maturities

1.2.2.2.3. almost no possibility of default

1.2.2.2.4. Financial institutions, corporations, and individuals buy these securities for their liquidity and safety of principal.

1.2.2.3. NEGOTIABLE CERTIFICATES OF DEPOSIT

1.2.2.3.1. large-denomination time deposits of the nation’s largest commercial banks

1.2.2.3.2. may be sold in the secondary market before their maturity

1.2.2.3.3. Only a handful of banks sell NCDs

1.2.2.4. COMMERCIAL PAPER

1.2.2.4.1. the unsecured promissory note (IOU) of a large business

1.2.2.4.2. maturity: a few days - 120 days

1.2.2.4.3. major issuers: corporations and finance companies

1.2.2.5. FEDERAL FUNDS

1.2.2.5.1. are bank deposits held with the Federal Reserve bank

1.2.2.5.2. The bank that acquires the fed funds may use them to cover a deficit reserve position or can use the funds to make consumer or business loans.

1.2.2.5.3. he fed funds interest rate is the interbank lending rate.

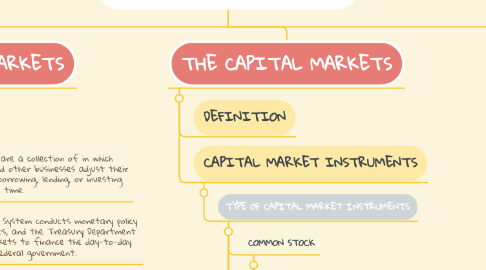

2. THE CAPITAL MARKETS

2.1. DEFINITION

2.2. CAPITAL MARKET INSTRUMENTS

2.2.1. TYPE OF CAPITAL MARKET INSTRUMENTS

2.2.1.1. COMMON STOCK

2.2.1.1.1. represents an ownership claim on a firm’s assets

2.2.1.1.2. The capital markets are where business firms obtain funds for long-term investment projects and where consumers finance the purchases of long-term assets, such as real estate

2.2.1.1.3. Also referred to as equity securities, stock differs from debt obligations in that equity holders have the right to share in the firm’s profits

2.2.1.1.4. The higher the firm’s net income, the higher the return to stockholders. On the other hand, stockholders must share in any of the losses that the company may incur

2.2.1.1.5. Most stock market transactions take place in the secondary markets.

2.2.1.2. MUNICIPAL BONDS

2.2.1.2.1. are the long-term debt obligations of state and local governments to finance capital expenditures for things such as schools, highways, and airports.

2.2.1.2.2. have limited secondary markets and thus are not considered liquid investments.

2.2.1.3. MORTGAGES

2.2.1.3.1. are long term loans secured by real estate

2.2.1.3.2. They are the largest segment in the capital markets in terms of the amount outstanding

2.2.1.3.3. More than half of the mortgage funds go into financing family homes, with the remainder financing business property, apartments, buildings, and farm construction.

2.2.1.3.4. do not have good secondary markets

2.2.1.3.5. a large number of mortgages can be pooled together to form new securities called mortgage-backed securities, which have an active secondary market